Region:Europe

Author(s):Shubham

Product Code:KRAA1916

Pages:98

Published On:August 2025

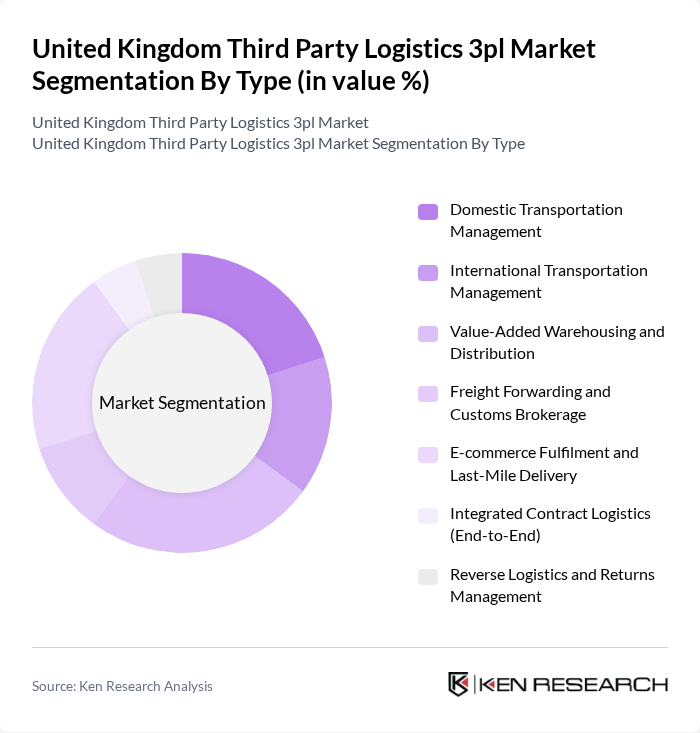

By Type:The market is segmented into various types, including Domestic Transportation Management, International Transportation Management, Value-Added Warehousing and Distribution, Freight Forwarding and Customs Brokerage, E-commerce Fulfilment and Last-Mile Delivery, Integrated Contract Logistics (End-to-End), and Reverse Logistics and Returns Management. Each of these segments plays a crucial role in meeting the diverse needs of businesses and consumers.

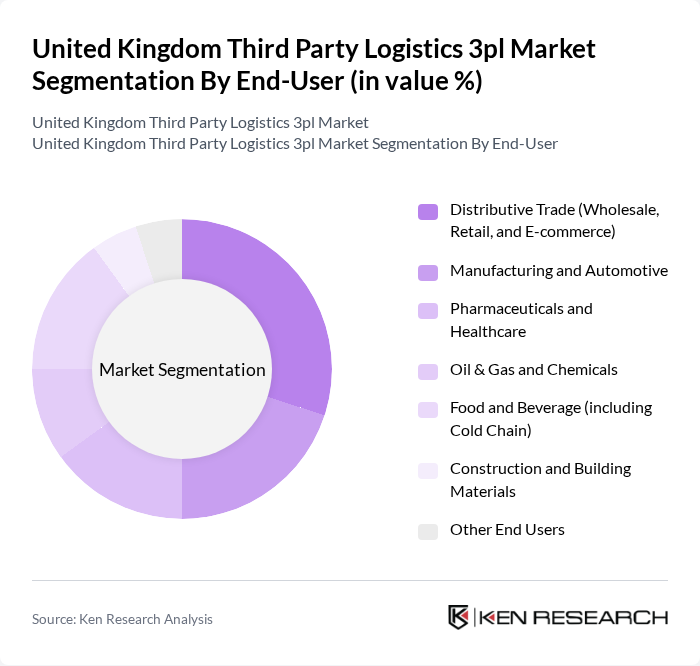

By End-User:The end-user segmentation includes Distributive Trade (Wholesale, Retail, and E-commerce), Manufacturing and Automotive, Pharmaceuticals and Healthcare, Oil & Gas and Chemicals, Food and Beverage (including Cold Chain), Construction and Building Materials, and Other End Users. Each sector has unique logistics requirements, influencing the demand for specific services.

The United Kingdom Third Party Logistics 3pl Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain (UK) Ltd, GXO Logistics (formerly XPO Logistics) UK, Kuehne + Nagel Ltd (UK), CEVA Logistics UK Ltd, DB Schenker UK, UPS Supply Chain Solutions (UK), GEODIS UK Ltd, DSV Solutions/DSV Road Ltd (UK), FedEx Express and FedEx Supply Chain (UK), Yusen Logistics (UK) Ltd, Agility Logistics UK Ltd (part of Agility/DSV Global Integrated Logistics), Wincanton plc, Clipper Logistics (a GXO company), Whistl Fulfilment (UK), Evri (Hermes Parcelnet Ltd) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK third-party logistics market appears promising, driven by ongoing digital transformation and the integration of advanced technologies. As companies increasingly adopt AI and machine learning, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainability will likely shape logistics strategies, with businesses seeking eco-friendly solutions. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Transportation Management International Transportation Management Value-Added Warehousing and Distribution Freight Forwarding and Customs Brokerage E-commerce Fulfilment and Last-Mile Delivery Integrated Contract Logistics (End-to-End) Reverse Logistics and Returns Management |

| By End-User | Distributive Trade (Wholesale, Retail, and E-commerce) Manufacturing and Automotive Pharmaceuticals and Healthcare Oil & Gas and Chemicals Food and Beverage (including Cold Chain) Construction and Building Materials Other End Users |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal Transport Parcel/Express Networks |

| By Service Level | Standard Services Expedited and Next-Day Services Customized and Dedicated Contract Logistics On-Demand and Same-Day Services |

| By Contract Type | Fixed-Term Contracts Flexible and Pay-as-you-go Contracts Spot and Project-Based Contracts Managed Transportation Agreements |

| By Technology Adoption | Warehouse Automation and Robotics Cloud-Based TMS/WMS IoT and Telematics Data Analytics and AI |

| By Pricing Model | Cost-Plus Pricing Fixed Pricing Volume- or Activity-Based Pricing Dynamic and Surge Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Management | 120 | Logistics Directors, Supply Chain Managers |

| Healthcare Supply Chain Solutions | 90 | Operations Managers, Procurement Specialists |

| Manufacturing Distribution Networks | 70 | Warehouse Managers, Production Planners |

| E-commerce Fulfillment Strategies | 110 | eCommerce Operations Managers, Logistics Coordinators |

| Technology Integration in 3PL | 60 | IT Managers, Digital Transformation Leads |

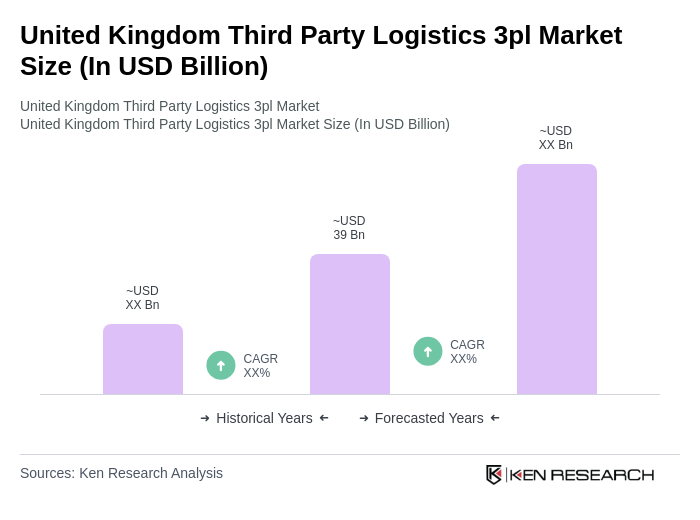

The UK Third Party Logistics market is valued at approximately USD 39 billion, reflecting significant growth driven by e-commerce expansion and supply chain outsourcing. This valuation is based on a comprehensive five-year historical analysis of the sector.