Region:Asia

Author(s):Geetanshi

Product Code:KRAA0216

Pages:93

Published On:August 2025

Market.png)

By Service Type:

The service type segmentation of the market includes Dedicated Contract Carriage (DCC), Domestic Transportation Management (DTM), International Transportation Management (ITM), Warehousing and Distribution, and Value-Added Logistics Services (VALs). Among these, Warehousing and Distribution is the leading sub-segment, driven by the surge in e-commerce and the need for efficient inventory management. Companies are increasingly outsourcing warehousing functions to optimize their supply chains, leading to a higher demand for these services. The focus on just-in-time delivery and inventory accuracy further enhances the significance of this sub-segment .

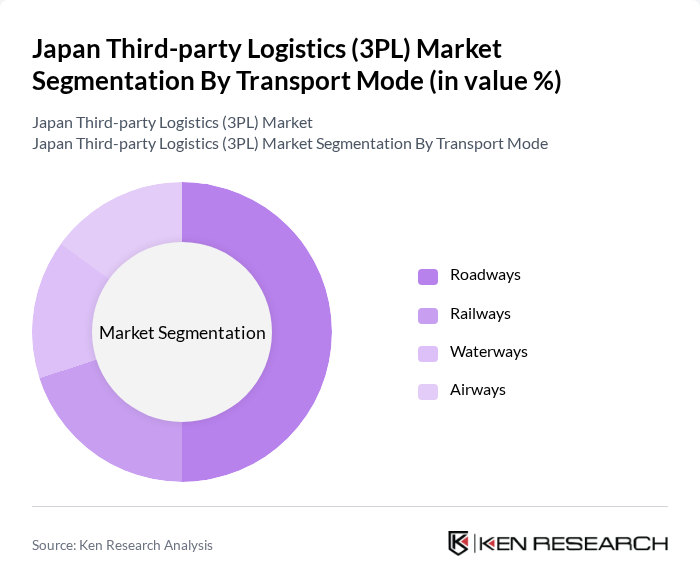

By Transport Mode:

The transport mode segmentation includes Roadways, Railways, Waterways, and Airways. Roadways dominate the market due to their flexibility and extensive network, making them the preferred choice for domestic logistics. The increasing demand for last-mile delivery services, particularly in urban areas, has further solidified the importance of road transport. Railways are also gaining traction for bulk shipments, while waterways and airways cater to specific needs such as international trade and time-sensitive deliveries .

The Japan Third-party Logistics (3PL) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express Holdings Inc., Yamato Holdings Co., Ltd., SG Holdings Co., Ltd. (Sagawa Express), Hitachi Transport System, Ltd. (LOGISTEED, Ltd.), Seino Holdings Co., Ltd., Kintetsu World Express, Inc., Mitsui-Soko Holdings Co., Ltd., Yusen Logistics Co., Ltd., Alps Logistics Co., Ltd., Deutsche Post AG (DHL Japan), Kuehne + Nagel Japan, DB Schenker Japan, CEVA Logistics Japan, Fukuyama Transporting Co., Ltd., Nichirei Logistics Group Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan 3PL market appears promising, driven by technological innovations and evolving consumer preferences. As e-commerce continues to thrive, logistics providers are likely to enhance their service offerings, focusing on speed and efficiency. Additionally, the integration of sustainable practices will become increasingly important, aligning with global trends. The market is expected to adapt to these changes, positioning itself for growth while addressing challenges such as labor shortages and operational costs.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Dedicated Contract Carriage (DCC) Domestic Transportation Management (DTM) International Transportation Management (ITM) Warehousing and Distribution Value-Added Logistics Services (VALs) |

| By Transport Mode | Roadways Railways Waterways Airways |

| By End-Use Industry | Retail Healthcare Manufacturing Automotive Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Management | 60 | Logistics Directors, Supply Chain Managers |

| Automotive Supply Chain Solutions | 50 | Procurement Managers, Operations Managers |

| Healthcare Logistics Services | 40 | Warehouse Managers, Compliance Officers |

| Food and Beverage Distribution | 45 | Quality Assurance Managers, Distribution Supervisors |

| E-commerce Fulfillment Strategies | 55 | eCommerce Operations Managers, Logistics Coordinators |

The Japan Third-party Logistics (3PL) Market is valued at approximately USD 67 billion, driven by the increasing demand for efficient supply chain management and the rapid expansion of e-commerce.