Region:Middle East

Author(s):Geetanshi

Product Code:KRAA2058

Pages:89

Published On:August 2025

Market.png)

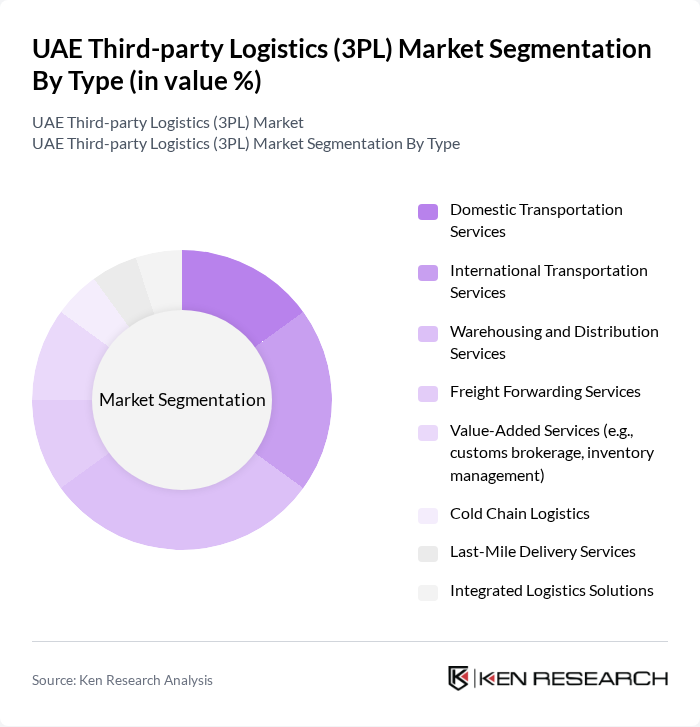

By Type:The market is segmented into various types of services that cater to different logistics needs. The subsegments include Domestic Transportation Services, International Transportation Services, Warehousing and Distribution Services, Freight Forwarding Services, Value-Added Services (e.g., customs brokerage, inventory management), Cold Chain Logistics, Last-Mile Delivery Services, and Integrated Logistics Solutions. Among these, Warehousing and Distribution Services are currently leading the market due to the increasing demand for efficient storage solutions and inventory management in the e-commerce sector. The prominence of warehousing is supported by the surge in omni-channel fulfillment, with major investments in bonded logistics corridors and specialized facilities in Dubai South and EZDubai .

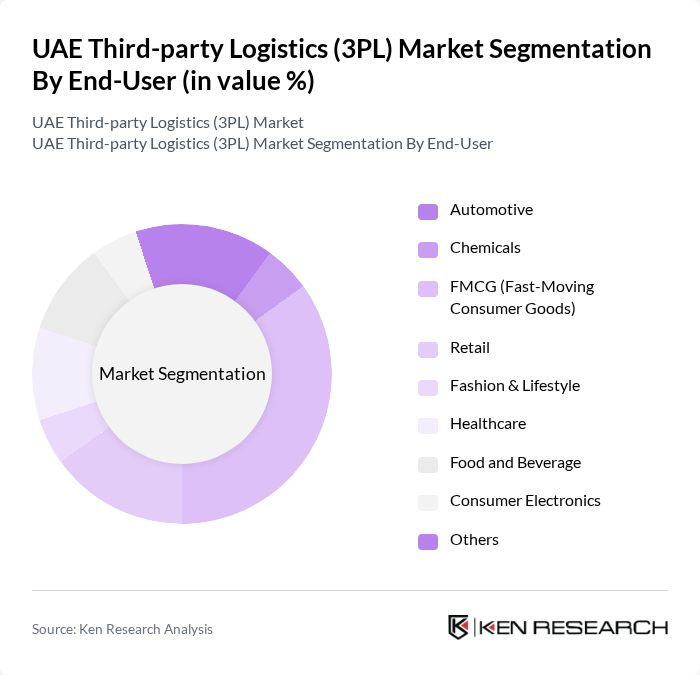

By End-User:The end-user segmentation includes Automotive, Chemicals, FMCG (Fast-Moving Consumer Goods), Retail, Fashion & Lifestyle, Healthcare, Food and Beverage, Consumer Electronics, and Others. The FMCG sector is currently the dominant segment, driven by the increasing consumer demand for fast delivery and efficient supply chain management, particularly in urban areas. This dominance is reinforced by the rapid growth of e-commerce and retail distribution, which require robust logistics support for inventory turnover and last-mile delivery .

The UAE Third-party Logistics (3PL) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agility Logistics, DB Schenker, Kuehne + Nagel, DHL Supply Chain (Deutsche Post DHL Group), CEVA Logistics, Aramex, FedEx, UPS Supply Chain Solutions, Al-Futtaim Logistics, Emirates Logistics LLC, The Kanoo Group, RAK Logistics, Geodis, Hellmann Worldwide Logistics, Al Hilal Transporting and Contracting Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE 3PL market appears promising, driven by ongoing investments in technology and infrastructure. As e-commerce continues to expand, logistics providers are likely to enhance their service offerings, focusing on automation and customer-centric solutions. The integration of sustainable practices will also become increasingly important, aligning with global trends. Overall, the market is expected to evolve rapidly, adapting to changing consumer demands and technological advancements, positioning itself for significant growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Transportation Services International Transportation Services Warehousing and Distribution Services Freight Forwarding Services Value-Added Services (e.g., customs brokerage, inventory management) Cold Chain Logistics Last-Mile Delivery Services Integrated Logistics Solutions |

| By End-User | Automotive Chemicals FMCG (Fast-Moving Consumer Goods) Retail Fashion & Lifestyle Healthcare Food and Beverage Consumer Electronics Others |

| By Service Model | Asset-Based 3PL Non-Asset-Based 3PL Hybrid 3PL |

| By Distribution Mode | Road Transportation Air Transportation Sea Transportation Rail Transportation |

| By Customer Type | B2B B2C C2C |

| By Geographic Coverage | Domestic International |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 100 | Logistics Managers, Supply Chain Analysts |

| Healthcare Supply Chain Management | 60 | Operations Directors, Procurement Managers |

| E-commerce Fulfillment Strategies | 80 | eCommerce Operations Managers, Logistics Coordinators |

| Manufacturing Logistics Solutions | 50 | Production Managers, Supply Chain Executives |

| Automotive Logistics and Distribution | 40 | Warehouse Managers, Distribution Directors |

The UAE Third-party Logistics (3PL) Market is valued at approximately USD 7.5 billion, driven by the growth of e-commerce, demand for efficient supply chain solutions, and the UAE's strategic location as a logistics hub connecting Europe, Asia, and Africa.