Region:North America

Author(s):Shubham

Product Code:KRAA1918

Pages:90

Published On:August 2025

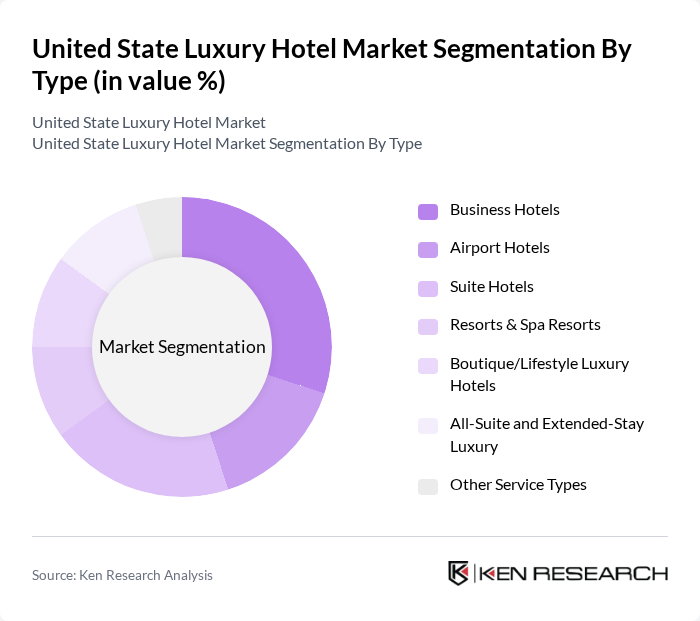

By Type:The luxury hotel market is segmented into various types, including business hotels, airport hotels, suite hotels, resorts & spa resorts, boutique/lifestyle luxury hotels, all-suite and extended-stay luxury, and other service types. Among these, business hotels are an important component; however, recent demand momentum in luxury has been particularly strong in leisure-led and lifestyle/boutique and resort properties, supported by affluent leisure travel, wellness, and experiential stays. Corporate and group travel recovery continues to support urban luxury and meeting-focused properties, with amenities such as high-speed internet, meeting rooms, and business centers remaining essential .

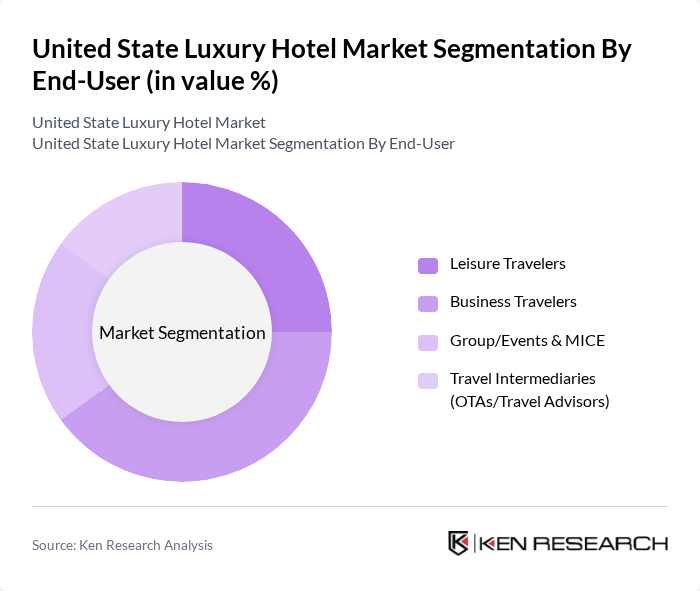

By End-User:The end-user segmentation includes leisure travelers, business travelers, group/events & MICE, and travel intermediaries (OTAs/travel advisors). Business travelers are critical to weekday demand and meetings-driven hotels, but affluent leisure travelers have been a major growth engine for luxury performance, with “bleisure” behavior blurring segments as remote and flexible work extend stays. High-touch services, wellness, and personalized itineraries are influencing booking via OTAs and luxury travel advisors .

The United State Luxury Hotel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marriott International, Inc. (The Ritz?Carlton, St. Regis, EDITION, W Hotels, Luxury Collection), Hilton Worldwide Holdings Inc. (Waldorf Astoria, Conrad, LXR Hotels & Resorts), Hyatt Hotels Corporation (Park Hyatt, Andaz, Thompson, Alila), Four Seasons Hotels and Resorts, The Ritz?Carlton Hotel Company, L.L.C., InterContinental Hotels Group PLC (IHG Hotels & Resorts: InterContinental, Six Senses, Kimpton, Regent), Accor S.A. (Fairmont, Raffles, Sofitel, Ennismore lifestyle brands), Mandarin Oriental Hotel Group, Rosewood Hotel Group, Belmond Ltd., Aman Group (Aman Resorts), The Leading Hotels of the World, Ltd., Preferred Hotels & Resorts, Small Luxury Hotels of the World, Nobu Hospitality contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. luxury hotel market appears promising, driven by evolving consumer preferences and technological advancements. As travelers increasingly seek wellness-oriented and sustainable experiences, hotels are likely to adapt their services accordingly. Additionally, the integration of advanced technologies, such as AI and personalized marketing, will enhance guest experiences. These trends suggest a dynamic landscape where luxury hotels must remain agile to meet changing demands and capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Business Hotels Airport Hotels Suite Hotels Resorts & Spa Resorts Boutique/Lifestyle Luxury Hotels All?Suite and Extended?Stay Luxury Other Service Types |

| By End-User | Leisure Travelers Business Travelers Group/Events & MICE Travel Intermediaries (OTAs/Travel Advisors) |

| By Price Range | Luxury (Upper?Upscale) Super?Luxury Ultra?Luxury |

| By Location | Urban/Core City Resort/Leisure Destinations Airport/Transportation Hubs |

| By Amenities Offered | Spa & Wellness (incl. Medical/Wellness Programs) Fine Dining & Signature Restaurants Concierge & Butler Services Meetings, Incentives, Conferences, Events (MICE) Spaces |

| By Distribution Channel | Direct Booking (Brand.com/App/Call Center) Online Travel Agencies (OTAs) Travel Advisors/Consortia (e.g., Virtuoso, Amex FHR) |

| By Customer Loyalty Programs | Tiered Membership Programs Points & Co?branded Credit Cards Elite?Only/Invitation Programs & Exclusive Offers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel General Managers | 60 | General Managers, Operations Directors |

| Frequent Luxury Travelers | 120 | Business Executives, Affluent Leisure Travelers |

| Travel Agents Specializing in Luxury | 70 | Luxury Travel Advisors, Agency Owners |

| Hospitality Industry Experts | 50 | Consultants, Industry Analysts |

| Luxury Hotel Marketing Professionals | 50 | Marketing Managers, Brand Strategists |

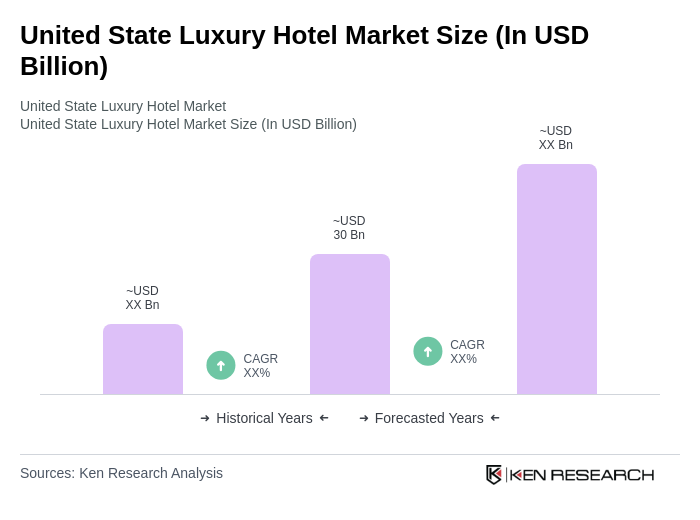

The United States luxury hotel market is valued at approximately USD 30 billion, driven by increasing disposable incomes, a rise in international tourism, and a growing preference for unique travel experiences among affluent consumers.