Region:North America

Author(s):Rebecca

Product Code:KRAB2901

Pages:97

Published On:October 2025

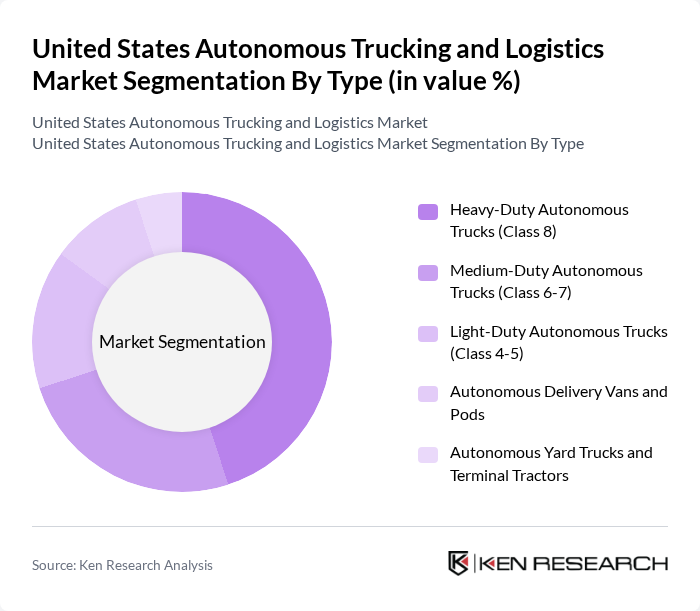

By Type:The market is segmented into various types of autonomous vehicles, including Heavy-Duty Autonomous Trucks (Class 8), Medium-Duty Autonomous Trucks (Class 6-7), Light-Duty Autonomous Trucks (Class 4-5), Autonomous Delivery Vans and Pods, and Autonomous Yard Trucks and Terminal Tractors. Among these, Heavy-Duty Autonomous Trucks (Class 8) dominate the market due to their suitability for long-haul freight transport, which is increasingly being automated to improve efficiency, safety, and reduce costs. The demand for these trucks is driven by the need for reliable, scalable, and cost-effective transportation solutions in the logistics sector .

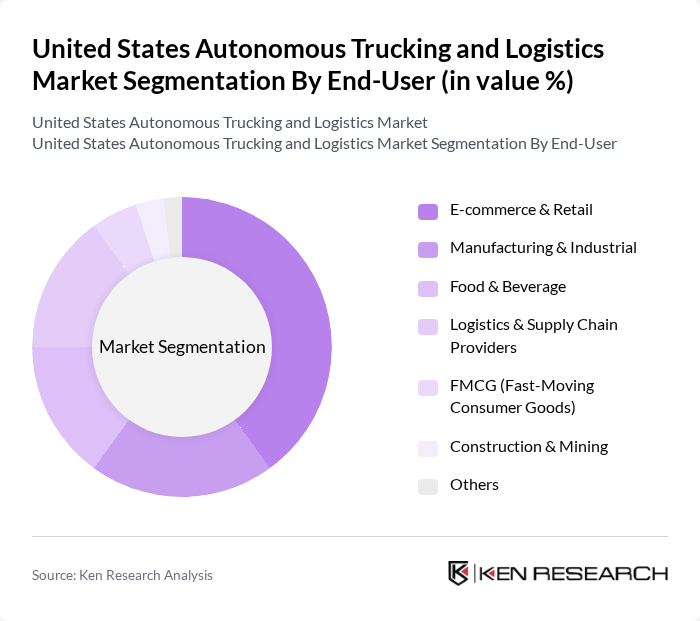

By End-User:The end-user segmentation includes E-commerce & Retail, Manufacturing & Industrial, Food & Beverage, Logistics & Supply Chain Providers, FMCG (Fast-Moving Consumer Goods), Construction & Mining, and Others. The E-commerce & Retail sector is the leading end-user, driven by the increasing demand for fast and efficient delivery services. The rise of online shopping and omnichannel retail has necessitated the adoption of autonomous logistics solutions to meet consumer expectations for rapid and reliable delivery .

The United States Autonomous Trucking and Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Waymo LLC, TuSimple Holdings Inc., Aurora Innovation Inc., Embark Technology Inc., Kodiak Robotics Inc., Gatik AI Inc., Nuro Inc., Daimler Truck North America LLC, Volvo Group North America, PACCAR Inc., Tesla Inc., Xos Inc., Nikola Corporation, Freightliner Trucks, and Rivian Automotive Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. autonomous trucking and logistics market appears promising, driven by technological advancements and increasing demand for efficient logistics solutions. As companies invest in smart infrastructure and integrate IoT technologies, operational efficiencies are expected to improve significantly. Furthermore, the ongoing development of regulatory frameworks will likely facilitate smoother market entry for autonomous vehicles. With a focus on sustainability and reduced emissions, the industry is poised for transformative growth, aligning with broader environmental goals and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Heavy-Duty Autonomous Trucks (Class 8) Medium-Duty Autonomous Trucks (Class 6-7) Light-Duty Autonomous Trucks (Class 4-5) Autonomous Delivery Vans and Pods Autonomous Yard Trucks and Terminal Tractors |

| By End-User | E-commerce & Retail Manufacturing & Industrial Food & Beverage Logistics & Supply Chain Providers FMCG (Fast-Moving Consumer Goods) Construction & Mining Others |

| By Application | Long-Haul Freight Transport Short-Haul & Regional Transport Last-Mile Delivery Intermodal & Port Operations Construction & Mining Logistics Others |

| By Fleet Type | Dedicated Autonomous Fleets Shared/Third-Party Autonomous Fleets Mixed Fleets (Autonomous & Human-Driven) Others |

| By Distribution Mode | Direct Distribution (Fleet-Owned) Third-Party Logistics (3PL) Freight Forwarding & Brokerage Others |

| By Pricing Model | Pay-Per-Mile Subscription-Based Lease-Based Others |

| By Service Type | Autonomous Transportation Services Autonomous Warehousing & Yard Management Value-Added Logistics Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Transportation Companies | 120 | Logistics Managers, Fleet Operations Directors |

| Technology Providers for Autonomous Systems | 90 | Product Development Managers, R&D Heads |

| Regulatory Agencies | 40 | Policy Makers, Compliance Officers |

| End-Users in E-commerce | 80 | Supply Chain Managers, Operations Executives |

| Logistics Consultants | 70 | Consultants, Industry Analysts |

The United States Autonomous Trucking and Logistics Market is valued at approximately USD 1.7 billion, driven by advancements in artificial intelligence, machine learning, and the increasing demand for efficient logistics solutions.