Region:North America

Author(s):Geetanshi

Product Code:KRAD7280

Pages:94

Published On:December 2025

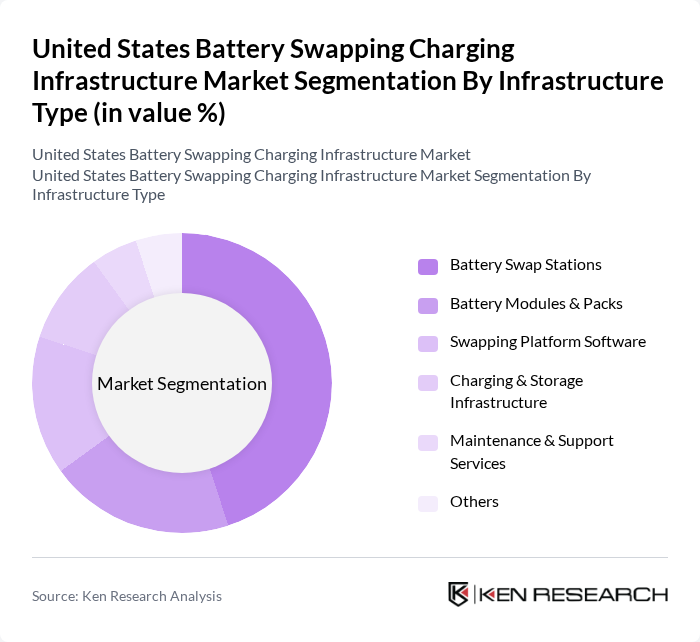

By Infrastructure Type:The infrastructure type segment includes various components essential for battery swapping operations. The dominant sub-segment is Battery Swap Stations, which serve as the primary locations for users to exchange depleted batteries for fully charged ones. This segment is crucial for enhancing the convenience of EV usage, particularly in urban areas where quick turnaround times are essential. Other sub-segments include Battery Modules & Packs, Swapping Platform Software, Charging & Storage Infrastructure, Maintenance & Support Services, and Others, each contributing to the overall efficiency and functionality of the battery swapping ecosystem.

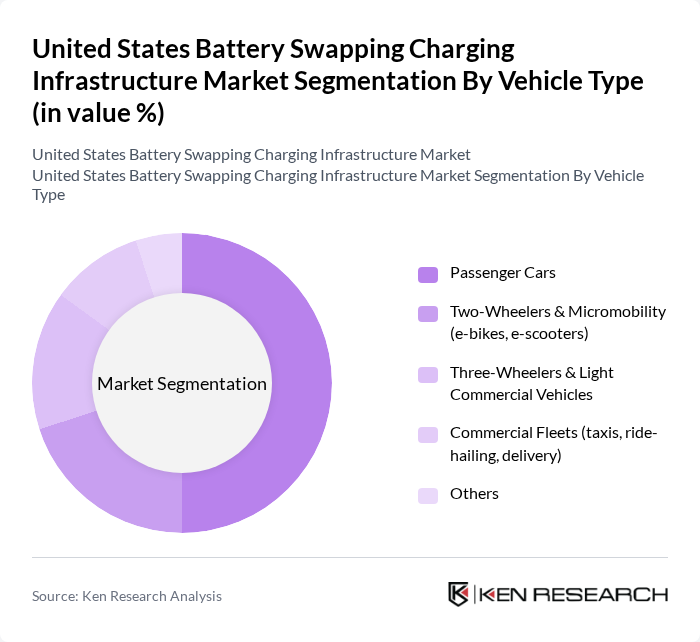

By Vehicle Type:This segment categorizes vehicles that utilize battery swapping services. The leading sub-segment is Passenger Cars, driven by the increasing number of electric passenger vehicles on the road and the growing consumer preference for convenient charging solutions. Other sub-segments include Two-Wheelers & Micromobility (e-bikes, e-scooters), Three-Wheelers & Light Commercial Vehicles, Commercial Fleets (taxis, ride-hailing, delivery), and Others, each playing a vital role in expanding the market reach of battery swapping technology.

The United States Battery Swapping Charging Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ample Inc., NIO Inc. (NIO Power), Gogoro Inc., Sun Mobility Pvt. Ltd., Aulton New Energy Automotive Technology Co., Ltd., BP p.l.c. (bp pulse), Shell plc (Shell Recharge), EVgo Inc., ChargePoint Holdings, Inc., Blink Charging Co., Tesla, Inc. (pilot swapping & fast-charge alternatives), Stellantis N.V. (U.S. pilot swapping & BaaS initiatives), General Motors Company (Ultium-based fleet and swapping pilots), Ford Motor Company (commercial fleet electrification partnerships), Uber Technologies, Inc. (fleet & micromobility swapping partnerships) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the battery swapping infrastructure market in the U.S. appears promising, driven by increasing EV adoption and supportive government policies. As technological advancements continue to enhance battery efficiency and reduce costs, the infrastructure will likely expand, particularly in urban areas. Additionally, partnerships with automotive manufacturers will play a crucial role in integrating battery swapping into mainstream EV offerings, further solidifying its position in the market as a viable alternative to traditional charging methods.

| Segment | Sub-Segments |

|---|---|

| By Infrastructure Type | Battery Swap Stations Battery Modules & Packs Swapping Platform Software Charging & Storage Infrastructure Maintenance & Support Services Others |

| By Vehicle Type | Two-Wheelers & Micromobility (e?bikes, e?scooters) Three-Wheelers & Light Commercial Vehicles Passenger Cars Commercial Fleets (taxis, ride?hailing, delivery) Others |

| By Service Model | Subscription (Battery?as?a?Service) Pay?per?Use / On?Demand Swapping Fleet Service Contracts Others |

| By Station Type | Manual Swapping Stations Semi?Automated Swapping Stations Fully Automated Swapping Stations Hybrid Swapping & Plug?in Charging Hubs |

| By Battery Type | Lithium?ion Batteries LFP and Other Advanced Chemistries Second?Life / Repurposed Batteries Others |

| By End?Use Application | Urban Shared Mobility Last?Mile Delivery & Logistics Corporate & Municipal Fleets Residential & Community Hubs Others |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Swapping Infrastructure Providers | 45 | CEOs, Business Development Managers |

| Electric Vehicle Manufacturers | 40 | Product Managers, R&D Directors |

| Energy Providers and Utilities | 40 | Energy Analysts, Operations Managers |

| Fleet Operators Utilizing Battery Swapping | 35 | Fleet Managers, Logistics Coordinators |

| Government and Regulatory Bodies | 40 | Policy Makers, Transportation Planners |

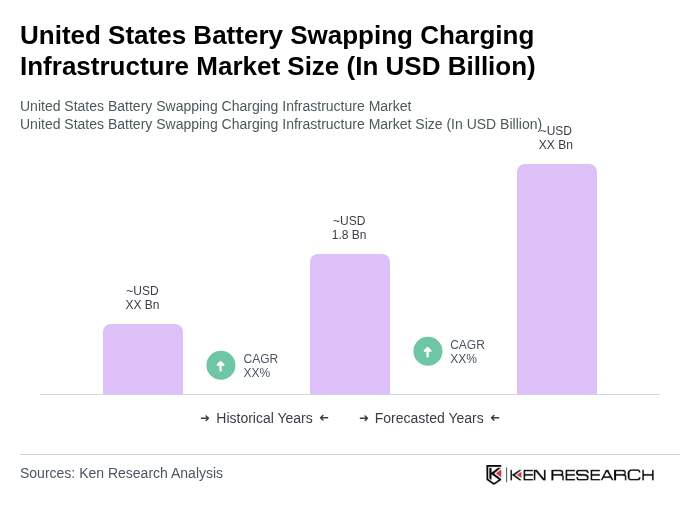

The United States Battery Swapping Charging Infrastructure Market is valued at approximately USD 1.8 billion, reflecting a significant growth trend driven by the increasing adoption of electric vehicles (EVs) and advancements in battery technology.