Region:North America

Author(s):Shubham

Product Code:KRAB3265

Pages:98

Published On:October 2025

Services Market.png)

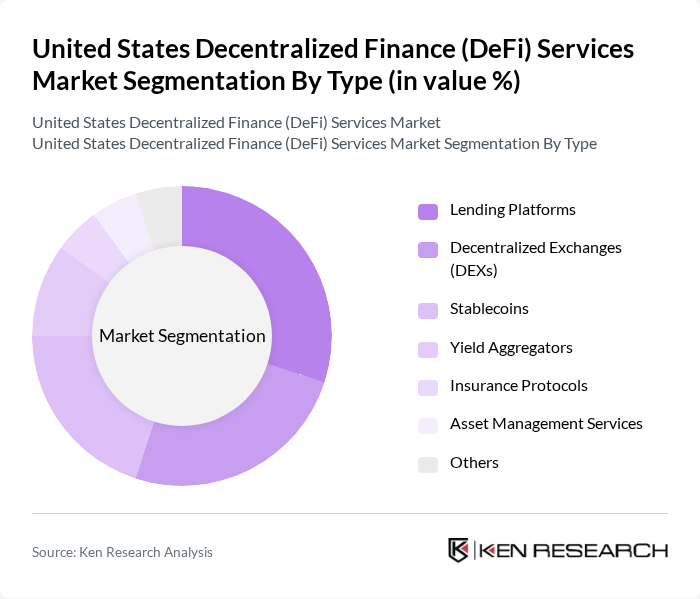

By Type:The DeFi services market can be segmented into various types, including Lending Platforms, Decentralized Exchanges (DEXs), Stablecoins, Yield Aggregators, Insurance Protocols, Asset Management Services, and Others. Each of these segments plays a crucial role in the overall ecosystem, catering to different user needs and preferences.

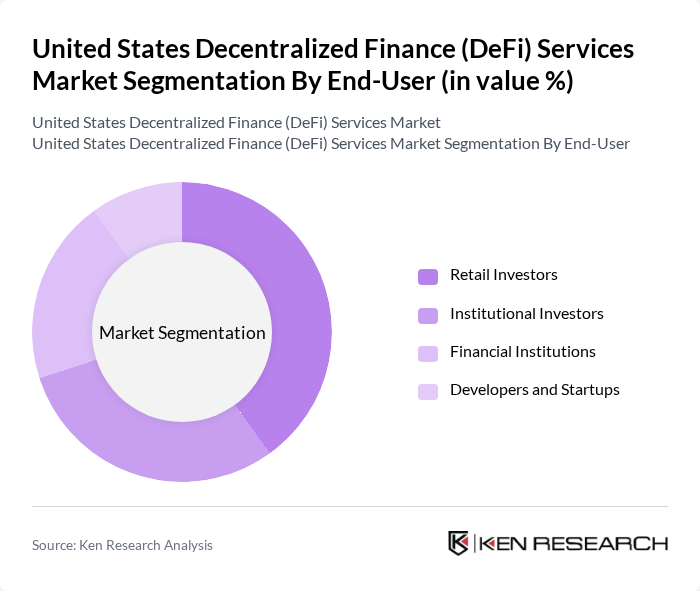

By End-User:The end-user segmentation includes Retail Investors, Institutional Investors, Financial Institutions, and Developers and Startups. Each group has distinct motivations and usage patterns, influencing the overall dynamics of the DeFi market.

The United States Decentralized Finance (DeFi) Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Uniswap Labs, Aave, Compound Labs, Inc., MakerDAO, Synthetix, Yearn Finance, Curve Finance, PancakeSwap, dYdX, 1inch Network, Balancer Labs, SushiSwap, Nexus Mutual, Harvest Finance, Ren Protocol contribute to innovation, geographic expansion, and service delivery in this space.

The future of the DeFi market in the United States appears promising, driven by technological advancements and increasing user adoption. As blockchain technology continues to evolve, we can expect enhanced security measures and user-friendly interfaces that will attract a broader audience. Additionally, the integration of DeFi with traditional financial systems is likely to create new synergies, fostering innovation and expanding the market. This convergence will pave the way for a more inclusive financial ecosystem, benefiting both consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Lending Platforms Decentralized Exchanges (DEXs) Stablecoins Yield Aggregators Insurance Protocols Asset Management Services Others |

| By End-User | Retail Investors Institutional Investors Financial Institutions Developers and Startups |

| By Application | Trading and Investment Lending and Borrowing Asset Management Insurance |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales |

| By Regulatory Compliance | KYC/AML Compliant Services Non-Compliant Services |

| By Investment Size | Small Investments Medium Investments Large Investments |

| By Policy Support | Government Grants Tax Incentives Regulatory Sandboxes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| DeFi Lending Platforms | 100 | Product Managers, Financial Analysts |

| Decentralized Exchanges (DEX) | 80 | Operations Managers, Blockchain Developers |

| DeFi Insurance Services | 60 | Risk Managers, Compliance Officers |

| Yield Farming and Staking Services | 70 | Investment Advisors, Crypto Enthusiasts |

| Regulatory Impact on DeFi | 50 | Legal Advisors, Policy Makers |

The United States Decentralized Finance (DeFi) Services Market is valued at approximately USD 15 billion, reflecting significant growth driven by the adoption of blockchain technology and cryptocurrencies, as well as the demand for financial services that operate without intermediaries.