Region:North America

Author(s):Geetanshi

Product Code:KRAD0127

Pages:96

Published On:August 2025

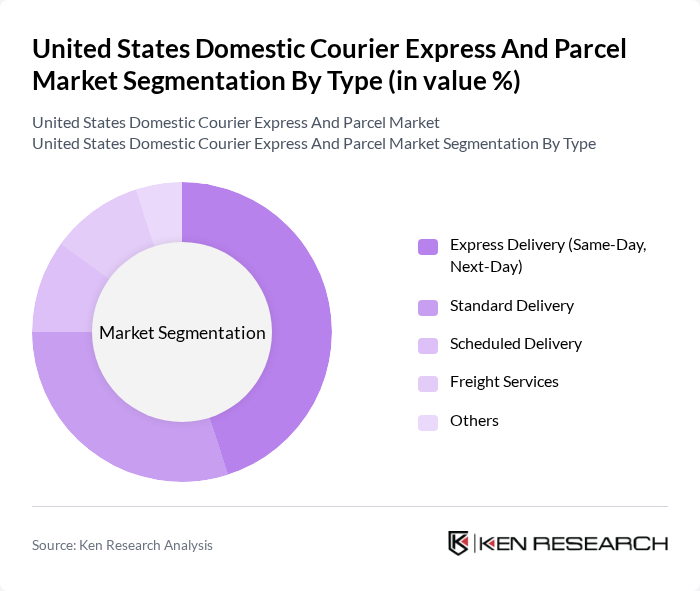

By Type:The market is segmented into Express Delivery (Same-Day, Next-Day), Standard Delivery, Scheduled Delivery, Freight Services, and Others. Among these, Express Delivery is gaining significant traction due to the increasing consumer preference for rapid delivery options. The demand for same-day and next-day services is particularly high in urban areas, where consumers expect quick turnaround times for their orders. Standard Delivery remains a staple for less urgent shipments, while Freight Services cater to larger shipments, often for businesses. The Others category includes niche services such as temperature-controlled or specialized item delivery .

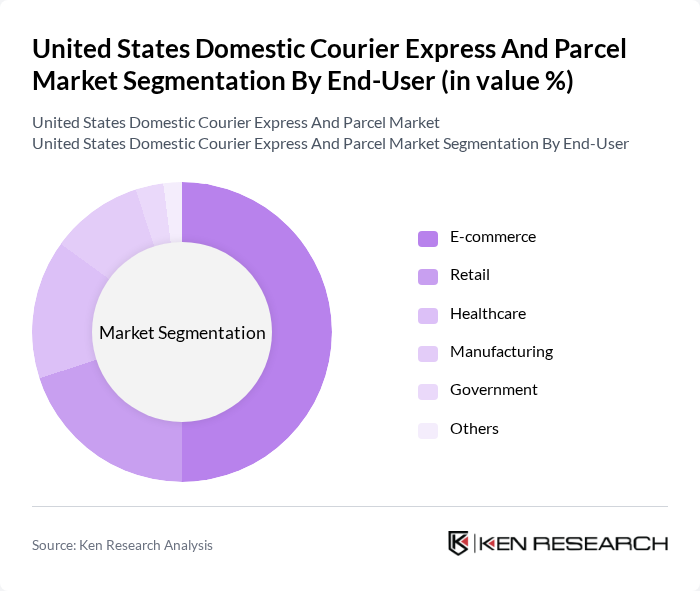

By End-User:The end-user segmentation includes E-commerce, Retail, Healthcare, Manufacturing, Government, and Others. E-commerce is the leading segment, driven by the rapid growth of online shopping and the need for efficient delivery solutions. Retail also plays a significant role, as brick-and-mortar stores increasingly rely on courier services for inventory replenishment and customer deliveries. The Healthcare sector demands specialized delivery services for medical supplies and pharmaceuticals, while Manufacturing and Government sectors utilize courier services for logistics and documentation. The Others category encompasses various industries that require parcel delivery services, such as financial services and primary industry .

The United States Domestic Courier Express And Parcel Market is characterized by a dynamic mix of regional and international players. Leading participants such as United Parcel Service, Inc. (UPS), FedEx Corporation, DHL Express (USA), Inc., XPO Logistics, Inc., Pitney Bowes Inc., OnTrac, Inc., LaserShip, Inc., United States Postal Service (USPS), TForce Final Mile, Inc., DHL eCommerce Solutions (USA), Postmates Inc. (a service of Uber Technologies, Inc.), DoorDash, Inc., Shipt, Inc. (a subsidiary of Target Corporation), GoPuff, Inc., Grubhub Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the U.S. domestic courier express and parcel market appears promising, driven by ongoing advancements in technology and evolving consumer preferences. As e-commerce continues to expand, companies are likely to invest in innovative delivery solutions, including drone technology and automated logistics systems. Additionally, the focus on sustainability will push firms to adopt greener practices, enhancing their appeal to environmentally conscious consumers and ensuring compliance with regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Express Delivery (Same-Day, Next-Day) Standard Delivery Scheduled Delivery Freight Services Others |

| By End-User | E-commerce Retail Healthcare Manufacturing Government Others |

| By Delivery Speed | Same-Day Delivery Next-Day Delivery Standard Delivery Scheduled Delivery |

| By Package Size | Small Packages Medium Packages Large Packages |

| By Distribution Channel | Direct Sales Online Platforms Retail Outlets Third-Party Logistics |

| By Pricing Model | Flat Rate Variable Rate Subscription-Based |

| By Service Type | Domestic Services International Services Specialized Services (e.g., Healthcare, Perishables) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Express Delivery Services | 100 | Operations Managers, Logistics Coordinators |

| Parcel Delivery for E-commerce | 80 | eCommerce Managers, Supply Chain Analysts |

| Same-Day Delivery Solutions | 60 | Business Development Managers, Customer Experience Leads |

| International Courier Services | 50 | Export Managers, Compliance Officers |

| Last-Mile Delivery Innovations | 60 | Logistics Engineers, Technology Officers |

The United States Domestic Courier Express and Parcel Market is valued at approximately USD 120 billion, driven by the growth of e-commerce, consumer demand for fast delivery, and advancements in logistics technology.