Region:Asia

Author(s):Dev

Product Code:KRAB0396

Pages:92

Published On:August 2025

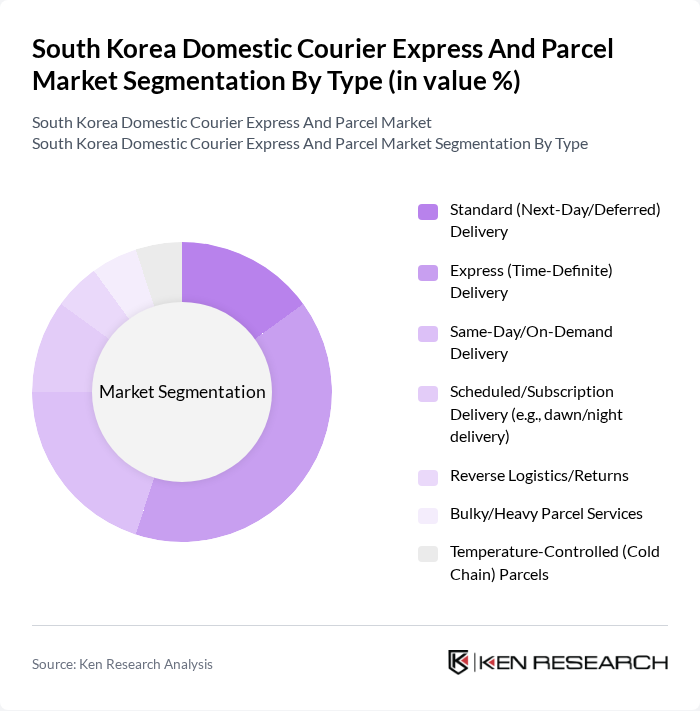

By Type:The market can be segmented into various types of delivery services, including Standard (Next-Day/Deferred) Delivery, Express (Time-Definite) Delivery, Same-Day/On-Demand Delivery, Scheduled/Subscription Delivery, Reverse Logistics/Returns, Bulky/Heavy Parcel Services, and Temperature-Controlled (Cold Chain) Parcels. Among these, Express (Time-Definite) Delivery is the leading sub-segment, driven by growing consumer expectations for rapid fulfillment, e-commerce service-level differentiation, and retailer partnerships offering guaranteed delivery windows.

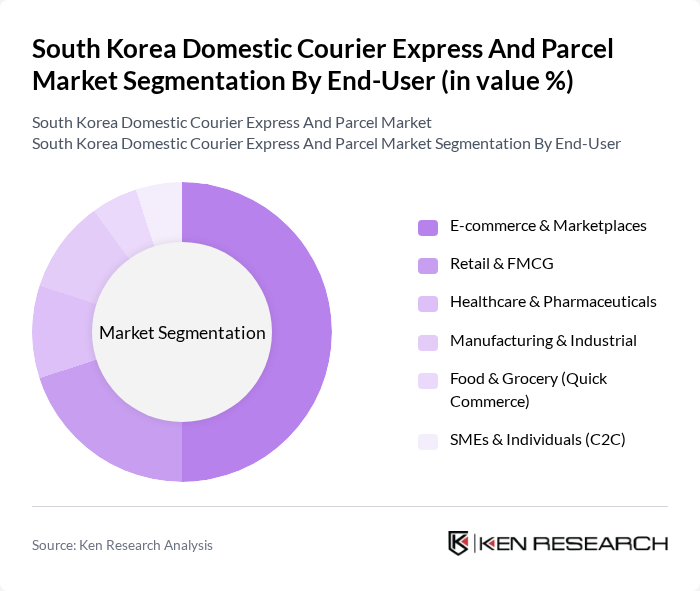

By End-User:The end-user segmentation includes E-commerce & Marketplaces, Retail & FMCG, Healthcare & Pharmaceuticals, Manufacturing & Industrial, Food & Grocery (Quick Commerce), and SMEs & Individuals (C2C). The E-commerce & Marketplaces segment is the dominant player, underpinned by sustained growth in online retail transactions and high penetration of digital shopping, which accelerates parcel demand and last-mile throughput.

The South Korea Domestic Courier Express and Parcel Market is characterized by a dynamic mix of regional and international players. Leading participants such as CJ Logistics Corporation, Hanjin Transportation Co., Ltd., Lotte Global Logistics Co., Ltd., Korea Post (Korea Post Logistics Service), Logen Co., Ltd. (Logen Logistics), GS Postbox (CVSnet Co., Ltd.), LX Pantos Co., Ltd. (formerly Pantos Logistics), Hyundai Glovis Co., Ltd., CU??? ?? (BGF Retail CU Convenience Store Parcel), Mesh Korea Co., Ltd. (VROONG), Coupang Logistics Services (Rocket Delivery), Woowa Bros. (Baemin) – Baemin Connect/Delivery, Naver Fulfillment Alliance Partners (e.g., CJ, Logen), KCTC Co., Ltd., Sagawa Express Korea Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean domestic courier market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As e-commerce continues to thrive, companies will increasingly adopt automation and AI to enhance operational efficiency. Additionally, the demand for sustainable practices will shape logistics strategies, with a focus on eco-friendly delivery options. The integration of innovative last-mile solutions will also be critical in meeting consumer expectations for speed and reliability, ensuring a dynamic and competitive market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard (Next-Day/Deferred) Delivery Express (Time-Definite) Delivery Same-Day/On-Demand Delivery Scheduled/Subscription Delivery (e.g., dawn/night delivery) Reverse Logistics/Returns Bulky/Heavy Parcel Services Temperature-Controlled (Cold Chain) Parcels |

| By End-User | E-commerce & Marketplaces Retail & FMCG Healthcare & Pharmaceuticals Manufacturing & Industrial Food & Grocery (Quick Commerce) SMEs & Individuals (C2C) |

| By Delivery Mode | Road (Two-wheeler/Van/Truck) Air (Domestic Air Express) Rail (Parcel/Container Services) Sea (Inter-island/Jeju lanes) Pickup & Locker Networks (PUDO) |

| By Package Size | Documents & Small Parcels (?2 kg) Medium Parcels (2–20 kg) Large Parcels (20–30 kg) Oversized/Heavy Parcels (>30 kg) |

| By Pricing Model | Flat Rate/Flat Box Weight- and Distance-Based Tiered/Volume Contracts (B2B) Dynamic/Peak Pricing |

| By Payment Method | Cards (Credit/Debit) Digital Wallets (e.g., Naver Pay, Kakao Pay) Cash on Delivery Bank Transfers/Invoicing |

| By Service Type | B2B B2C C2C Fulfillment & Value-Added Services (warehousing, installation) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Express Delivery Services | 120 | Operations Managers, Logistics Coordinators |

| Parcel Delivery for E-commerce | 100 | eCommerce Managers, Supply Chain Analysts |

| Standard Delivery Services | 80 | Customer Service Managers, Delivery Supervisors |

| Last-Mile Delivery Solutions | 70 | Urban Logistics Planners, Fleet Managers |

| Corporate Logistics Solutions | 90 | Procurement Managers, Business Development Executives |

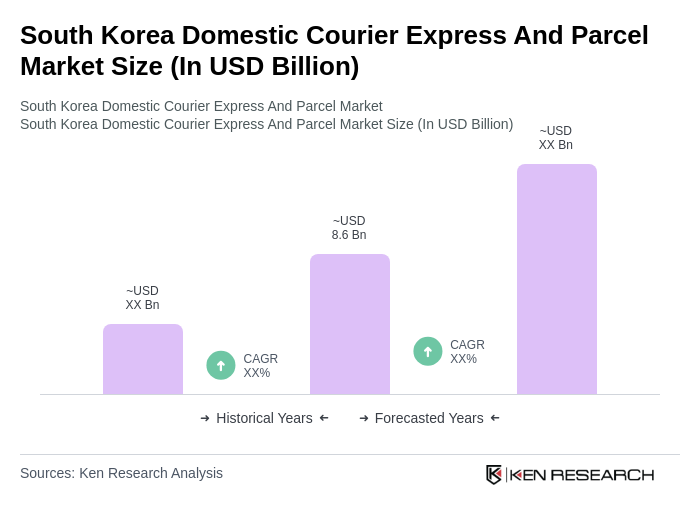

The South Korea Domestic Courier Express and Parcel Market is valued at approximately USD 8.6 billion, reflecting significant growth driven by e-commerce expansion and consumer demand for fast delivery services.