Region:Asia

Author(s):Geetanshi

Product Code:KRAB0131

Pages:100

Published On:August 2025

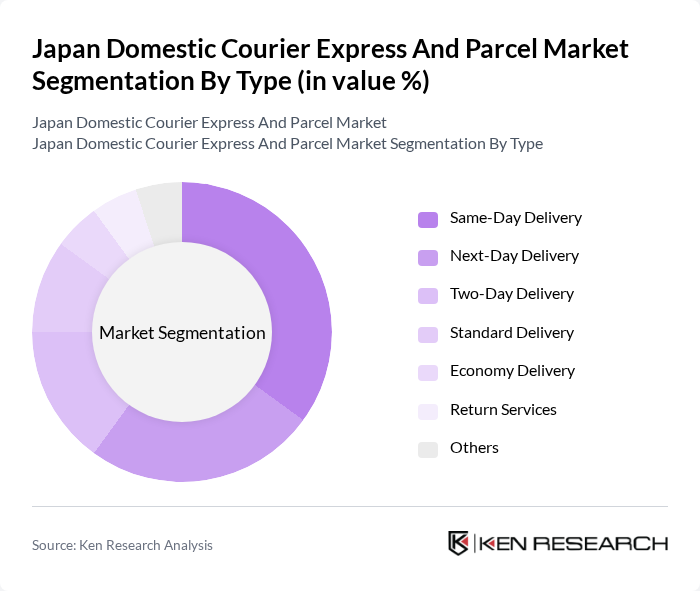

By Type:The market is segmented into various types of delivery services, including Same-Day Delivery, Next-Day Delivery, Two-Day Delivery, Standard Delivery, Economy Delivery, Return Services, and Others. Among these, Same-Day Delivery has gained significant traction due to the increasing consumer demand for rapid service, particularly in urban areas. The convenience and immediacy offered by this service have made it a preferred choice for both businesses and consumers. Express delivery services, which include same-day and next-day options, are the fastest-growing segment, driven by the need for speed and reliability in e-commerce fulfillment .

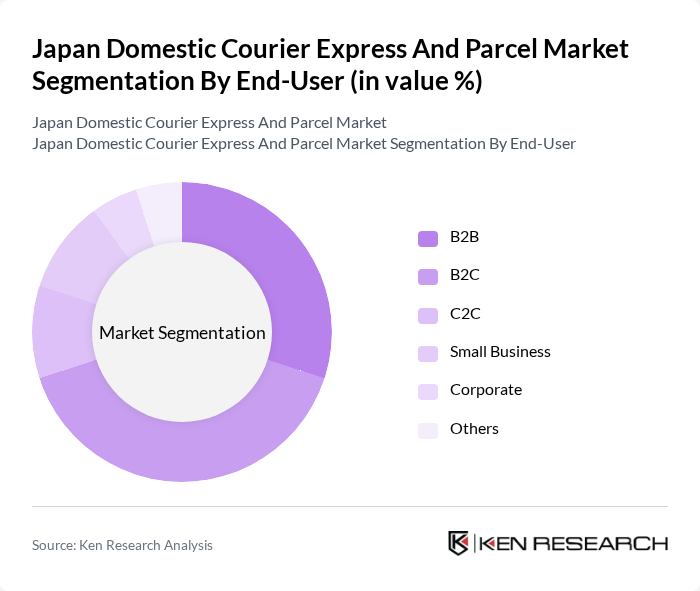

By End-User:The end-user segmentation includes B2B, B2C, C2C, Small Business, Corporate, and Others. The B2C segment is currently leading the market, driven by the rapid growth of e-commerce and online shopping. Consumers increasingly prefer home delivery options, which has led to a surge in demand for parcel services tailored to individual customers. The B2B segment remains significant due to the continued need for business logistics and document delivery, but B2C dominates due to the scale of e-commerce parcel volumes .

The Japan Domestic Courier Express and Parcel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yamato Holdings Co., Ltd., Sagawa Express Co., Ltd., Japan Post Co., Ltd., Seino Holdings Co., Ltd., Fukuyama Transporting Co., Ltd., Nippon Express Co., Ltd., DHL Japan, Inc., FedEx Express Japan, UPS Japan Co., Ltd., Rakuten Super Logistics Japan, Inc., Kintetsu World Express, Inc., TSE Express Co., Ltd., SG Holdings Co., Ltd., Hitachi Transport System, Ltd., Senko Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Japan domestic courier express and parcel market appears promising, driven by evolving consumer preferences and technological advancements. As e-commerce continues to thrive, companies are likely to invest in innovative delivery solutions, including automated systems and enhanced tracking technologies. Additionally, the focus on sustainability will shape operational strategies, with more firms adopting eco-friendly practices to meet regulatory demands and consumer expectations, ensuring a competitive edge in the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Same-Day Delivery Next-Day Delivery Two-Day Delivery Standard Delivery Economy Delivery Return Services Others |

| By End-User | B2B B2C C2C Small Business Corporate Others |

| By Delivery Mode | Road Transport Air Transport Rail Transport Sea Transport Others |

| By Package Size | Small Packages Medium Packages Large Packages Bulk Shipments Others |

| By Pricing Model | Flat Rate Variable Rate Subscription-Based Others |

| By Service Type | Door-to-Door Services Drop-off Services Pickup Services Others |

| By Customer Segment | B2B B2C C2C Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Courier Services | 100 | Operations Managers, Logistics Coordinators |

| Rural Delivery Solutions | 60 | Regional Managers, Delivery Supervisors |

| Same-Day Delivery Trends | 50 | Customer Service Managers, Sales Directors |

| Parcel Tracking Innovations | 40 | IT Managers, Product Development Leads |

| Corporate Logistics Partnerships | 50 | Supply Chain Executives, Procurement Managers |

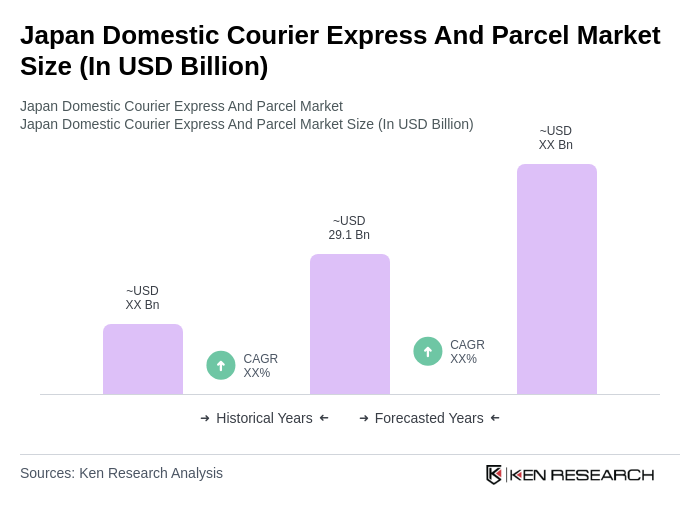

The Japan Domestic Courier Express and Parcel Market is valued at approximately USD 29.1 billion, reflecting significant growth driven by the rise in e-commerce and advancements in logistics technology.