Region:North America

Author(s):Rebecca

Product Code:KRAB4760

Pages:83

Published On:October 2025

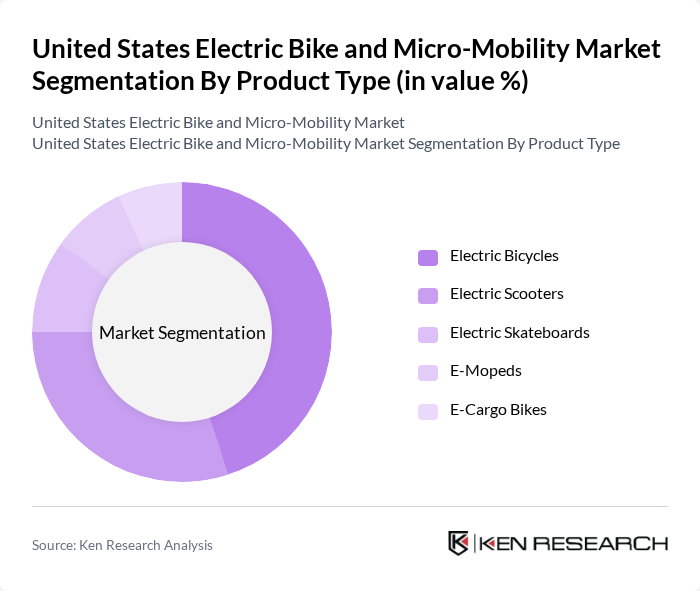

By Product Type:The product type segmentation includes various categories such as Electric Bicycles, Electric Scooters, Electric Skateboards, E-Mopeds, and E-Cargo Bikes. Among these, Electric Bicycles have emerged as the dominant segment, driven by their versatility and appeal to a wide range of consumers. The increasing popularity of cycling for both leisure and commuting purposes has led to a surge in demand for electric bicycles, making them a preferred choice for many. Electric Scooters also show significant growth, particularly in urban areas where they serve as a convenient mode of transport for short distances. The market for Electric Skateboards, E-Mopeds, and E-Cargo Bikes is growing but remains smaller compared to the leading segments .

By Drive Type:The drive type segmentation includes Chain Drive and Belt Drive. The Chain Drive segment is currently leading the market due to its efficiency and widespread use in electric bicycles and scooters. Chain drives are favored for their durability and ease of maintenance, making them a popular choice among consumers. Belt drives, while gaining traction for their quieter operation and lower maintenance needs, still represent a smaller portion of the market. The preference for chain drives is largely influenced by their proven performance and reliability in various riding conditions .

The United States Electric Bike and Micro-Mobility Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rad Power Bikes, Trek Bicycle Corporation, Specialized Bicycle Components, Giant Manufacturing Co. Ltd., Pedego Electric Bikes, Aventon Bikes, Yamaha Motor Co. Ltd., Bosch eBike Systems, Shimano Inc., Super73, Juiced Bikes, EVELO Electric Bicycles, Lectric eBikes, Ride1UP, Accell Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric bike and micro-mobility market in the United States appears promising, driven by increasing urbanization and a growing emphasis on sustainability. As cities invest in infrastructure to support electric mobility, the adoption of e-bikes is expected to rise significantly. Furthermore, technological advancements will continue to enhance user experience, making electric bikes more appealing. The integration of smart technology and eco-friendly practices will likely shape the market landscape, fostering a shift towards greener transportation solutions.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Electric Bicycles Electric Scooters Electric Skateboards E-Mopeds E-Cargo Bikes |

| By Drive Type | Chain Drive Belt Drive |

| By Battery Type | Lithium-Ion Batteries Lead-Acid Batteries Others |

| By Usage Type | Personal Use Commercial Use Shared Mobility |

| By End-User | Individual Consumers Delivery Services Tourism and Recreation Corporate Fleets |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Rental Services Direct Sales |

| By Price Range | Budget Segment (Under $1,500) Mid-Range Segment ($1,500-$3,500) Premium Segment (Above $3,500) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Bike Retailers | 60 | Store Owners, Sales Managers |

| Micro-Mobility Service Providers | 50 | Operations Managers, Fleet Coordinators |

| Urban Transportation Planners | 40 | City Officials, Transportation Analysts |

| End-Users of Electric Bikes | 90 | Commuters, Recreational Users |

| Micro-Mobility Users | 70 | Students, Tourists, Local Residents |

The United States Electric Bike and Micro-Mobility Market is valued at approximately USD 2.7 billion, reflecting significant growth driven by urbanization, rising fuel prices, and a shift towards sustainable transportation solutions.