United States Hair Mask Market Overview

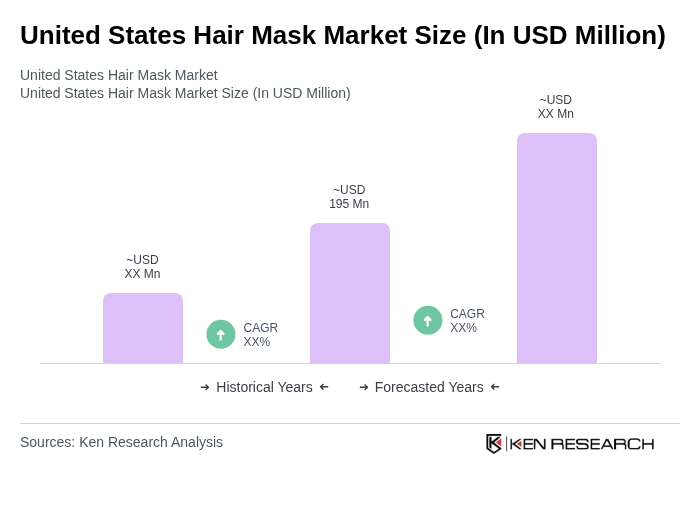

- The United States Hair Mask Market is valued at USD 195 million, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness regarding hair health, the rising trend of self-care routines, and the growing demand for premium and natural hair care products. The market has seen a significant shift towards natural and organic ingredients, reflecting changing consumer preferences and a focus on clean beauty and wellness. The expansion of e-commerce and direct-to-consumer brands is further accelerating market growth, making hair masks more accessible to a wider audience.

- Key players in this market benefit from strong demand in major cities such as New York, Los Angeles, and Chicago, which dominate due to their large populations and high disposable incomes. These urban centers are recognized as trendsetters in beauty and personal care, influencing consumer behavior nationwide. The presence of numerous salons, beauty retailers, and a vibrant influencer community in these cities further enhances market growth, driving adoption of premium and specialized hair mask products.

- In 2023, the U.S. government enacted the Modernization of Cosmetics Regulation Act (MoCRA), issued by the U.S. Food and Drug Administration (FDA). This regulation requires all cosmetic products, including hair masks, to disclose ingredient sourcing and safety data, and mandates facility registration and product listing. MoCRA aims to enhance consumer safety and promote transparency in the beauty industry, ensuring that products meet specific health and environmental standards.

United States Hair Mask Market Segmentation

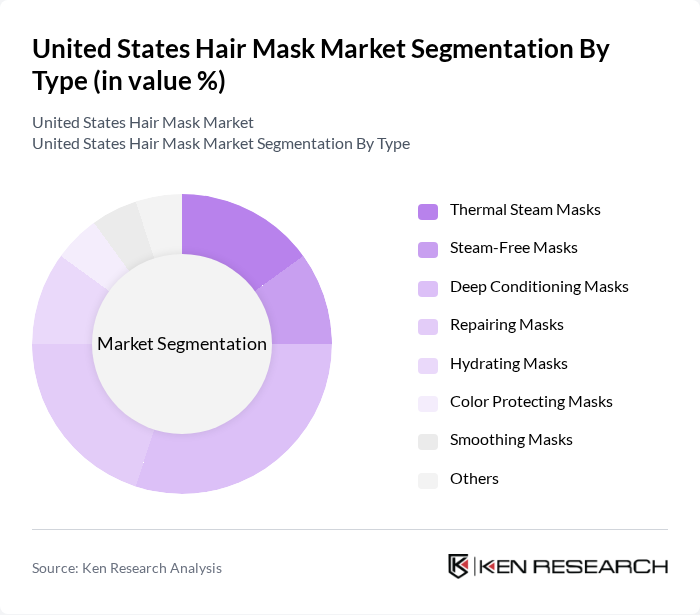

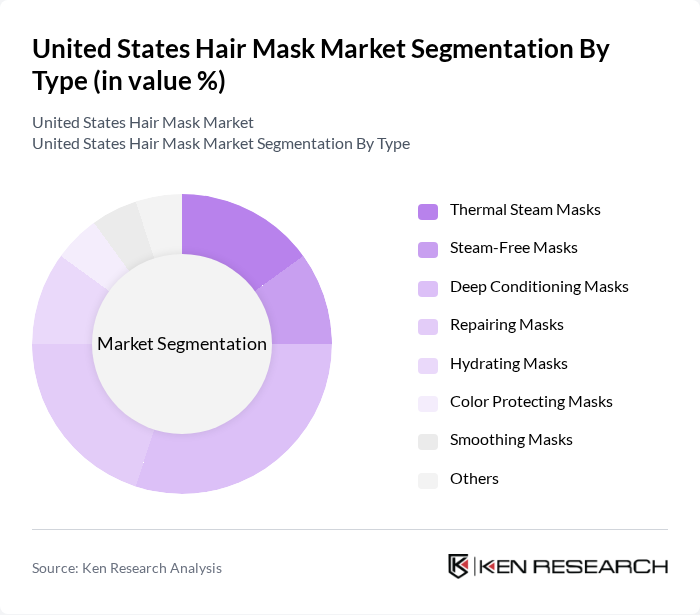

By Type:The hair mask market is segmented into various types, including Thermal Steam Masks, Steam-Free Masks, Deep Conditioning Masks, Repairing Masks, Hydrating Masks, Color Protecting Masks, Smoothing Masks, and Others. Among these, Deep Conditioning Masks are currently dominating the market due to their effectiveness in restoring moisture and repairing damaged hair. Consumers are increasingly seeking products that provide intensive care, leading to a surge in demand for these masks. The trend towards natural ingredients has also influenced the popularity of Deep Conditioning Masks, as many brands are now formulating these products with organic and nourishing components. Moisture retention and damage repair products represent the largest segment, driven by consumer concerns over hair health, heat styling, and environmental stressors.

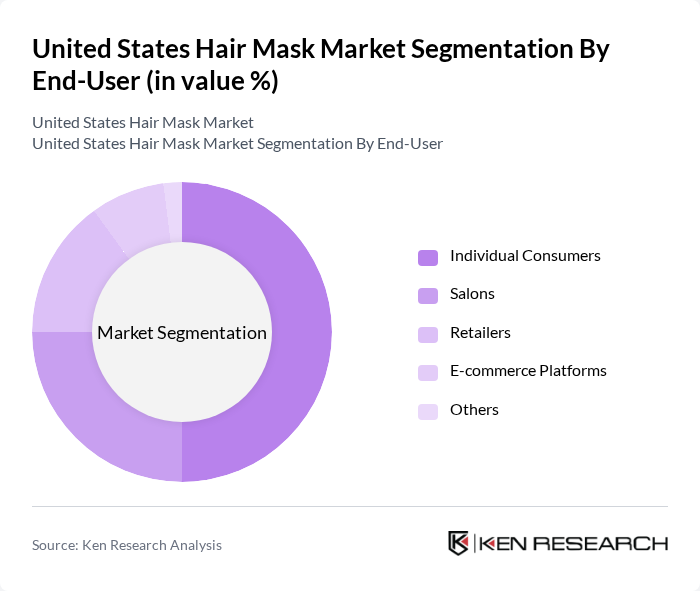

By End-User:The market is segmented by end-user into Individual Consumers, Salons, Retailers, E-commerce Platforms, and Others. Individual Consumers are the leading segment, driven by the growing trend of at-home hair care and the increasing availability of hair masks in retail and online channels. The rise of social media influencers and beauty bloggers has also contributed to the popularity of hair masks among consumers, as they seek to replicate salon-quality results at home. Salons remain significant players, using professional-grade products to cater to their clientele. The expansion of e-commerce platforms is also boosting market penetration, making hair masks accessible to a broader consumer base.

United States Hair Mask Market Competitive Landscape

The United States Hair Mask Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal USA, Procter & Gamble (Pantene, Herbal Essences), Unilever (Dove, TRESemmé, Nexxus), Coty Inc. (Wella Professionals), Johnson & Johnson (OGX), Estée Lauder Companies Inc. (Aveda, Bumble and bumble), Henkel AG & Co. KGaA (Schwarzkopf), Revlon Inc., Amika, SheaMoisture, Ouai Haircare, Briogeo, Olaplex Holdings Inc., Eva NYC, Garnier contribute to innovation, geographic expansion, and service delivery in this space.

United States Hair Mask Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness About Hair Care:The U.S. hair care market is projected to reach $87 billion, driven by heightened consumer awareness regarding hair health. This awareness is reflected in the growing demand for hair masks, which are increasingly recognized for their restorative properties. According to a recent survey by the American Academy of Dermatology, 65% of consumers actively seek products that promote hair health, indicating a significant shift towards informed purchasing decisions in the beauty sector.

- Rising Demand for Natural and Organic Products:The natural and organic personal care market in the U.S. is expected to surpass $25 billion, with hair masks being a key segment. A report from the Organic Trade Association indicates that 50% of consumers prefer products with natural ingredients, driving brands to innovate and reformulate their offerings. This trend is further supported by a recent Nielsen report, which found that 70% of millennials prioritize eco-friendly and organic products in their beauty routines.

- Growth of E-commerce Platforms for Beauty Products:E-commerce sales in the beauty sector are projected to reach $30 billion, significantly impacting the hair mask market. According to Statista, online beauty product sales grew by 25%, driven by convenience and a wider selection. This shift towards digital shopping is further supported by a recent report from McKinsey, which found that 60% of consumers prefer purchasing beauty products online, enhancing accessibility to hair masks and related products.

Market Challenges

- High Competition Among Established Brands:The U.S. hair mask market is characterized by intense competition, with over 200 brands vying for market share. Major players like L'Oréal and Procter & Gamble dominate, making it challenging for new entrants to establish a foothold. According to IBISWorld, the market's competitive landscape is expected to intensify, with a projected 5% increase in the number of brands, leading to price wars and reduced profit margins for smaller companies.

- Price Sensitivity Among Consumers:Economic factors have led to increased price sensitivity among U.S. consumers, particularly in the beauty sector. A recent report from the Bureau of Labor Statistics indicated that consumer spending on personal care products decreased by 3% due to inflationary pressures. This trend poses a challenge for hair mask brands, as consumers may opt for lower-priced alternatives, impacting sales and brand loyalty in a market where premium products are often priced higher.

United States Hair Mask Market Future Outlook

The future of the U.S. hair mask market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for personalized hair care solutions grows, brands are likely to invest in innovative formulations tailored to specific hair types. Additionally, the increasing focus on sustainability will push companies to adopt eco-friendly practices, including biodegradable packaging. These trends suggest a dynamic market landscape where adaptability and consumer engagement will be crucial for success in future.

Market Opportunities

- Expansion into Untapped Regional Markets:There is significant potential for hair mask brands to expand into underserved regions, particularly in rural areas where access to premium products is limited. According to the U.S. Census Bureau, approximately 20% of the population resides in rural areas, representing a substantial market opportunity for brands willing to invest in distribution and marketing strategies tailored to these demographics.

- Development of Specialized Hair Masks for Different Hair Types:The increasing diversity of hair types in the U.S. presents an opportunity for brands to create specialized hair masks. A recent report from the Professional Beauty Association indicates that 40% of consumers express interest in products designed for specific hair concerns, such as frizz control or color protection. This trend highlights the potential for targeted marketing and product development to meet diverse consumer needs.