Region:North America

Author(s):Shubham

Product Code:KRAC0851

Pages:87

Published On:August 2025

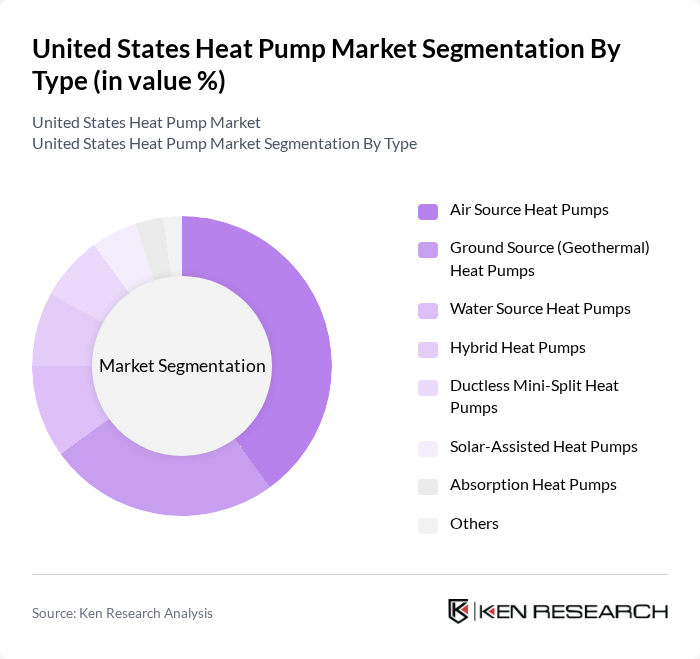

By Type:The heat pump market can be segmented into various types, including Air Source Heat Pumps, Ground Source (Geothermal) Heat Pumps, Water Source Heat Pumps, Hybrid Heat Pumps, Ductless Mini-Split Heat Pumps, Solar-Assisted Heat Pumps, Absorption Heat Pumps, and Others. Among these, Air Source Heat Pumps are the most popular due to their versatility, cost-effectiveness, and ease of installation, making them a preferred choice for both residential and commercial applications .

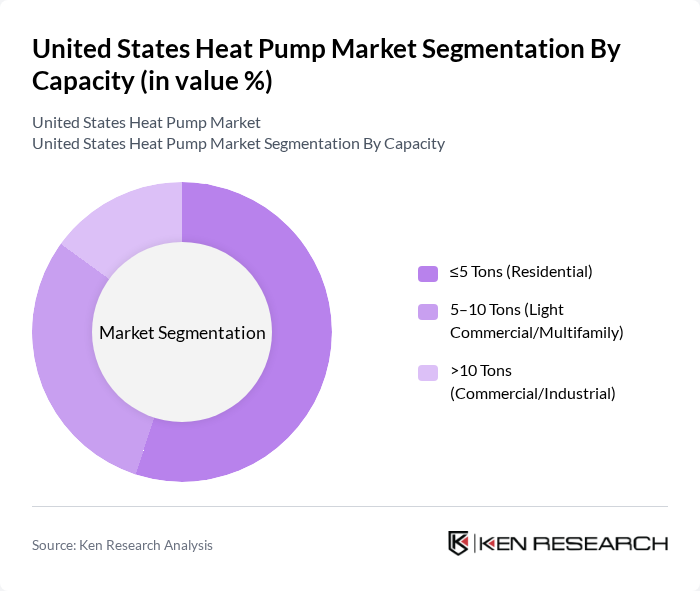

By Capacity:The market can also be segmented by capacity, which includes ?5 Tons (Residential), 5–10 Tons (Light Commercial/Multifamily), and >10 Tons (Commercial/Industrial). The ?5 Tons segment is the most significant due to the high demand for residential heating solutions, driven by the growing trend of energy-efficient homes, increasing residential construction, and the rising number of residential installations .

The United States Heat Pump Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trane Technologies, Carrier Global Corporation, Lennox International Inc., Rheem Manufacturing Company, Daikin North America LLC, Bosch Thermotechnology Corp., Mitsubishi Electric US, Inc., Goodman Manufacturing Company, L.P., Fujitsu General America, Inc., York International Corporation (Johnson Controls), Panasonic Corporation of North America, Nortek Global HVAC, American Standard Heating & Air Conditioning, LG Electronics USA, Inc., Gree USA, Inc., WaterFurnace International, Inc., Bosch Industriekessel GmbH (Bosch Group), Bard HVAC, and Dandelion Energy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. heat pump market appears promising, driven by increasing regulatory support and a shift towards sustainable energy solutions. As urbanization accelerates, the demand for efficient heating systems will likely rise, prompting manufacturers to innovate. Additionally, the integration of smart technologies into heat pump systems is expected to enhance user experience and energy management. Overall, the market is poised for significant growth as consumers and businesses prioritize energy efficiency and environmental sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Source Heat Pumps Ground Source (Geothermal) Heat Pumps Water Source Heat Pumps Hybrid Heat Pumps Ductless Mini-Split Heat Pumps Solar-Assisted Heat Pumps Absorption Heat Pumps Others |

| By Capacity | ?5 Tons (Residential) –10 Tons (Light Commercial/Multifamily) >10 Tons (Commercial/Industrial) |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Space Heating Water Heating Pool Heating Process Heating |

| By Sales Channel | Direct Sales Distributors Online Retail HVAC Contractors |

| By Distribution Mode | Wholesale Distribution Retail Distribution Direct-to-Consumer |

| By Price Range | Low-End Heat Pumps Mid-Range Heat Pumps High-End Heat Pumps |

| By Policy Support | Federal Subsidies State Incentives Tax Credits Renewable Energy Certificates (RECs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Heat Pump Installations | 120 | Homeowners, HVAC Installers |

| Commercial Heat Pump Applications | 90 | Facility Managers, Building Owners |

| Energy Efficiency Program Insights | 60 | Program Administrators, Utility Representatives |

| Heat Pump Technology Adoption Trends | 50 | Industry Experts, Researchers |

| Consumer Satisfaction and Feedback | 100 | Homeowners, Energy Auditors |

The United States Heat Pump Market is valued at approximately USD 15 billion, reflecting a significant growth trend driven by increased energy efficiency awareness, government incentives for renewable energy, and a rising demand for sustainable heating and cooling solutions.