United States Industrial 3D Printing & Additive Manufacturing Market Overview

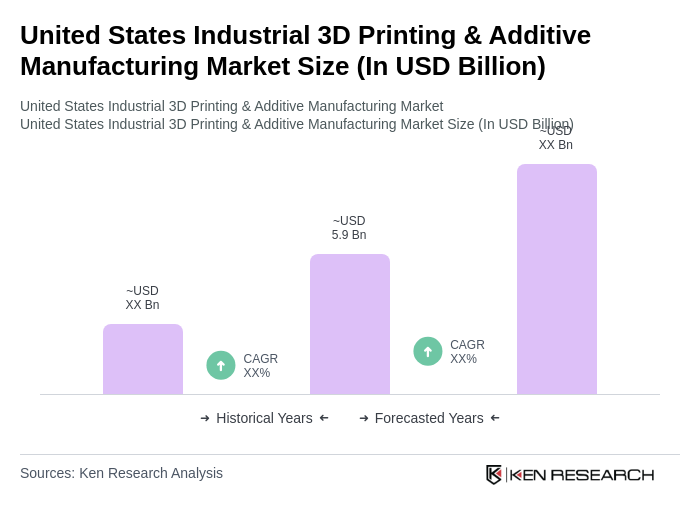

- The United States Industrial 3D Printing & Additive Manufacturing Market is valued at USD 5.9 billion, based on a five-year historical analysis. This growth is primarily driven by advancements in printer technology, increased adoption across automotive, aerospace, healthcare, and consumer goods industries, and the demand for customized manufacturing solutions. The market has seen a significant rise in applications ranging from rapid prototyping to production parts, reflecting the versatility and efficiency of additive manufacturing processes. Companies are investing in advanced printers, materials, and software integration to scale up production while ensuring precision and cost efficiency. Government initiatives promoting smart manufacturing and Industry 4.0 frameworks are further strengthening adoption.

- Key players in this market include cities like San Francisco, Boston, and Chicago, which dominate due to their strong technological ecosystems, access to skilled labor, and proximity to major manufacturing hubs. These cities foster innovation through collaboration between startups, established companies, and research institutions, making them pivotal in the growth of the 3D printing sector. The widespread adoption of 3D printing in education and research institutions further supports regional leadership.

- In 2023, the U.S. government implemented regulations to promote the use of additive manufacturing in defense and aerospace sectors. Specifically, the “Additive Manufacturing Forward (AM Forward) Initiative, 2022” issued by the White House and Department of Defense, mandates increased federal funding for research and development, sets compliance standards for defense contractors, and encourages domestic sourcing of critical components. The regulation requires manufacturers supplying defense and aerospace sectors to meet specified quality assurance and traceability standards for additively manufactured parts, and provides incentives for adopting advanced manufacturing technologies.

United States Industrial 3D Printing & Additive Manufacturing Market Segmentation

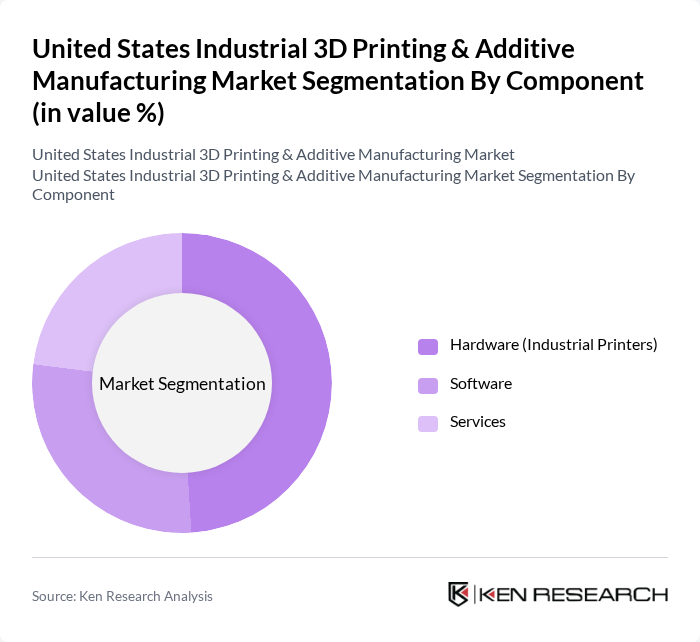

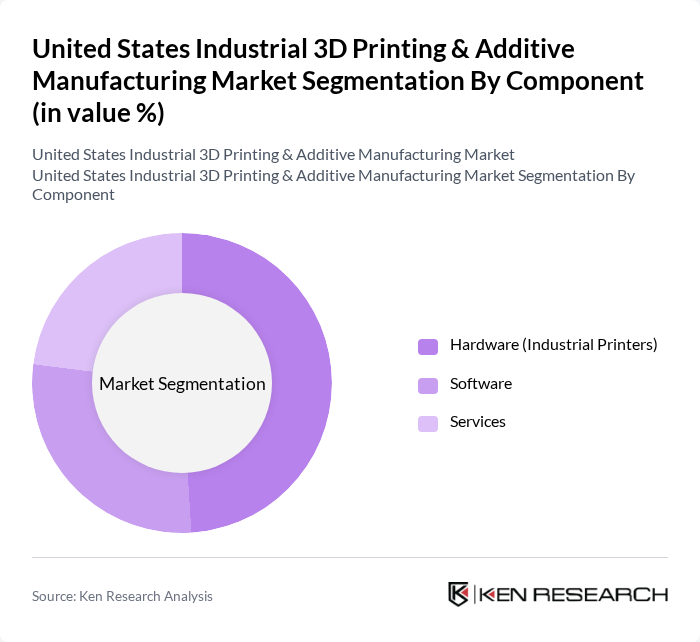

By Component:The market is segmented into Hardware (Industrial Printers), Software, and Services. Hardware, particularly industrial printers, is the leading segment due to the increasing demand for high-quality and efficient printing solutions. Software solutions are gaining traction as they enhance the functionality and usability of 3D printers, while services are essential for maintenance and support. The hardware segment accounts for the largest share, reflecting the industry’s focus on scaling up production capacity and integrating advanced printer models for industrial applications.

By Printer Type:The market is divided into Desktop 3D Printers and Industrial Printers. Industrial printers dominate the market due to their ability to produce high-volume, high-quality parts for various applications, including aerospace and automotive. Desktop printers are popular among hobbyists and small businesses, but their market share is significantly lower compared to industrial counterparts. Industrial printers are increasingly integrated into large-scale production lines, supporting cost-effective and on-demand manufacturing.

United States Industrial 3D Printing & Additive Manufacturing Market Competitive Landscape

The United States Industrial 3D Printing & Additive Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stratasys Ltd., 3D Systems Corporation, HP Inc., GE Additive, EOS GmbH, Materialise NV, Renishaw plc, SLM Solutions Group AG, Desktop Metal, Inc., Formlabs, Inc., Xometry, Inc., Carbon, Inc., Ultimaker B.V., Markforged, Inc., Arcam AB, Protolabs, Inc., Velo3D, Inc., ExOne Company, 3D Hubs (now part of Protolabs), BCN3D Technologies contribute to innovation, geographic expansion, and service delivery in this space.

United States Industrial 3D Printing & Additive Manufacturing Market Industry Analysis

Growth Drivers

- Increasing Demand for Customization:The U.S. industrial 3D printing market is experiencing a surge in demand for customized products, driven by consumer preferences for personalized solutions. In future, the customization market is projected to reach $1.5 billion, reflecting a 20% increase from the previous year. This trend is particularly evident in sectors like consumer goods and fashion, where tailored designs are becoming essential for competitive differentiation. Companies are leveraging 3D printing to meet these demands efficiently, enhancing customer satisfaction and loyalty.

- Advancements in Material Technologies:The development of advanced materials is significantly propelling the industrial 3D printing market. In future, the market for innovative materials, including bio-based and composite materials, is expected to exceed $800 million. These materials offer enhanced properties such as durability and flexibility, making them suitable for a wider range of applications. As manufacturers adopt these technologies, they can produce higher-quality products, thereby increasing operational efficiency and reducing waste in production processes.

- Cost Reduction in Prototyping:The ability to reduce prototyping costs is a key growth driver for the industrial 3D printing market. In future, companies are projected to save approximately $300 million collectively through rapid prototyping techniques enabled by 3D printing. This cost efficiency allows businesses to accelerate product development cycles, enabling faster time-to-market. As firms increasingly recognize the financial benefits of 3D printing for prototyping, adoption rates are expected to rise, further driving market growth.

Market Challenges

- High Initial Investment Costs:One of the significant challenges facing the industrial 3D printing market is the high initial investment required for advanced printing technologies. In future, the average cost of industrial 3D printers is estimated to be around $250,000, which can deter small and medium-sized enterprises from entering the market. This financial barrier limits the widespread adoption of 3D printing technologies, hindering potential growth opportunities in various sectors.

- Limited Material Options:The limited availability of materials suitable for industrial 3D printing poses a challenge to market expansion. Currently, there are over 200 materials available, but many industries require specialized materials that are not yet developed. In future, approximately 30% of manufacturers report difficulties in sourcing appropriate materials for their applications. This limitation restricts the versatility of 3D printing, preventing companies from fully capitalizing on its potential benefits across diverse sectors.

United States Industrial 3D Printing & Additive Manufacturing Market Future Outlook

The future of the U.S. industrial 3D printing market appears promising, driven by technological advancements and increasing integration with digital technologies. As companies continue to innovate, the adoption of 3D printing is expected to expand across various sectors, including aerospace and healthcare. Furthermore, the focus on sustainability will likely lead to the development of eco-friendly materials and processes, enhancing the industry's appeal. Overall, the market is poised for significant growth as it adapts to evolving consumer demands and technological capabilities.

Market Opportunities

- Growth in Aerospace and Automotive Sectors:The aerospace and automotive industries are increasingly adopting 3D printing technologies for lightweight components and complex geometries. In future, these sectors are expected to invest over $500 million in 3D printing applications, driven by the need for efficiency and performance improvements. This trend presents substantial opportunities for manufacturers to innovate and capture market share in these high-value industries.

- Adoption in Healthcare for Prosthetics:The healthcare sector is witnessing a surge in the adoption of 3D printing for prosthetics and implants. In future, the market for 3D-printed medical devices is projected to reach $400 million, as hospitals and clinics seek personalized solutions for patients. This growing demand offers significant opportunities for companies specializing in medical applications, enabling them to enhance patient outcomes and expand their product offerings.