Region:Middle East

Author(s):Dev

Product Code:KRAC4042

Pages:90

Published On:October 2025

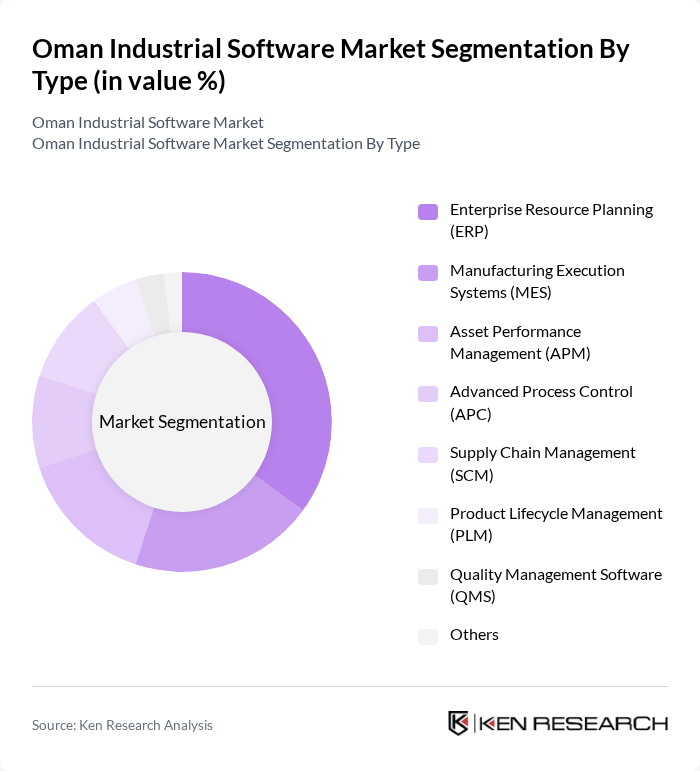

By Type:The market is segmented into various types of industrial software solutions, including Enterprise Resource Planning (ERP), Manufacturing Execution Systems (MES), Asset Performance Management (APM), Advanced Process Control (APC), Supply Chain Management (SCM), Product Lifecycle Management (PLM), Quality Management Software (QMS), and Others.ERP systems lead the marketdue to their ability to integrate core business processes, streamline workflows, and provide real-time data for decision-making. The increasing adoption of cloud-based ERP and the need for digital connectivity across production and supply chains are key drivers for this segment .

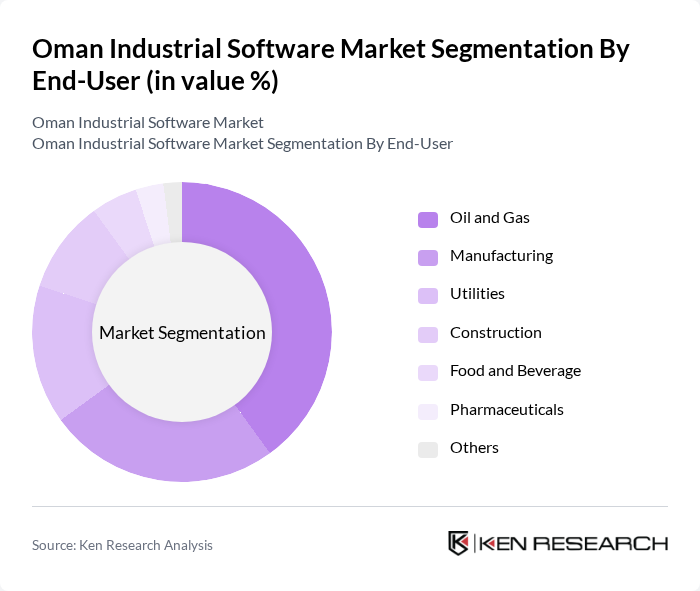

By End-User:The end-user segmentation includes Oil and Gas, Manufacturing, Utilities, Construction, Food and Beverage, Pharmaceuticals, and Others.The Oil and Gas sector is the dominant end-user, driven by the need for advanced software to manage complex operations, ensure regulatory compliance, and support asset integrity. Manufacturing follows, with increasing investments in automation and digital supply chains. Utilities and construction are also adopting industrial software to improve operational efficiency and resource management .

The Oman Industrial Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Siemens AG, Rockwell Automation, Inc., Schneider Electric SE, ABB Ltd., Dassault Systèmes SE, PTC Inc., Hexagon AB, Infor, Inc., Microsoft Corporation, Autodesk, Inc., Honeywell International Inc., IBM Corporation, Siemens Digital Industries Software, Aveva Group plc, Emerson Electric Co., Yokogawa Electric Corporation, Aspen Technology, Inc., OQ Technology (Oman), Bahwan CyberTek (Oman), and Omantel (Oman, for industrial IoT platforms) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman industrial software market is poised for transformative growth, driven by technological advancements and government support. As industries increasingly adopt automation and smart manufacturing practices, the demand for innovative software solutions will rise. The integration of AI and IoT technologies is expected to enhance operational efficiencies significantly. Furthermore, the government's commitment to digital transformation will likely create a conducive environment for software development, fostering a competitive landscape that encourages innovation and investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Enterprise Resource Planning (ERP) Manufacturing Execution Systems (MES) Asset Performance Management (APM) Advanced Process Control (APC) Supply Chain Management (SCM) Product Lifecycle Management (PLM) Quality Management Software (QMS) Others |

| By End-User | Oil and Gas Manufacturing Utilities Construction Food and Beverage Pharmaceuticals Others |

| By Application | Process Automation Data Analytics Asset Management Compliance Management Predictive Maintenance Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | Automotive Aerospace Food and Beverage Pharmaceuticals Chemicals Mining and Metals Others |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Software Solutions | 60 | IT Managers, Production Supervisors |

| Logistics Management Software | 45 | Logistics Coordinators, Supply Chain Managers |

| Healthcare IT Systems | 40 | Healthcare Administrators, IT Directors |

| Enterprise Resource Planning (ERP) Software | 50 | Finance Managers, Operations Directors |

| Customer Relationship Management (CRM) Tools | 42 | Sales Managers, Marketing Directors |

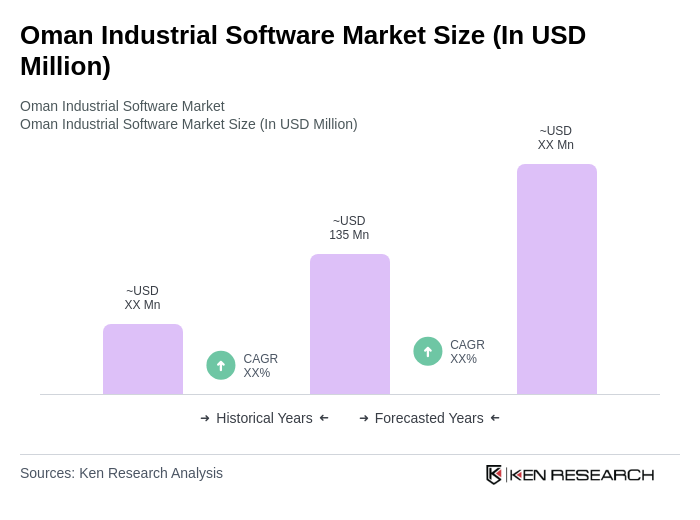

The Oman Industrial Software Market is valued at approximately USD 135 million, reflecting a significant growth trend driven by digital transformation initiatives across various sectors, including oil and gas, manufacturing, and utilities.