Region:Middle East

Author(s):Shubham

Product Code:KRAE0285

Pages:88

Published On:December 2025

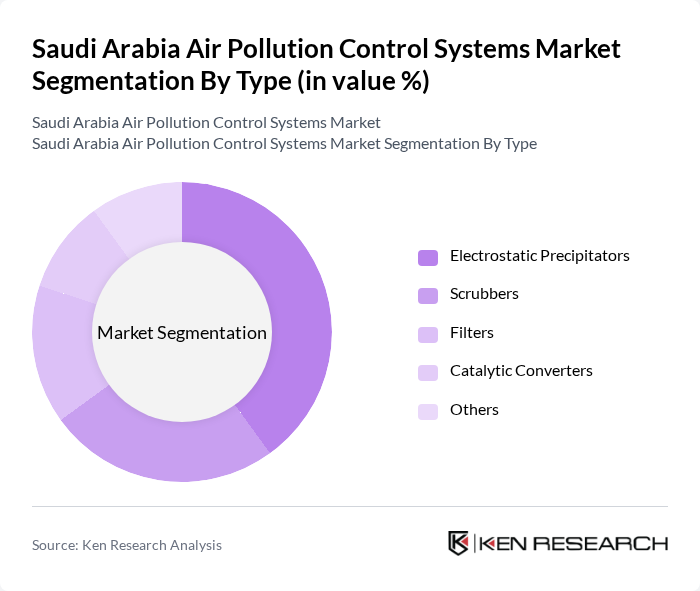

By Type:The market is segmented into various types of air pollution control systems, including Electrostatic Precipitators, Scrubbers, Filters, Catalytic Converters, and Others. Among these, Electrostatic Precipitators are leading due to their efficiency in removing particulate matter from industrial emissions, making them a preferred choice for many manufacturing sectors.

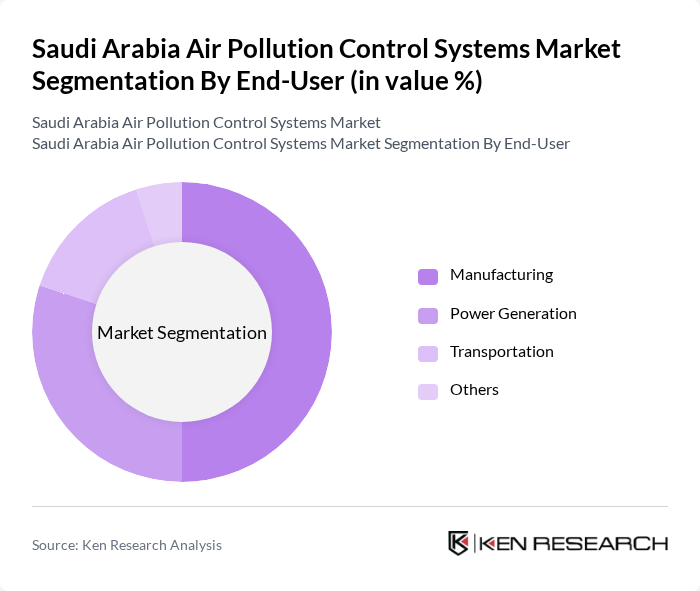

By End-User:The end-user segmentation includes Manufacturing, Power Generation, Transportation, and Others. The Manufacturing sector holds the largest share, driven by stringent regulations and the need for compliance with environmental standards, leading to increased investments in air pollution control technologies.

The Saudi Arabia Air Pollution Control Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alstom, Siemens, GE Power, Honeywell, Mitsubishi Heavy Industries, Veolia, Babcock & Wilcox, AECOM, Jacobs Engineering, Emissions Control Technologies, Ducon Technologies, FLSmidth, Cormetech, Clean Air Engineering, Air Pollution Control Association contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia air pollution control systems market appears promising, driven by ongoing industrial growth and increasing regulatory pressures. As the government intensifies its focus on environmental sustainability, investments in innovative pollution control technologies are expected to rise. Additionally, the integration of smart technologies and IoT solutions will enhance monitoring capabilities, leading to more effective pollution management. This evolving landscape will create new opportunities for market players to innovate and expand their offerings in response to emerging environmental challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Electrostatic Precipitators Scrubbers Filters Catalytic Converters Others |

| By End-User | Manufacturing Power Generation Transportation Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Chemical Treatment Physical Treatment Biological Treatment Others |

| By Application | Air Quality Monitoring Emission Control Waste Management Others |

| By Investment Source | Private Investments Government Funding International Aid Others |

| By Policy Support | Environmental Regulations Financial Incentives Public Awareness Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Air Quality Management | 100 | Environmental Managers, Compliance Officers |

| Municipal Air Pollution Control | 80 | City Planners, Environmental Policy Makers |

| Commercial Building Emission Controls | 70 | Facility Managers, Sustainability Coordinators |

| Transportation Sector Emission Reduction | 60 | Transport Managers, Regulatory Affairs Specialists |

| Research and Development in Air Quality Technologies | 50 | R&D Directors, Innovation Managers |

The Saudi Arabia Air Pollution Control Systems Market is valued at approximately USD 2 billion, driven by increasing industrial activities, urbanization, and stringent environmental regulations aimed at improving air quality and compliance with international standards.