Region:North America

Author(s):Dev

Product Code:KRAC2092

Pages:91

Published On:October 2025

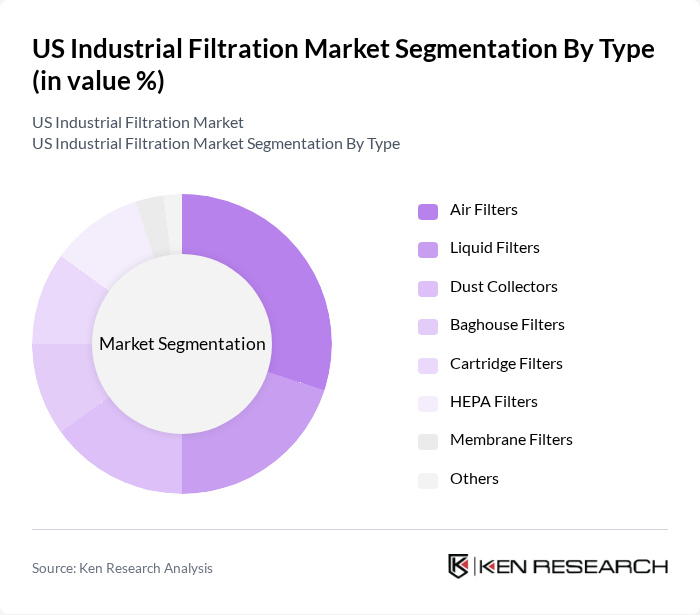

By Type:The market is segmented into air filters, liquid filters, dust collectors, baghouse filters, cartridge filters, HEPA filters, membrane filters, and others. Air filters and HEPA filters are particularly dominant due to their critical role in maintaining air quality and meeting regulatory standards in industrial settings. The increasing focus on workplace health and safety, especially in pharmaceuticals, food processing, and semiconductor manufacturing, has led to a surge in demand for high-efficiency particulate air (HEPA) filters and advanced membrane technologies .

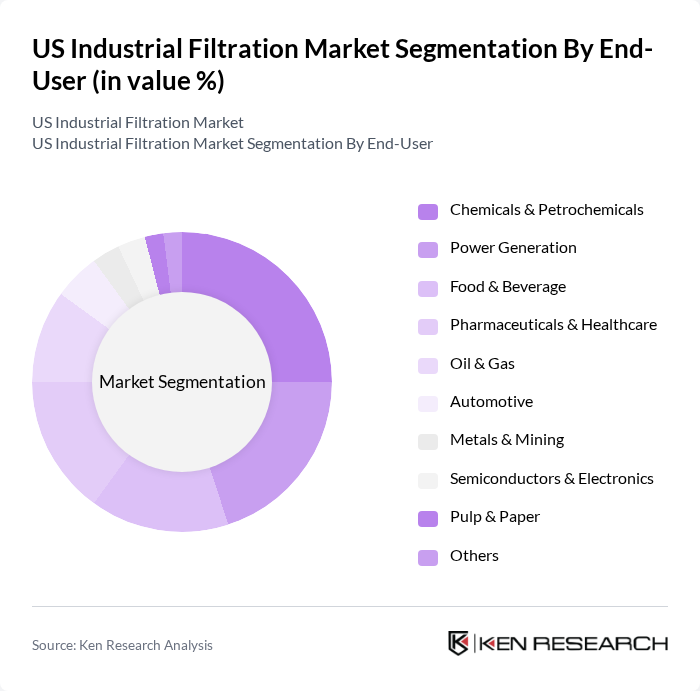

By End-User:The industrial filtration market serves a diverse range of end-users, including chemicals & petrochemicals, power generation, food & beverage, pharmaceuticals & healthcare, oil & gas, automotive, metals & mining, semiconductors & electronics, pulp & paper, and others. The chemicals & petrochemicals sector is the largest consumer of filtration solutions, driven by the need for high-quality products and compliance with environmental regulations. The healthcare sector's demand for sterile environments and contamination control has significantly boosted the adoption of advanced filtration technologies. Power generation and food & beverage industries also represent substantial market shares due to their operational requirements and regulatory compliance needs .

The US Industrial Filtration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Donaldson Company, Inc., Parker Hannifin Corporation, 3M Company, Camfil AB, AAF International (Daikin Industries, Ltd.), Filtration Group Corporation, Eaton Corporation plc, Graver Technologies, LLC, Pentair plc, Pall Corporation, Alfa Laval AB, MANN+HUMMEL Group, SUEZ Water Technologies & Solutions, ITT Inc., Veolia Environnement S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The US industrial filtration market is poised for significant evolution, driven by increasing environmental awareness and technological advancements. As industries adopt more sustainable practices, the demand for eco-friendly filtration solutions will rise. Furthermore, the integration of IoT technologies in filtration systems is expected to enhance monitoring and efficiency, allowing for real-time adjustments. This trend will likely lead to improved compliance with regulations and operational cost savings, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Filters Liquid Filters Dust Collectors Baghouse Filters Cartridge Filters HEPA Filters Membrane Filters Others |

| By End-User | Chemicals & Petrochemicals Power Generation Food & Beverage Pharmaceuticals & Healthcare Oil & Gas Automotive Metals & Mining Semiconductors & Electronics Pulp & Paper Others |

| By Application | Air Filtration Water Filtration Process Filtration Wastewater Treatment Emission Control Others |

| By Component | Filters Housings Accessories Monitoring Systems Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Others |

| By Distribution Mode | Wholesale Retail E-commerce Direct Delivery Others |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Filtration Systems | 100 | Quality Control Managers, Production Supervisors |

| Food and Beverage Filtration Solutions | 80 | Operations Managers, Compliance Officers |

| Chemical Processing Filtration | 60 | Process Engineers, Safety Managers |

| Air Filtration in Manufacturing | 90 | Facility Managers, Environmental Health Officers |

| Water Treatment Filtration Systems | 70 | Water Quality Specialists, Plant Managers |

The US Industrial Filtration Market is valued at approximately USD 30 billion, driven by stricter environmental regulations and the demand for efficient filtration solutions across various industries, including manufacturing and power generation.