Region:Central and South America

Author(s):Shubham

Product Code:KRAB6201

Pages:80

Published On:October 2025

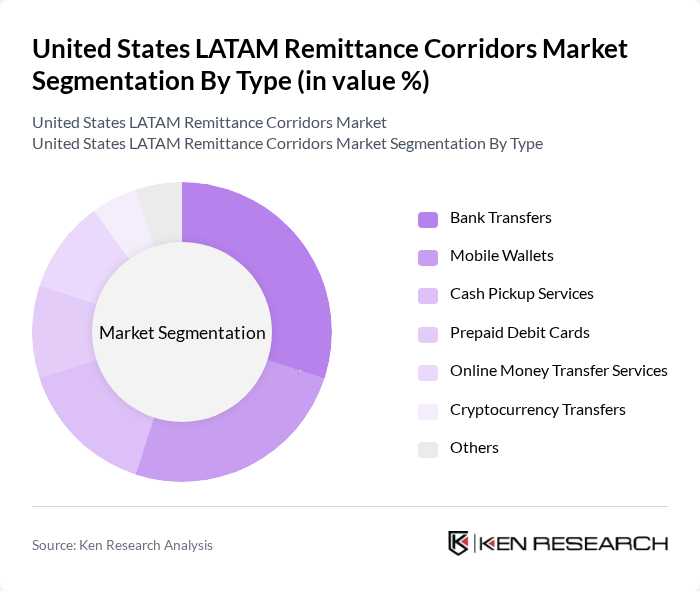

By Type:The remittance market can be segmented into various types, including Bank Transfers, Mobile Wallets, Cash Pickup Services, Prepaid Debit Cards, Online Money Transfer Services, Cryptocurrency Transfers, and Others. Each of these sub-segments caters to different consumer preferences and technological advancements, with some being more popular in specific demographics.

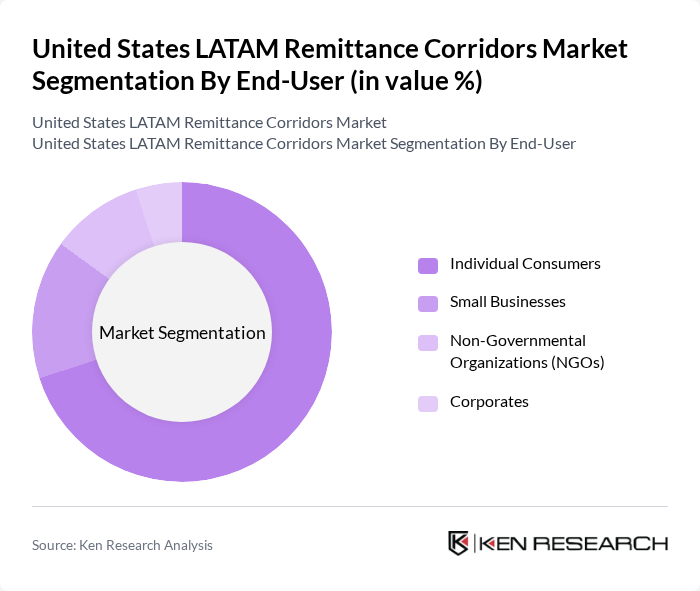

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Non-Governmental Organizations (NGOs), and Corporates. Each of these segments has distinct needs and transaction behaviors, with individual consumers being the largest segment due to the high volume of personal remittances sent to families and friends.

The United States LATAM Remittance Corridors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram International, PayPal Holdings, Inc., Remitly, Inc., Xoom Corporation, WorldRemit Ltd., Ria Money Transfer, TransferWise Ltd., OFX Group Ltd., Revolut Ltd., Venmo, Inc., Zelle, Cash App, Skrill Limited, Circle Internet Financial, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States LATAM remittance corridors market appears promising, driven by technological innovations and an increasing immigrant population. As digital remittance services expand, users will benefit from lower transaction costs and faster processing times. Additionally, partnerships with local financial institutions will enhance service accessibility. The focus on customer experience and personalized services will likely attract more users, fostering a competitive landscape that encourages further growth and innovation in the remittance sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Bank Transfers Mobile Wallets Cash Pickup Services Prepaid Debit Cards Online Money Transfer Services Cryptocurrency Transfers Others |

| By End-User | Individual Consumers Small Businesses Non-Governmental Organizations (NGOs) Corporates |

| By Payment Method | Bank Account Transfers Credit/Debit Card Payments Cash Payments Mobile Payments |

| By Destination Country | Mexico Brazil Colombia Argentina Peru Chile Others |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Transactions | One-time Transfers Regular Transfers Occasional Transfers |

| By Service Provider Type | Traditional Banks Money Transfer Operators Fintech Companies Peer-to-Peer Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| U.S. to Mexico Remittance Senders | 150 | Individuals aged 18-65, Regular remittance senders |

| U.S. to Central America Remittance Senders | 100 | Individuals aged 25-55, Employed in the U.S. |

| U.S. to South America Remittance Senders | 80 | Individuals aged 30-60, Family members of recipients |

| Remittance Service Providers | 50 | Executives and Managers from remittance companies |

| Financial Advisors and Community Leaders | 40 | Financial consultants, Community organization leaders |

The United States LATAM Remittance Corridors Market is valued at approximately USD 100 billion, driven by the increasing number of Latin American immigrants in the U.S. who send money back home to support their families and the growing adoption of digital payment solutions.