Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA3245

Pages:100

Published On:September 2025

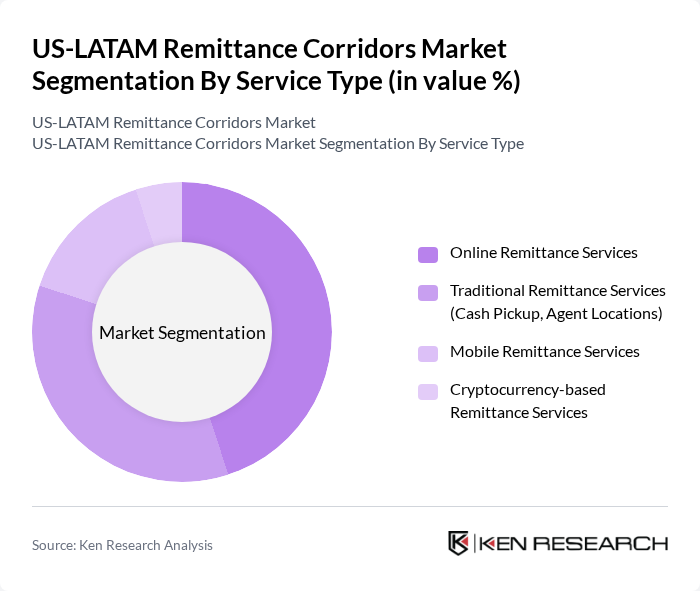

By Service Type:The service type segmentation includes various methods through which remittances are sent. The dominant sub-segment isonline remittance services, which have gained popularity due to their convenience, speed, and lower fees compared to traditional methods. Traditional remittance services, including cash pickups and agent locations, remain significant, especially among older demographics and unbanked populations.Mobile remittance servicesare also on the rise, driven by increasing smartphone penetration and digital literacy in LATAM.Cryptocurrency-based remittance servicesare emerging, particularly in corridors with high remittance costs or currency instability, but still represent a smaller share of the market .

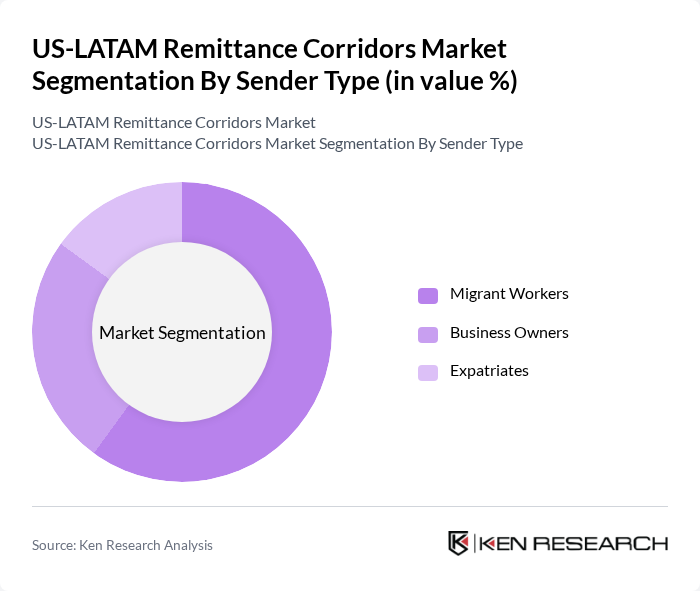

By Sender Type:The sender type segmentation includes various categories of individuals who send remittances.Migrant workersare the largest group, as they often send money back home to support their families.Business ownersalso contribute significantly, sending funds for business operations or investments.Expatriates, while fewer in number, also play a role in the remittance market, often sending larger amounts due to their higher income levels .

The US-LATAM Remittance Corridors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, PayPal / Xoom, Remitly, WorldRemit, Wise (formerly TransferWise), Ria Money Transfer, OFX, Intermex (International Money Express), Sigue, Pangea Money Transfer, Viamericas, BanCoppel (Mexico), BBVA (LATAM), Banco Azteca (Mexico) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US-LATAM remittance corridors is poised for transformation, driven by technological advancements and a growing emphasis on financial inclusion. As digital payment solutions proliferate, remittance services will become more accessible, particularly for unbanked populations. Additionally, partnerships with local financial institutions will enhance service delivery and expand market reach. The integration of blockchain technology is expected to further streamline transactions, reducing costs and improving security, thereby fostering a more robust remittance ecosystem in the region.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Online Remittance Services Traditional Remittance Services (Cash Pickup, Agent Locations) Mobile Remittance Services Cryptocurrency-based Remittance Services |

| By Sender Type | Migrant Workers Business Owners Expatriates |

| By Payment Method | Bank Transfers Mobile Wallets Cash Pickup Prepaid Cards |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Transactions | One-time Transfers Regular Transfers Occasional Transfers |

| By Geographic Focus | Urban Areas Rural Areas Cross-Border Regions |

| By Recipient Country | Mexico Guatemala El Salvador Honduras Colombia Brazil Peru Others (LATAM) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| US-LATAM Remittance Service Providers | 60 | CEOs, Product Managers, Compliance Officers |

| Migrant Community Insights | 100 | Community Leaders, Migrant Workers, Financial Advisors |

| Regulatory Impact Assessment | 50 | Policy Makers, Financial Regulators, Economic Analysts |

| Digital Remittance Trends | 50 | Tech Developers, Marketing Managers, User Experience Designers |

| Consumer Behavior Analysis | 80 | End Users, Financial Literacy Educators, Market Researchers |

The US-LATAM remittance corridors market is valued at approximately USD 160 billion, driven by the increasing number of Latin American migrants in the United States sending money back home to support their families.