Region:Asia

Author(s):Shubham

Product Code:KRAB6236

Pages:94

Published On:October 2025

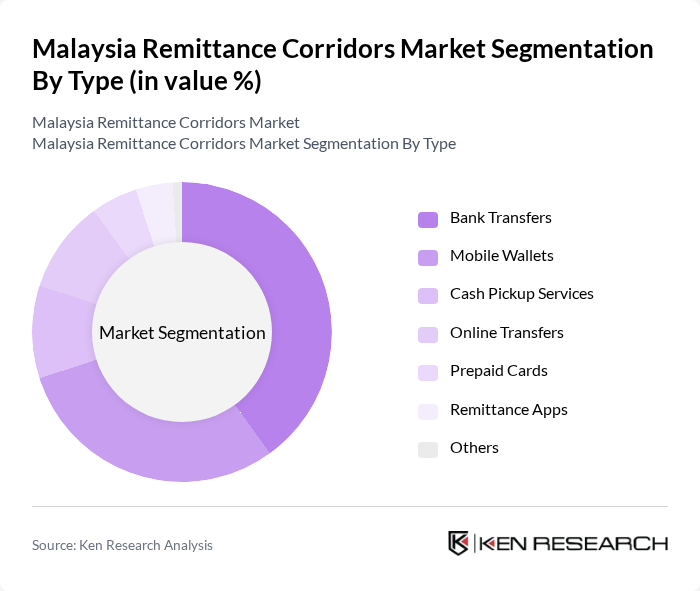

By Type:The remittance corridors market can be segmented into various types, including Bank Transfers, Mobile Wallets, Cash Pickup Services, Online Transfers, Prepaid Cards, Remittance Apps, and Others. Among these, Bank Transfers and Mobile Wallets are the most prominent due to their reliability and convenience. Bank Transfers are favored for larger amounts, while Mobile Wallets cater to the tech-savvy younger demographic seeking quick and easy transactions.

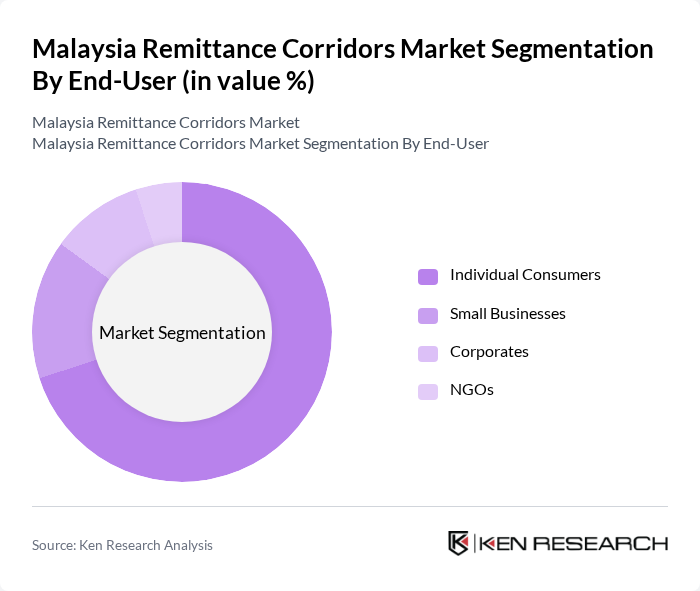

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Corporates, and NGOs. Individual Consumers dominate the market as they represent the largest group of remittance senders, primarily sending money back home to support families. Small Businesses also contribute significantly, often using remittance services for cross-border transactions and payments.

The Malaysia Remittance Corridors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, Ria Money Transfer, PayPal, TransferWise, WorldRemit, Remitly, Xoom, Skrill, Revolut, CIMB Bank, Maybank, Public Bank Berhad, Hong Leong Bank, Bank Islam Malaysia Berhad contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia remittance corridors market appears promising, driven by technological advancements and an increasing migrant workforce. As digital payment solutions gain traction, the market is likely to see a surge in user adoption, particularly among younger demographics. Additionally, regulatory frameworks are expected to evolve, fostering a more conducive environment for innovation. The focus on enhancing customer experience will further shape service offerings, ensuring that providers remain competitive in a rapidly changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Bank Transfers Mobile Wallets Cash Pickup Services Online Transfers Prepaid Cards Remittance Apps Others |

| By End-User | Individual Consumers Small Businesses Corporates NGOs |

| By Region | Southeast Asia South Asia Middle East Others |

| By Payment Method | Bank Transfers Credit/Debit Cards E-Wallets Cash Payments |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Transactions | Daily Weekly Monthly |

| By Customer Segment | Domestic Workers International Students Expatriates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Behavior | 150 | Expatriates, Financial Advisors |

| Remittance Service Provider Insights | 100 | Service Managers, Compliance Officers |

| Regulatory Impact Assessment | 80 | Policy Makers, Economic Analysts |

| Consumer Preferences in Remittance | 120 | End-users, Community Leaders |

| Market Trends and Innovations | 90 | Industry Experts, Technology Providers |

The Malaysia Remittance Corridors Market is valued at approximately USD 15 billion, driven by the increasing number of Malaysians working abroad and the rise of digital transaction solutions, particularly in regions like Singapore, the Middle East, and Australia.