United States Middle East Consumer Packaged Goods Market Overview

- The United States Middle East Consumer Packaged Goods Market is valued at approximately USD 95 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for convenience, health-conscious products, and the expansion of e-commerce platforms. The market has seen a significant shift towards online shopping, with consumers preferring packaged goods that offer convenience and quality. Key growth drivers also include rising disposable incomes, urbanization, and the adoption of sustainable packaging solutions, reflecting broader global trends in the consumer packaged goods industry .

- Key players in this market include major cities such as New York, Los Angeles, and Houston, which dominate due to their large populations and diverse consumer bases. Additionally, the presence of numerous retail outlets and distribution centers in these areas facilitates easy access to a wide range of consumer packaged goods, further driving market growth .

- In 2023, the U.S. government implemented regulations aimed at enhancing food safety standards for consumer packaged goods. This includes stricter labeling requirements and quality control measures to ensure that products meet health and safety guidelines, thereby protecting consumers and promoting transparency in the market. The Food Safety Modernization Act (FSMA), administered by the U.S. Food and Drug Administration (FDA), mandates comprehensive preventive controls for food products, enhanced traceability, and robust compliance standards for manufacturers and distributors of consumer packaged goods .

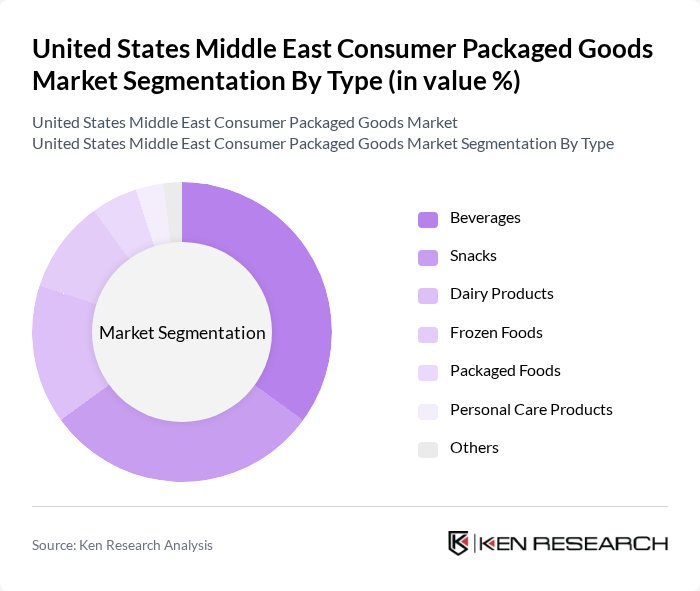

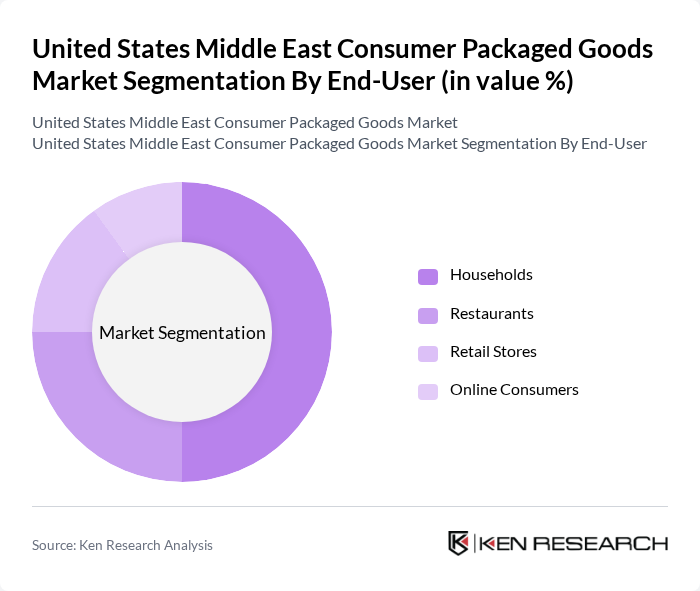

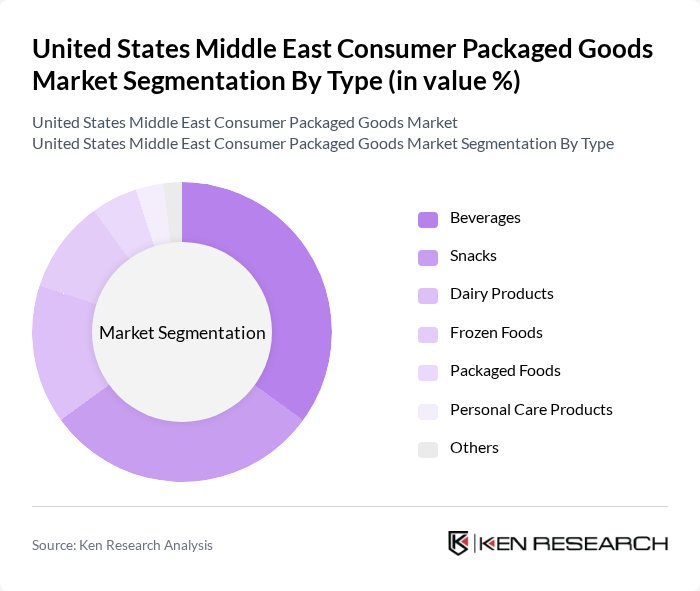

United States Middle East Consumer Packaged Goods Market Segmentation

By Type:The market is segmented into various types of consumer packaged goods, including beverages, snacks, dairy products, frozen foods, packaged foods, personal care products, and others. Among these, beverages and snacks are the most dominant segments, driven by changing consumer preferences towards on-the-go consumption and health-oriented options. The increasing trend of snacking and the demand for ready-to-drink beverages have significantly influenced market dynamics. Additionally, the market is witnessing growth in health & wellness products, organic offerings, and sustainable packaging, reflecting evolving consumer priorities .

By End-User:The end-user segmentation includes households, restaurants, retail stores, and online consumers. Households represent the largest segment, as they account for a significant portion of consumer packaged goods consumption. The growing trend of online shopping has also led to an increase in the online consumer segment, as more people prefer the convenience of purchasing goods from home. Restaurants and retail stores continue to play a vital role in market distribution, supported by robust supply chains and expanding digital platforms .

United States Middle East Consumer Packaged Goods Market Competitive Landscape

The United States Middle East Consumer Packaged Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., Unilever PLC, Nestlé S.A., PepsiCo, Inc., The Coca-Cola Company, Colgate-Palmolive Company, Danone S.A., Mondelez International, Inc., Kraft Heinz Company, General Mills, Inc., Kimberly-Clark Corporation, Reckitt Benckiser Group PLC, Henkel AG & Co. KGaA, Conagra Brands, Inc., The Clorox Company, Savola Group, Almarai Company, Arla Foods, L'Oréal S.A., Johnson & Johnson contribute to innovation, geographic expansion, and service delivery in this space.

United States Middle East Consumer Packaged Goods Market Industry Analysis

Growth Drivers

- Increasing Demand for Ethnic Foods:The United States has seen a significant rise in the demand for ethnic foods, particularly Middle Eastern cuisine. In future, the ethnic food market was valued at approximately $8 billion, with projections indicating a growth rate of 5% annually. This trend is driven by the increasing diversity of the U.S. population, with over 3.5 million Middle Eastern Americans contributing to a growing consumer base that seeks authentic flavors and traditional products, thereby boosting sales in the consumer packaged goods sector.

- Rising Health Consciousness Among Consumers:Health consciousness is reshaping consumer preferences, with a notable shift towards healthier food options. In future, the organic food market is expected to reach $70 billion, reflecting a 10% increase from the previous valuation. This trend is fueled by consumers prioritizing nutrition and wellness, leading to increased demand for organic and natural packaged goods. Brands that align their offerings with health trends are likely to capture a larger market share, enhancing their competitive edge in the consumer packaged goods landscape.

- Expansion of E-commerce Platforms:The growth of e-commerce has revolutionized the consumer packaged goods market, particularly in the Middle Eastern segment. In future, online grocery sales reached $120 billion, with a projected increase to $140 billion. This shift is driven by convenience and the increasing adoption of digital shopping among consumers. Brands that invest in robust online platforms and digital marketing strategies are well-positioned to capitalize on this trend, enhancing their reach and accessibility to a broader audience.

Market Challenges

- Intense Competition Among Brands:The consumer packaged goods market is characterized by fierce competition, with over 1,000 brands vying for market share in the Middle Eastern segment. This saturation leads to price wars and increased marketing expenditures, which can erode profit margins. In future, the average marketing spend for leading brands was approximately $600 million, highlighting the financial pressure on companies to maintain visibility and consumer loyalty in a crowded marketplace.

- Supply Chain Disruptions:Supply chain challenges have significantly impacted the consumer packaged goods industry, particularly in sourcing raw materials. In future, 75% of companies reported disruptions due to geopolitical tensions and logistical issues. These disruptions have led to increased lead times and costs, with average shipping costs rising by 20% year-over-year. Companies must adapt their supply chain strategies to mitigate risks and ensure product availability, which is crucial for maintaining customer satisfaction and market competitiveness.

United States Middle East Consumer Packaged Goods Market Future Outlook

The future of the United States Middle East consumer packaged goods market appears promising, driven by evolving consumer preferences and technological advancements. As health and wellness trends continue to dominate, brands that innovate with organic and plant-based products are likely to thrive. Additionally, the expansion of e-commerce will facilitate greater market penetration, allowing companies to reach untapped demographics. Strategic partnerships with local distributors will further enhance market access, ensuring that brands can effectively cater to diverse consumer needs and preferences in this dynamic landscape.

Market Opportunities

- Growth in Online Grocery Shopping:The surge in online grocery shopping presents a significant opportunity for consumer packaged goods brands. With online grocery sales projected to reach $140 billion, companies can leverage this trend by enhancing their digital presence and optimizing their e-commerce platforms to attract tech-savvy consumers seeking convenience and variety in their shopping experiences.

- Increasing Popularity of Organic Products:The rising demand for organic products offers a lucrative opportunity for brands to expand their offerings. As the organic food market is expected to grow to $70 billion, companies that invest in organic product lines can tap into a health-conscious consumer base, driving sales and enhancing brand loyalty through sustainable and health-oriented offerings.