Region:Middle East

Author(s):Shubham

Product Code:KRAC4951

Pages:90

Published On:October 2025

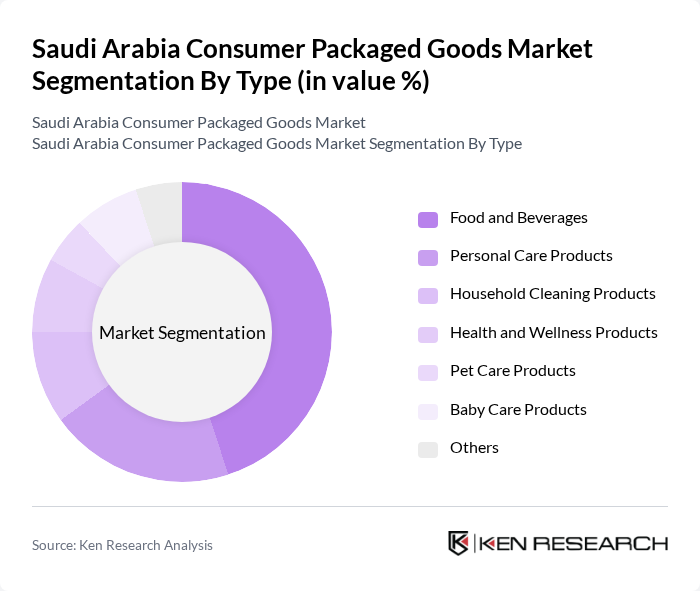

By Type:The market is segmented into food and beverages, personal care products, household cleaning products, health and wellness products, pet care products, baby care products, and others. Food and beverages remain the dominant segment, driven by high demand for convenience, ready-to-eat options, and the growing popularity of health-oriented products. The rise of snacking, functional foods, and fortified beverages is accelerating growth, while personal care and wellness products are experiencing rapid expansion due to increased health awareness and premiumization trends .

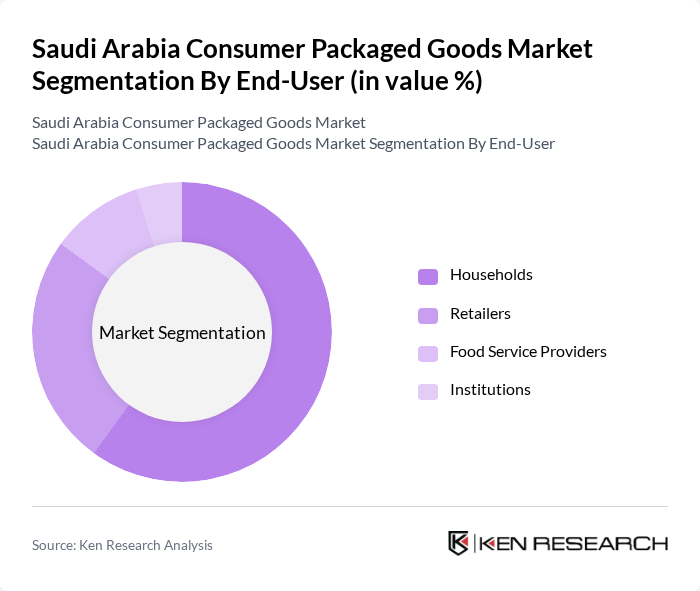

By End-User:The consumer packaged goods market is segmented by end-user into households, retailers, food service providers, and institutions. Households represent the largest segment, supported by rising purchasing power, urbanization, and a shift toward premium and convenience products. Retailers play a pivotal role in market expansion, offering diverse product assortments and leveraging omnichannel strategies to meet evolving consumer needs. Food service providers and institutions contribute to steady demand, particularly for bulk and specialty products .

The Saudi Arabia Consumer Packaged Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Savola Group, National Agricultural Development Company (Nadec), Al-Othaim Holding Company, Al-Faisaliah Group, Unilever Saudi Arabia, Procter & Gamble Saudi Arabia, Nestlé Saudi Arabia, PepsiCo Saudi Arabia, Coca-Cola Bottling Company of Saudi Arabia, Mondel?z International Saudi Arabia, Reckitt Benckiser Saudi Arabia, Henkel Saudi Arabia, Danone Saudi Arabia, Kimberly-Clark Saudi Arabia, Colgate-Palmolive Saudi Arabia, Arla Foods Saudi Arabia, Mars Saudi Arabia, Johnson & Johnson Saudi Arabia, Americana Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia consumer packaged goods market appears promising, driven by urbanization and rising disposable incomes. As consumers increasingly prioritize health and sustainability, companies will need to adapt their product offerings accordingly. The integration of technology in retail, particularly through e-commerce, will further enhance consumer access to diverse products. Additionally, the government's focus on economic diversification will likely create a more favorable environment for CPG innovation and investment, fostering long-term growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Food and Beverages Ready Meals Baked Foods Breakfast Cereals Soups Baby Food Potato Chips & Snacks Nuts Instant Noodles & Pasta Biscuits & Confectionery Cheese, Yogurt, Ice Creams Sauces, Dressings & Condiments Non-Alcoholic Drinks Personal Care Products Household Cleaning Products Health and Wellness Products Pet Care Products Baby Care Products Others |

| By End-User | Households Retailers Food Service Providers Institutions |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Direct Sales |

| By Price Range | Premium Products Mid-Range Products Economy Products |

| By Packaging Type | Plastic Packaging Glass Packaging Metal Packaging Paper Packaging |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Conscious Customers |

| By Consumer Demographics | Age Group Gender Income Level Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Sector | 100 | Brand Managers, Product Development Managers |

| Personal Care Products | 60 | Marketing Directors, Consumer Insights Analysts |

| Household Goods | 50 | Retail Buyers, Category Managers |

| Emerging Local Brands | 40 | Startup Founders, Business Development Managers |

| Consumer Behavior Insights | 80 | End Consumers, Market Research Participants |

The Saudi Arabia Consumer Packaged Goods Market is valued at approximately USD 67 billion, reflecting a significant growth trend driven by urbanization, a growing middle class, and changing consumer preferences towards convenience and health-conscious products.