United States Natural Gas Market Overview

- The United States Natural Gas Market is valued at USD 155 billion, based on a five-year historical analysis. This value reflects the robust expansion of natural gas production and consumption, with the market supported by strong domestic demand, increased LNG export capacity, and the ongoing transition to lower-emission energy sources . Growth is primarily driven by the increasing demand for cleaner energy sources, advancements in extraction technologies such as hydraulic fracturing and horizontal drilling, and the expansion of natural gas infrastructure across the country. The market has seen a significant rise in production and consumption, particularly in the industrial and power generation sectors .

- Key producing regions include Texas, Pennsylvania, and Louisiana, which dominate due to their rich natural gas reserves and established extraction and distribution networks. Texas benefits from its extensive shale formations, notably the Permian Basin, while Pennsylvania's Marcellus Shale has become a significant contributor to the national supply. Louisiana remains a critical hub for LNG exports and pipeline infrastructure, making these regions central to overall market dynamics .

- In 2023, the U.S. government implemented the Inflation Reduction Act, which includes provisions to promote the use of natural gas as a transitional fuel towards renewable energy. While the act primarily targets renewable energy, it also incentivizes investments in natural gas infrastructure and technology to ensure grid reliability and support the energy transition, thereby supporting market growth and ensuring a stable energy supply during the shift to greener alternatives .

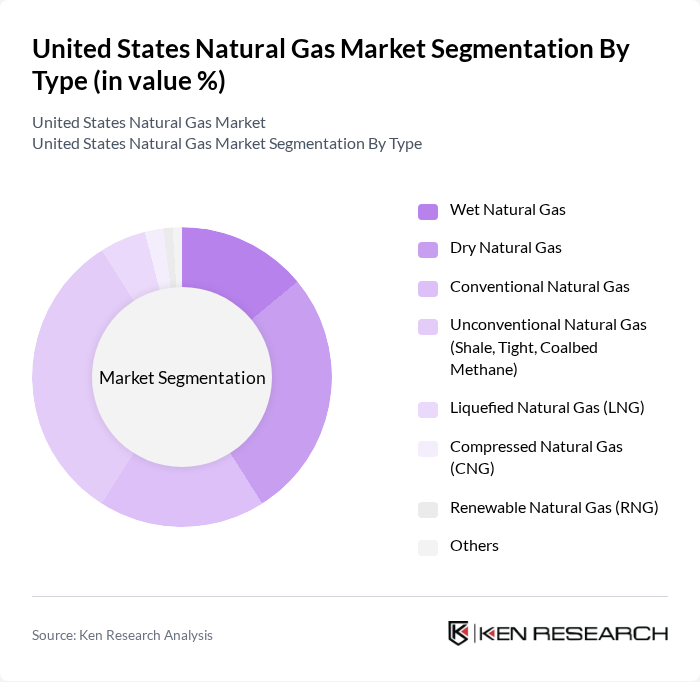

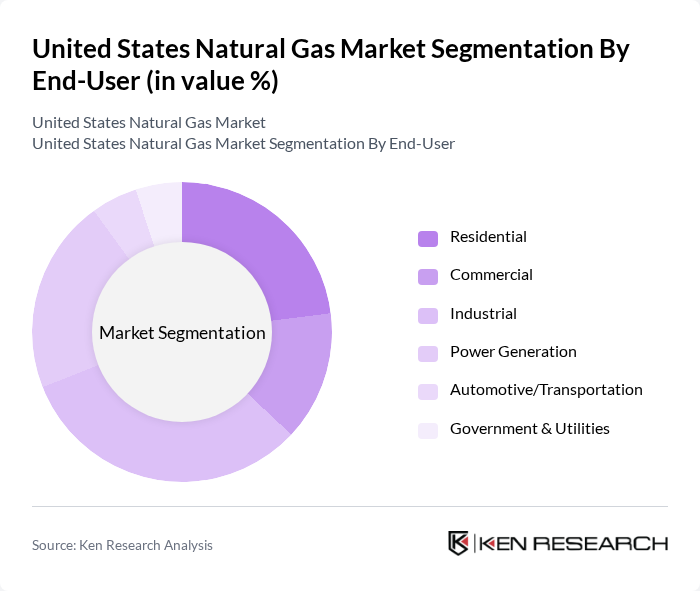

United States Natural Gas Market Segmentation

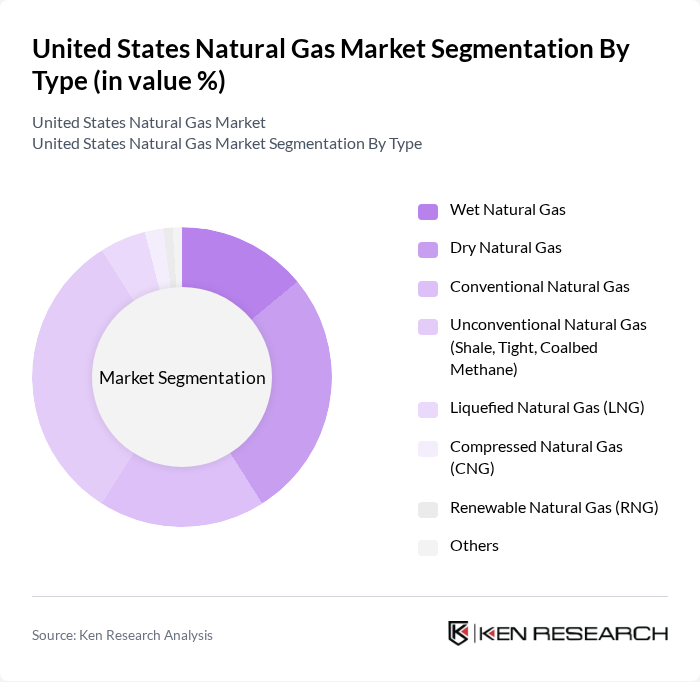

By Type:The market is segmented into Wet Natural Gas, Dry Natural Gas, Conventional Natural Gas, Unconventional Natural Gas (Shale, Tight, Coalbed Methane), Liquefied Natural Gas (LNG), Compressed Natural Gas (CNG), Renewable Natural Gas (RNG), and Others. Wet and dry natural gas refer to the presence or absence of natural gas liquids, while conventional and unconventional sources reflect the extraction method and geological formation. Unconventional sources, particularly shale gas, have driven recent production growth. LNG and CNG are primarily used for storage, transport, and export, while RNG represents a small but growing segment focused on sustainability .

By End-User:The market is segmented by end-users, including Residential, Commercial, Industrial, Power Generation, Automotive/Transportation, and Government & Utilities. The industrial and power generation sectors account for the largest share of consumption, driven by the need for reliable, lower-carbon energy. Residential and commercial segments primarily use natural gas for heating and cooking, while the transportation sector utilizes CNG and LNG for fleet and heavy-duty vehicles. Utilities and government entities focus on grid stability and public infrastructure .

United States Natural Gas Market Competitive Landscape

The United States Natural Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Corporation, Chevron Corporation, ConocoPhillips, Kinder Morgan, Inc., Dominion Energy, Inc., Williams Companies, Inc., EnLink Midstream, LLC, EQT Corporation, Antero Resources Corporation, Coterra Energy Inc., Range Resources Corporation, Chesapeake Energy Corporation, Southwestern Energy Company, ONEOK, Inc., NiSource Inc. contribute to innovation, geographic expansion, and service delivery in this space.

United States Natural Gas Market Industry Analysis

Growth Drivers

- Increasing Demand for Clean Energy:The U.S. natural gas consumption reached approximately33 trillion cubic feet (Tcf)in future, driven by a shift towards cleaner energy sources. The Energy Information Administration (EIA) indicates that natural gas accounts for about41%of the electricity generation mix, reflecting a growing preference for lower carbon emissions compared to coal. This trend is supported by the U.S. government's goal to reduce greenhouse gas emissions by 50% in future, further boosting natural gas demand.

- Technological Advancements in Extraction:Innovations in hydraulic fracturing and horizontal drilling have significantly increased U.S. natural gas production, which reachedapproximately 103 billion cubic feet per day (Bcf/d)in future. The U.S. Geological Survey estimates that the Marcellus Shale holds about97 trillion cubic feet (Tcf)of recoverable natural gas. These advancements not only enhance extraction efficiency but also reduce operational costs, making natural gas a more attractive energy source for utilities and industries alike, thereby driving market growth.

- Infrastructure Development and Expansion:The U.S. has invested overUSD 100 billionin natural gas infrastructure over the past decade, including pipelines and storage facilities. The Federal Energy Regulatory Commission (FERC) reported that approximately1,000 milesof new pipelines were constructed in future. This expansion facilitates better distribution and access to natural gas, supporting increased consumption across various sectors, including residential heating and industrial applications, thus propelling market growth.

Market Challenges

- Environmental Regulations:The natural gas industry faces stringent environmental regulations, particularly concerning methane emissions. The Environmental Protection Agency (EPA) has proposed regulations that could impose costs exceedingUSD 1 billion annuallyon the industry in future. Compliance with these regulations may lead to increased operational costs and could hinder production capabilities, posing a significant challenge to market growth and profitability.

- Price Volatility:Natural gas prices have experienced significant fluctuations, with the Henry Hub spot price averagingUSD 2.54 per million British thermal units (MMBtu)in future. Factors such as weather patterns, geopolitical tensions, and supply-demand imbalances contribute to this volatility. Such unpredictability can deter investment and complicate long-term planning for companies in the natural gas sector, presenting a challenge to market stability.

United States Natural Gas Market Future Outlook

The U.S. natural gas market is poised for continued evolution, driven by the increasing integration of renewable energy sources and advancements in extraction technologies. As the demand for cleaner energy rises, natural gas is expected to play a pivotal role in the transition towards a more sustainable energy landscape. Additionally, ongoing investments in infrastructure and regulatory frameworks will likely shape the market dynamics, fostering innovation and enhancing operational efficiencies in the coming years.

Market Opportunities

- Export Potential to Global Markets:The U.S. is positioned to become a leading exporter of liquefied natural gas (LNG), with export capacity projected to reachapproximately 14 billion cubic feet per day (Bcf/d)in future. This growth is driven by increasing global demand for cleaner energy sources, particularly in Asia and Europe, where countries are seeking alternatives to coal and oil, presenting significant market opportunities for U.S. producers.

- Innovations in LNG Technology:Advances in LNG technology, such as floating LNG facilities, are expected to enhance the efficiency and cost-effectiveness of natural gas liquefaction. The U.S. Department of Energy has allocatedUSD 50 millionfor research and development in this area, which could lead to breakthroughs that lower production costs and expand market access, creating new opportunities for growth in the natural gas sector.