Region:North America

Author(s):Dev

Product Code:KRAB0337

Pages:100

Published On:August 2025

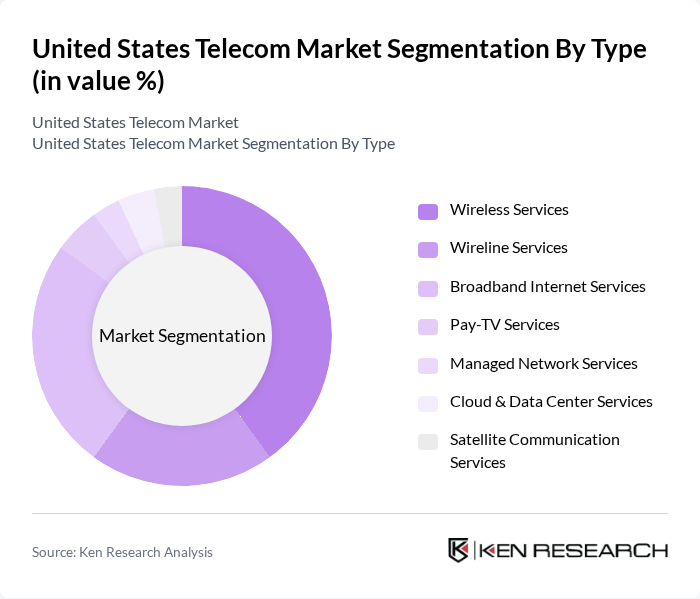

By Type:The telecom market is segmented into Wireless Services, Wireline Services, Broadband Internet Services, Pay-TV Services, Managed Network Services, Cloud & Data Center Services, and Satellite Communication Services. Each segment addresses specific communication needs for consumers and businesses, with wireless and broadband services leading growth due to mobile data demand and fiber expansion. Cloud & Data Center Services and Managed Network Services are increasingly important for enterprise digital transformation and remote work enablement.

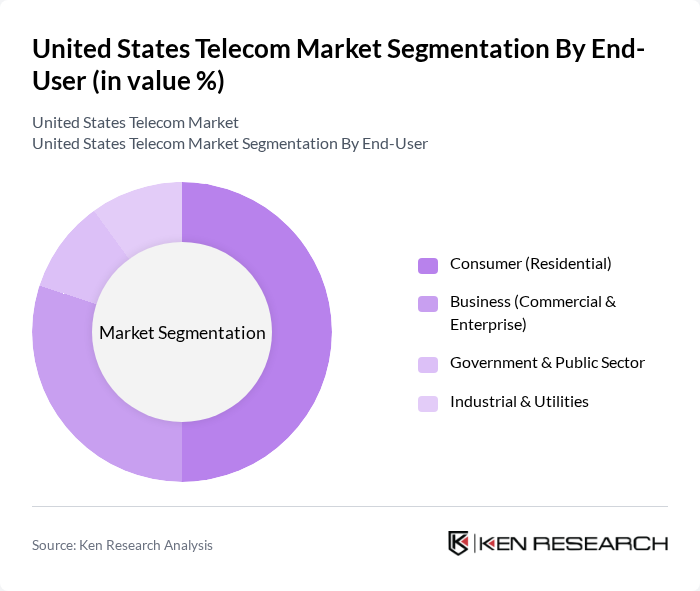

By End-User:The telecom market is segmented by end-user categories: Consumer (Residential), Business (Commercial & Enterprise), Government & Public Sector, and Industrial & Utilities. Consumer demand is driven by mobile and broadband connectivity, while business and enterprise segments focus on managed services, cloud, and data center solutions. Government and public sector require secure, reliable communications, and industrial/utilities increasingly leverage IoT and private networks for operational efficiency.

The United States Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as AT&T Inc., Verizon Communications Inc., T-Mobile US, Inc., Comcast Corporation, Charter Communications, Inc., Lumen Technologies, Inc., Dish Network L.L.C., Altice USA, Inc., Frontier Communications Parent, Inc., Cox Communications, Inc., Windstream Holdings, Inc., United States Cellular Corporation, Cincinnati Bell Inc., Mediacom Communications Corporation, Google Fiber Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. telecom market appears promising, driven by technological advancements and evolving consumer preferences. As 5G networks become more widespread, telecom companies will likely focus on enhancing service offerings and customer experiences. Additionally, the integration of AI and automation in operations will streamline processes and improve efficiency. The increasing demand for high-speed internet and IoT applications will further shape the market landscape, presenting opportunities for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Wireless Services Wireline Services Broadband Internet Services Pay-TV Services Managed Network Services Cloud & Data Center Services Satellite Communication Services |

| By End-User | Consumer (Residential) Business (Commercial & Enterprise) Government & Public Sector Industrial & Utilities |

| By Application | Voice Communication Data Communication Video & Media Streaming Internet of Things (IoT) & M2M |

| By Technology | G G/LTE Fiber Optic Fixed Wireless Access (FWA) Satellite |

| By Sales Channel | Direct Sales Retail Sales Online Sales |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Customer Segment | Individual Consumers Small & Medium Businesses Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Providers | 100 | Product Managers, Marketing Directors |

| Broadband Internet Services | 90 | Network Engineers, Customer Experience Managers |

| Telecom Regulatory Bodies | 40 | Policy Analysts, Regulatory Affairs Managers |

| Consumer Insights on Telecom Services | 150 | General Consumers, Tech-Savvy Users |

| Emerging Technologies in Telecom | 60 | R&D Managers, Technology Strategists |

The United States Telecom Market is valued at approximately USD 400 billion, driven by the increasing demand for high-speed internet, mobile connectivity, and the expansion of 5G technology. This valuation is based on a comprehensive five-year historical analysis.