Region:North America

Author(s):Shubham

Product Code:KRAA1717

Pages:93

Published On:August 2025

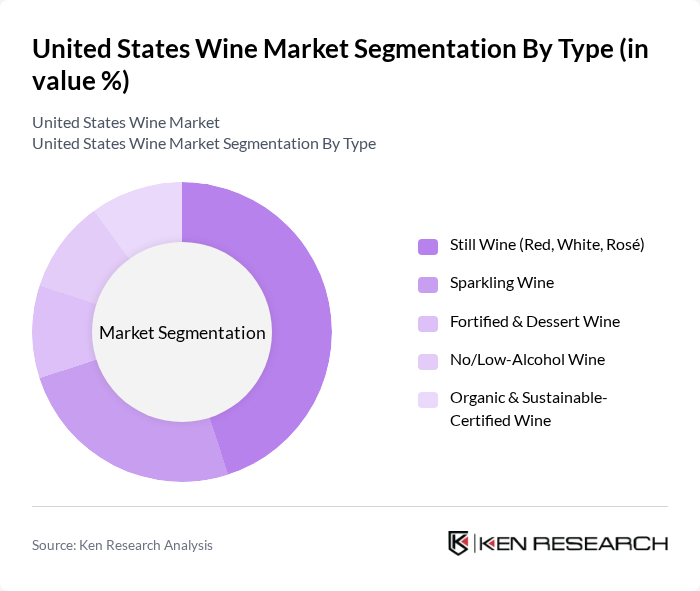

By Type:The wine market is segmented into various types, including Still Wine (Red, White, Rosé), Sparkling Wine, Fortified & Dessert Wine, No/Low-Alcohol Wine, and Organic & Sustainable-Certified Wine. Among these, Still Wine, particularly red and white varieties, dominates retail value and volume given its broad consumption occasions and food?pairing versatility. Sparkling continues to outperform the total category on a multi?year basis, while organic/sustainable and no/low?alcohol offerings are growing from a smaller base as consumers increasingly seek environmental credentials and moderated alcohol intake .

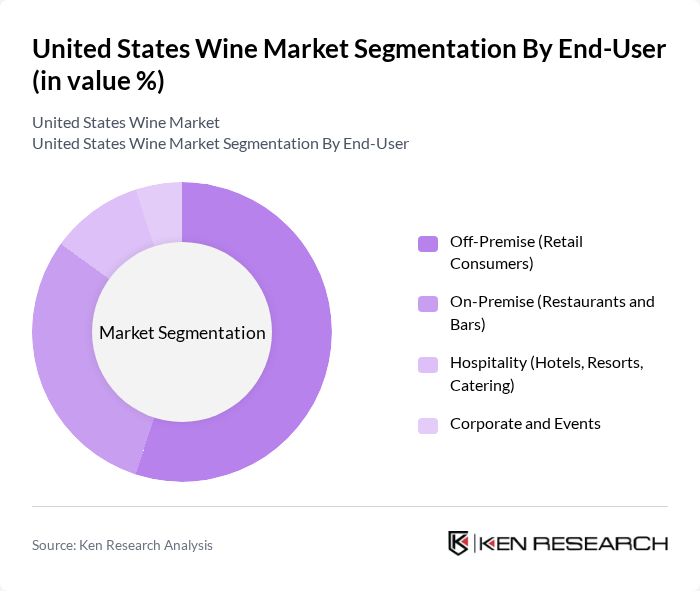

By End-User:The end-user segmentation includes Off-Premise (Retail Consumers), On-Premise (Restaurants and Bars), Hospitality (Hotels, Resorts, Catering), and Corporate and Events. Off?Premise sales account for the majority of category throughput, supported by at?home consumption and broad retail availability. On?Premise remains strategically important for premium trade?up and curated pairings that enhance consumer experiences, while hospitality and events contribute additional experiential channels .

The United States Wine Market is characterized by a dynamic mix of regional and international players. Leading participants such as E. & J. Gallo Winery, Constellation Brands, Inc., The Wine Group, Treasury Wine Estates, Jackson Family Wines, Pernod Ricard USA, Diageo North America, Ste. Michelle Wine Estates, Bronco Wine Company, Trinchero Family Estates, Delicato Family Wines, Vintage Wine Estates, The Duckhorn Portfolio, Inc., Chateau Ste. Michelle, Deutsch Family Wine & Spirits contribute to innovation, geographic expansion, and service delivery in this space .

The future of the U.S. wine market appears promising, driven by evolving consumer preferences and innovative marketing strategies. As health-conscious trends continue to rise, wineries are likely to adapt by offering more organic and low-alcohol options. Additionally, the integration of technology in marketing and sales will enhance consumer engagement, particularly through social media platforms. The focus on sustainability will also shape production practices, aligning with consumer values and potentially attracting new demographics to the wine market.

| Segment | Sub-Segments |

|---|---|

| By Type | Still Wine (Red, White, Rosé) Sparkling Wine Fortified & Dessert Wine No/Low-Alcohol Wine Organic & Sustainable-Certified Wine |

| By End-User | Off-Premise (Retail Consumers) On-Premise (Restaurants and Bars) Hospitality (Hotels, Resorts, Catering) Corporate and Events |

| By Sales Channel | Off-Premise: Supermarkets/Hypermarkets Off-Premise: Specialty Wine & Liquor Stores Direct-to-Consumer (Winery DTC, Wine Clubs) E-commerce/Marketplaces (Incl. Delivery Apps) |

| By Price Range | Value (Under USD 10) Popular/Premium (USD 10–19.99) Premium-Plus (USD 20–49.99) Luxury (USD 50 and above) |

| By Region | West (CA, OR, WA) Northeast (NY, MA, PA) Midwest (IL, MI, OH) South (TX, FL, VA) |

| By Packaging Type | Glass Bottles Cans Bag-in-Box Tetra Pak/Cartons |

| By Distribution Mode | Three-Tier Wholesale Distribution Direct Shipment (DTC, Winery-to-Consumer) E-commerce/Delivery Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Wine Sales | 140 | Wine Retail Managers, Category Buyers |

| Winery Operations | 100 | Winemakers, Vineyard Managers |

| Consumer Preferences | 150 | Wine Consumers, Enthusiasts |

| Distribution Channels | 80 | Logistics Managers, Distribution Coordinators |

| Online Wine Sales | 120 | E-commerce Managers, Digital Marketing Specialists |

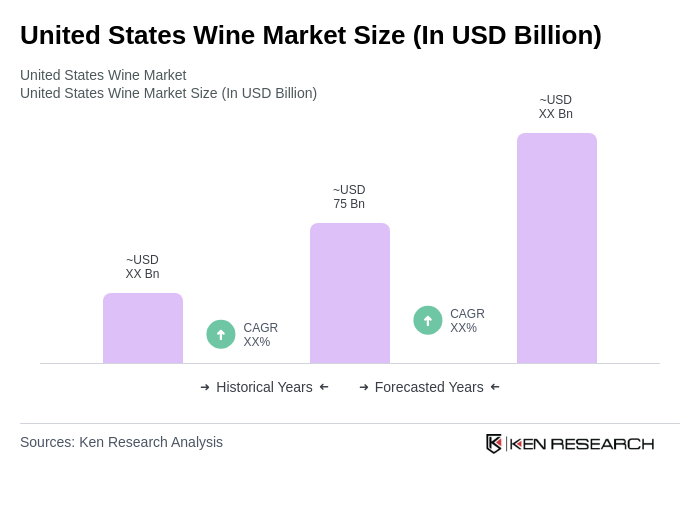

The United States wine market is valued at approximately USD 75 billion, reflecting stabilization in market value despite softer volumes. This valuation is supported by trends in premiumization, which enhances pricing strategies across various wine categories.