Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2451

Pages:85

Published On:October 2025

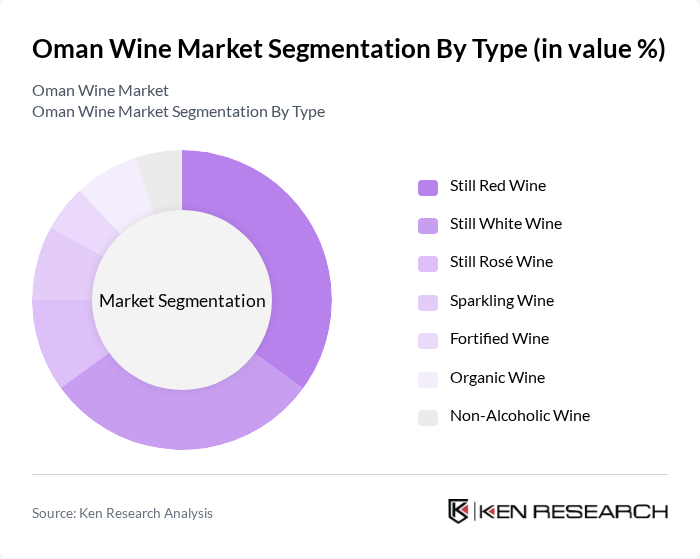

By Type:The wine market in Oman is segmented into Still Red Wine, Still White Wine, Still Rosé Wine, Sparkling Wine, Fortified Wine, Organic Wine, and Non-Alcoholic Wine. Still Red Wine and Still White Wine are the most popular, reflecting consumer preferences and the broad availability of these categories. Demand for Organic Wine is increasing as health-conscious consumers seek natural and sustainably produced options .

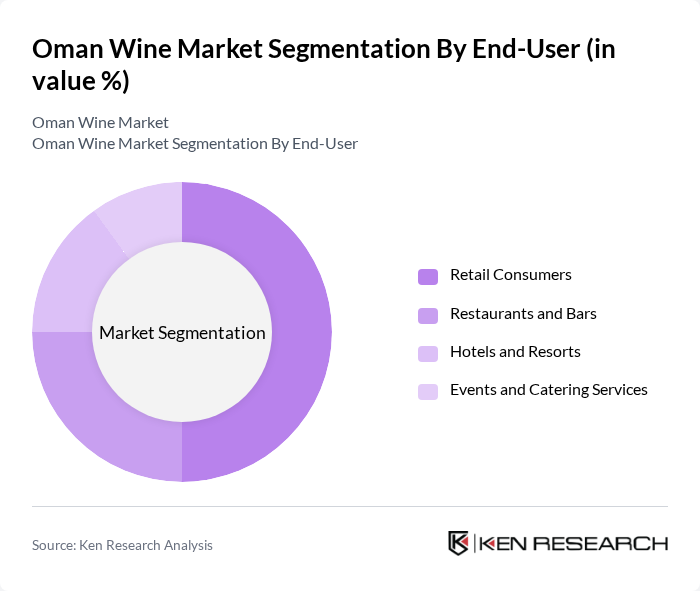

By End-User:The end-user segmentation of the wine market includes Retail Consumers, Restaurants and Bars, Hotels and Resorts, and Events and Catering Services. Retail Consumers account for the largest share, supported by the increasing availability of wine in supermarkets and specialty outlets. The trend of home consumption and social gatherings continues to drive demand in this segment .

The Oman Wine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Wine Company, Al Jazeera International, Oman Vineyards LLC, Muscat Wine Traders, Dhofar Wines, Al Harthy Wines, Oman Beverage Company, Al Mandoos Wines, Muscat Alcool, Oman Wine Importers, Al Batinah Wines, Salalah Wine Co., Sohar Wine Distributors, Nizwa Wine Traders, and Al Dakhiliyah Wines contribute to innovation, geographic expansion, and service delivery in this space.

The Oman wine market is poised for gradual growth, driven by increasing tourism and a rising expatriate population. As disposable incomes continue to rise, consumers are likely to seek premium wine options, enhancing market dynamics. Additionally, the expansion of retail and online sales channels will improve accessibility. However, the market must navigate strict regulations and cultural resistance. Overall, the future of the Oman wine market appears promising, with opportunities for growth in niche segments and international collaborations.

| Segment | Sub-Segments |

|---|---|

| By Type | Still Red Wine Still White Wine Still Rosé Wine Sparkling Wine Fortified Wine Organic Wine Non-Alcoholic Wine |

| By End-User | Retail Consumers Restaurants and Bars Hotels and Resorts Events and Catering Services |

| By Sales Channel | Online Retail Supermarkets and Hypermarkets Specialty Wine Shops Duty-Free Shops |

| By Price Range | Premium Mid-Range Budget |

| By Origin | Imported Local (if applicable) |

| By Packaging Type | Glass Bottles Tetra Packs Cans |

| By Occasion | Celebrations Everyday Consumption Gifting |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Wine Outlets | 40 | Store Managers, Wine Buyers |

| Wine Importers | 40 | Import Managers, Sales Directors |

| Wine Consumers | 120 | Regular Wine Drinkers, Occasional Buyers |

| Hospitality Sector (Restaurants & Hotels) | 40 | Food and Beverage Managers, Sommeliers |

| Wine Event Organizers | 20 | Event Coordinators, Marketing Managers |

The Oman Wine Market is valued at approximately USD 3 million, reflecting a contraction in recent years due to regulatory changes and shifts in import volumes. However, growth is supported by increasing tourism and evolving consumer preferences.