Region:North America

Author(s):Geetanshi

Product Code:KRAB3386

Pages:99

Published On:October 2025

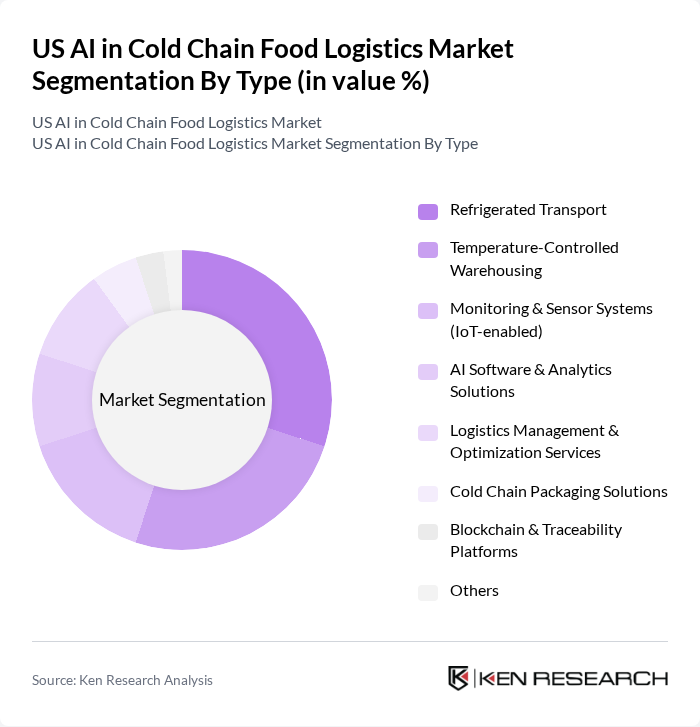

By Type:The market is segmented into various types, including Refrigerated Transport, Temperature-Controlled Warehousing, Monitoring & Sensor Systems (IoT-enabled), AI Software & Analytics Solutions, Logistics Management & Optimization Services, Cold Chain Packaging Solutions, Blockchain & Traceability Platforms, and Others. Each of these segments plays a crucial role in ensuring the efficiency and reliability of cold chain logistics. AI-powered monitoring and sensor systems, in particular, are increasingly deployed for real-time temperature and humidity tracking, while AI software and analytics solutions are used for predictive maintenance, route optimization, and inventory management .

By End-User:The end-user segmentation includes Food & Beverage Manufacturers (Dairy, Meat, Seafood, Produce, Frozen Foods), Grocery Retailers & Supermarkets, Food Distributors & Wholesalers, Restaurants, QSRs, and Food Service Providers, E-commerce & Meal Kit Platforms, Pharmaceutical & Biotech Companies, and Others. Each segment has unique requirements and contributes to the overall demand for AI in cold chain logistics. Food and beverage manufacturers and grocery retailers are the dominant end-users, reflecting the high volume of perishable goods requiring strict temperature control and traceability .

The US AI in Cold Chain Food Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Americold Logistics LLC, Lineage Logistics Holdings LLC, United States Cold Storage Inc., Preferred Freezer Services, Cold Chain Technologies, VersaCold Logistics Services, XPO Logistics Inc., DHL Supply Chain, C.H. Robinson Worldwide Inc., Sysco Corporation, McLane Company Inc., Gordon Food Service, US Foods Holding Corp., Performance Food Group Company, RLS Logistics, Sensitech Inc., Thermo King (Ingersoll Rand Inc.), Carrier Transicold (Carrier Global Corporation), Blue Yonder (JDA Software Group, Inc.), ORBCOMM Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in cold chain food logistics appears promising, driven by technological advancements and increasing regulatory pressures for food safety. As companies adopt AI solutions, we can expect enhanced operational efficiencies and reduced waste. The integration of AI with IoT will likely lead to smarter logistics networks, improving real-time tracking and predictive analytics. Furthermore, the growing emphasis on sustainability will push companies to innovate, ensuring compliance with environmental regulations while meeting consumer demands for transparency and quality.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Temperature-Controlled Warehousing Monitoring & Sensor Systems (IoT-enabled) AI Software & Analytics Solutions Logistics Management & Optimization Services Cold Chain Packaging Solutions Blockchain & Traceability Platforms Others |

| By End-User | Food & Beverage Manufacturers (Dairy, Meat, Seafood, Produce, Frozen Foods) Grocery Retailers & Supermarkets Food Distributors & Wholesalers Restaurants, QSRs, and Food Service Providers E-commerce & Meal Kit Platforms Pharmaceutical & Biotech Companies Others |

| By Application | Fresh Produce Dairy & Frozen Desserts Meat, Poultry & Seafood Ready-to-Eat Meals Pharmaceuticals & Biotech Products Floral & Specialty Products Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Fulfillment Others |

| By Sales Channel | Online Sales Offline Sales B2B Sales B2C Sales Others |

| By Region | Northeast Midwest South West Others |

| By Policy Support | Subsidies for Cold Chain Infrastructure Tax Incentives for AI Adoption Grants for Research and Development Regulatory Support for Digitalization Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 100 | Operations Managers, Facility Directors |

| Food Distribution Companies | 80 | Supply Chain Executives, Logistics Coordinators |

| AI Technology Providers | 50 | Product Managers, Business Development Leads |

| Retail Food Chains | 90 | Procurement Officers, Quality Control Managers |

| Regulatory Bodies | 40 | Policy Analysts, Compliance Officers |

The US AI in Cold Chain Food Logistics Market is valued at approximately USD 14 billion, driven by the demand for efficient food distribution, e-commerce growth, and enhanced food safety standards. This market is expected to grow further as AI technologies are integrated into logistics operations.