Region:North America

Author(s):Dev

Product Code:KRAD7653

Pages:80

Published On:December 2025

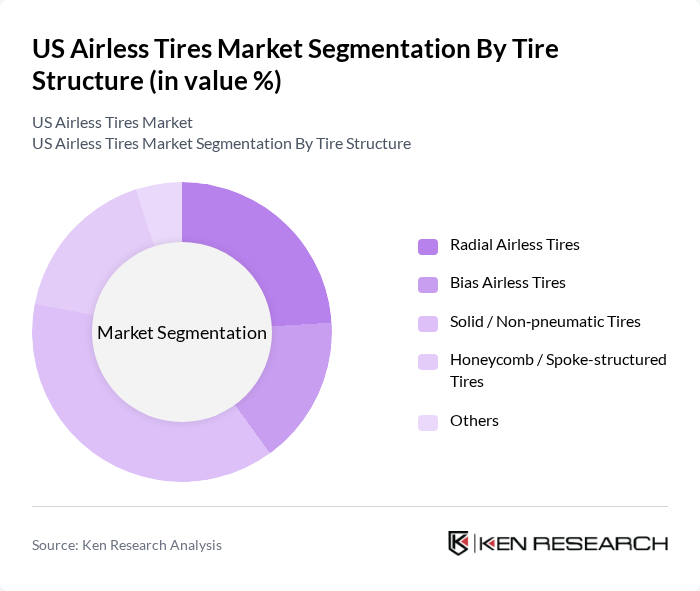

By Tire Structure:The tire structure segment includes various types of airless tires designed for different applications. The dominant subsegment is Solid / Non-pneumatic Tires, which are widely used for low?speed, high?load applications in industrial, material?handling, lawn and garden, and construction equipment due to their durability and low maintenance requirements. These tires are increasingly used in industrial and construction applications where puncture resistance and resistance to sidewall damage are critical. Radial Airless Tires and Honeycomb / Spoke-structured Tires are also gaining traction as next?generation concepts for passenger and light commercial vehicles, utility vehicles and small EVs, offering improved ride comfort, lower rolling resistance and better heat dissipation compared with traditional solid designs.

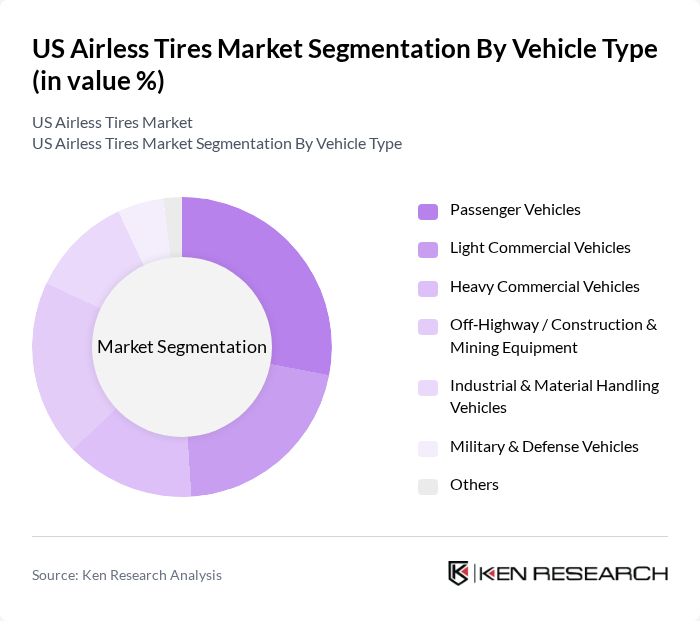

By Vehicle Type:This segment encompasses various vehicle categories utilizing airless tires. The Passenger Vehicles subsegment is emerging as an important focus area through pilots and limited?volume deployments for compact EVs, UTVs and specialty vehicles, driven by consumer demand for safer and more reliable tire options that are puncture?proof and low maintenance. Light Commercial Vehicles and Heavy Commercial Vehicles are also significant contributors in targeted use cases such as last?mile delivery fleets, utility trucks and municipal vehicles, as businesses seek to minimize downtime and maintenance costs associated with traditional tires. Off-Highway / Construction & Mining Equipment is another core area for airless tires, where durability, cut resistance, and stable performance under high loads are paramount, alongside Industrial & Material Handling Vehicles such as forklifts, skid steers and ground support equipment that already represent major installed bases for non?pneumatic designs.

The US Airless Tires Market is characterized by a dynamic mix of regional and international players. Leading participants such as Michelin Group (Michelin UPTIS, Tweel), Bridgestone Corporation (Air Free Concept), The Goodyear Tire & Rubber Company, Continental AG, Hankook Tire & Technology Co., Ltd., Sumitomo Rubber Industries, Ltd., Trelleborg AB, Toyo Tire Corporation, Kenda Rubber Industrial Co., Ltd., Maxxis International (Cheng Shin Rubber Ind. Co., Ltd.), Yokohama Rubber Co., Ltd., Nokian Tyres plc, The Carlstar Group LLC (Carlisle), Polaris Inc. (terrain?specific non?pneumatic tires for UTV/ATV), and Resilient Technologies / Oshkosh Corporation are actively involved in concept development, field trials, OEM collaborations, and niche commercial deployments of non?pneumatic tire solutions in North America.

The US airless tires market is poised for significant growth as consumer preferences shift towards sustainable and maintenance-free solutions. With the automotive industry increasingly embracing electric vehicles, the demand for innovative tire technologies will likely rise. Additionally, partnerships between tire manufacturers and automotive companies can facilitate the integration of airless tires into new vehicle models, enhancing their market presence. As awareness and acceptance grow, the airless tire segment is expected to capture a larger share of the overall tire market.

| Segment | Sub-Segments |

|---|---|

| By Tire Structure | Radial Airless Tires Bias Airless Tires Solid / Non?pneumatic Tires Honeycomb / Spoke-structured Tires Others |

| By Vehicle Type | Passenger Vehicles Light Commercial Vehicles Heavy Commercial Vehicles Off?Highway / Construction & Mining Equipment Industrial & Material Handling Vehicles (forklifts, warehouse equipment) Military & Defense Vehicles Others |

| By Application | OEM Fitment Replacement / Aftermarket Electric & Autonomous Vehicles Utility Terrain Vehicles (UTV), ATV & Recreational Last?mile Delivery & Urban Mobility Fleets Others |

| By Material | Rubber?based Compounds Thermoplastic Elastomers Composite & Reinforced Polymer Structures Recycled / Sustainable Materials Others |

| By Sales Channel | OEM Aftermarket – Online Aftermarket – Offline (dealers, specialty distributors) Direct to Fleet / Enterprise Sales Others |

| By US Region | Northeast Midwest South West |

| By Price Positioning | Budget / Entry-level Mid?Range Premium / Performance Fleet / TCO?optimized Offerings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 100 | Product Development Engineers, R&D Managers |

| Commercial Fleet Operators | 80 | Fleet Managers, Operations Directors |

| Automotive Safety Regulators | 50 | Regulatory Affairs Specialists, Compliance Officers |

| Tire Retailers and Distributors | 70 | Sales Managers, Inventory Analysts |

| Research Institutions in Automotive Technology | 60 | Research Scientists, Automotive Analysts |

The US Airless Tires Market is valued at approximately USD 2.3 billion, driven by the demand for innovative tire solutions that enhance safety and reduce maintenance costs, particularly in fleets and off-highway applications.