Region:North America

Author(s):Dev

Product Code:KRAD4575

Pages:93

Published On:December 2025

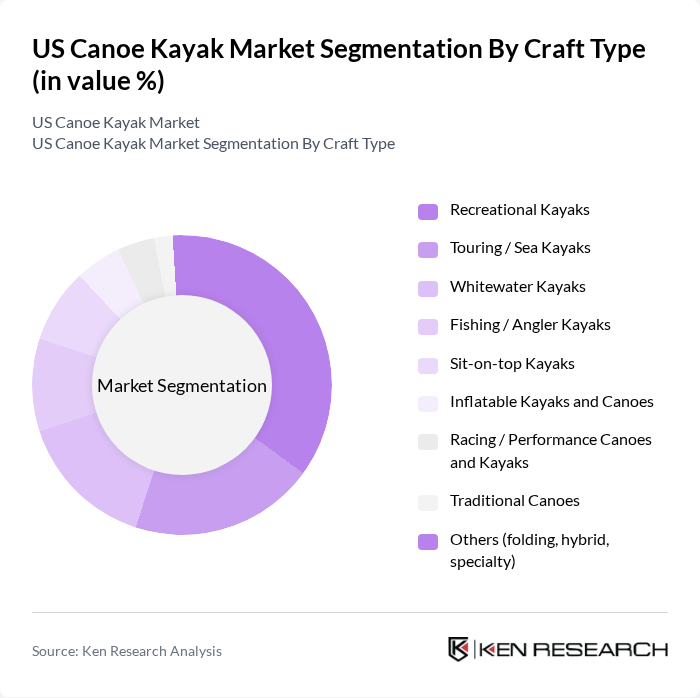

By Craft Type:The craft type segmentation includes various categories such as recreational kayaks, touring/sea kayaks, whitewater kayaks, fishing/angler kayaks, sit-on-top kayaks, inflatable kayaks and canoes, racing/performance canoes and kayaks, traditional canoes, and others (folding, hybrid, specialty). Among these, recreational kayaks are the most popular due to their versatility and ease of use, appealing to both beginners and experienced paddlers. The growing trend of outdoor activities has further fueled the demand for these craft types.

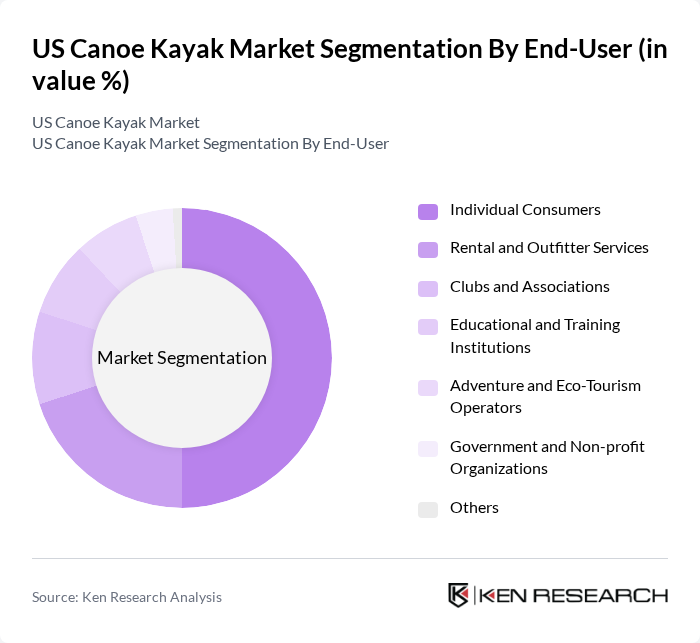

By End-User:The end-user segmentation encompasses individual consumers, rental and outfitter services, clubs and associations, educational and training institutions, adventure and eco-tourism operators, government and non-profit organizations, and others. Individual consumers represent the largest segment, driven by the increasing popularity of outdoor recreational activities and the growing trend of health and fitness. Rental services also play a significant role, particularly in tourist-heavy regions where access to kayaks and canoes is essential for visitors.

The US Canoe Kayak Market is characterized by a dynamic mix of regional and international players. Leading participants such as Old Town Canoe & Kayak (Johnson Outdoors Inc.), Ocean Kayak (Johnson Outdoors Inc.), Perception Kayaks (Confluence Outdoor), Wilderness Systems (Confluence Outdoor), Dagger Kayaks (Confluence Outdoor), Hobie Cat Company, Jackson Kayak, Pelican International Inc., Sea Eagle Boats Inc., Advanced Elements Inc., Emotion Kayaks (lifetime and legacy brands), Lifetime Products Inc., Riot Kayaks (Kayak Distribution Inc.), Aquabound Paddles (Branch Paddle Sports), NRS (Northwest River Supplies) contribute to innovation, geographic expansion, and service delivery in this space.

The US canoe kayak market is poised for significant evolution, driven by increasing consumer interest in sustainable practices and innovative technologies. As more individuals seek eco-friendly recreational options, manufacturers are likely to focus on developing biodegradable materials and energy-efficient production methods. Additionally, the integration of smart technology in kayaking gear, such as GPS and fitness tracking, will enhance user experience, attracting a broader audience and fostering long-term market growth.

| Segment | Sub-Segments |

|---|---|

| By Craft Type | Recreational Kayaks Touring / Sea Kayaks Whitewater Kayaks Fishing / Angler Kayaks Sit-on-top Kayaks Inflatable Kayaks and Canoes Racing / Performance Canoes and Kayaks Traditional Canoes Others (folding, hybrid, specialty) |

| By End-User | Individual Consumers Rental and Outfitter Services Clubs and Associations Educational and Training Institutions Adventure and Eco-Tourism Operators Government and Non?profit Organizations Others |

| By Application | Recreational and Leisure Paddling Fishing Whitewater and Expedition Competitive and Racing Instruction, Training, and Safety Programs Commercial Tours and Rentals Others |

| By Hull Material | Rotomolded Plastic (Polyethylene) Thermoformed ABS and Composites Fiberglass and Composite Laminates Carbon Fiber and High?performance Composites Wood and Wood?core Inflatable PVC and Drop?stitch Materials Others |

| By Price Range | Entry-level / Budget Mid-Range Premium Enthusiast High?end / Professional Rental / Fleet-focused |

| By Distribution Channel | Online Direct-to-Consumer Online Marketplaces and Retailers Specialty Paddle Sports Retailers Outdoor and Sporting Goods Chains Mass Merchandisers Rental and Outfitter Sales Others |

| By Region | Northeast Midwest South West Alaska and Hawaii |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Canoe Retail Market | 100 | Store Managers, Sales Representatives |

| Kayak Manufacturing Insights | 90 | Production Managers, Quality Control Specialists |

| Outdoor Recreation Participation | 150 | Recreational Paddlers, Adventure Tour Operators |

| Accessory Sales Trends | 70 | Product Managers, Marketing Executives |

| Consumer Preferences in Paddling | 120 | Outdoor Enthusiasts, Survey Respondents |

The US Canoe Kayak Market is valued at approximately USD 900 million, reflecting a significant growth trend driven by increased participation in outdoor recreational activities and a rising awareness of health and fitness among consumers.