Region:North America

Author(s):Rebecca Mary Reji

Product Code:KRO101

Pages:90

Published On:November 2025

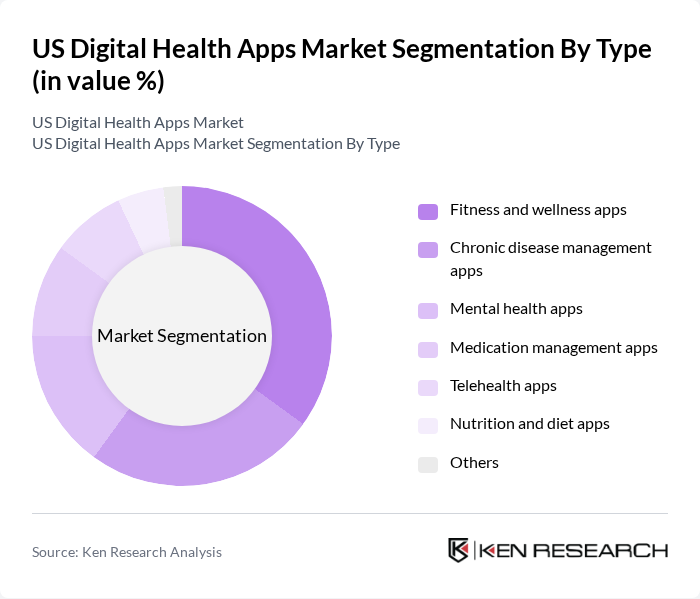

By Type:The digital health apps market is segmented into various types, including fitness and wellness apps, chronic disease management apps, mental health apps, medication management apps, telehealth apps, nutrition and diet apps, and others. Among these, fitness and wellness apps are currently leading the market due to the increasing focus on personal health and fitness, driven by a growing trend of health-conscious consumers. Chronic disease management apps are also gaining traction as they provide essential tools for managing long-term health conditions, reflecting a shift towards proactive healthcare management.

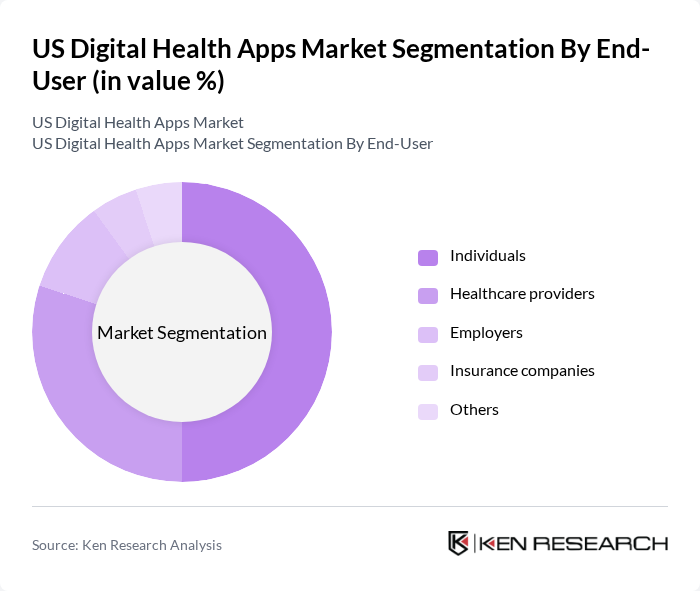

By End-User:The end-user segmentation of the digital health apps market includes individuals, healthcare providers, employers, insurance companies, and others. Individuals represent the largest segment, driven by the increasing consumer demand for personalized health solutions and the convenience of managing health through mobile applications. Healthcare providers are also significant users, utilizing these apps to enhance patient engagement and streamline care delivery.

The US Digital Health Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as MyFitnessPal, Headspace, Fitbit, Calm, Noom, Teladoc Health, Omada Health, Livongo, WellDoc, DarioHealth, Zocdoc, BetterHelp, Talkspace, HealthTap, 23andMe contribute to innovation, geographic expansion, and service delivery in this space.

The US digital health apps market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As personalization becomes a key focus, apps that leverage AI and machine learning will enhance user experiences and health outcomes. Additionally, the integration of telehealth services with wearable technology will create seamless health management solutions. The emphasis on mental health and wellness will further shape app development, catering to a growing demographic seeking holistic health solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness and wellness apps Chronic disease management apps Mental health apps Medication management apps Telehealth apps Nutrition and diet apps Others |

| By End-User | Individuals Healthcare providers Employers Insurance companies Others |

| By Demographics | Age groups (Children, Adults, Seniors) Gender Socioeconomic status Others |

| By Functionality | Health tracking Appointment scheduling Virtual consultations Health education Others |

| By Distribution Channel | App stores Direct downloads from websites Partnerships with healthcare organizations Others |

| By Pricing Model | Free apps Freemium apps Subscription-based apps One-time purchase apps Others |

| By User Engagement Level | High engagement apps Moderate engagement apps Low engagement apps Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness App Users | 150 | Health Enthusiasts, Personal Trainers |

| Mental Health App Users | 100 | Therapists, Mental Health Advocates |

| Chronic Disease Management App Users | 80 | Patients, Caregivers |

| Healthcare Professionals | 120 | Doctors, Nurses, Health IT Specialists |

| Digital Health App Developers | 70 | Product Managers, UX Designers |

The US Digital Health Apps Market is valued at approximately USD 25 billion, reflecting significant growth driven by smartphone adoption, health awareness, and demand for remote healthcare solutions. This market is expected to continue expanding as technology and consumer needs evolve.