Region:North America

Author(s):Dev

Product Code:KRAA9634

Pages:85

Published On:November 2025

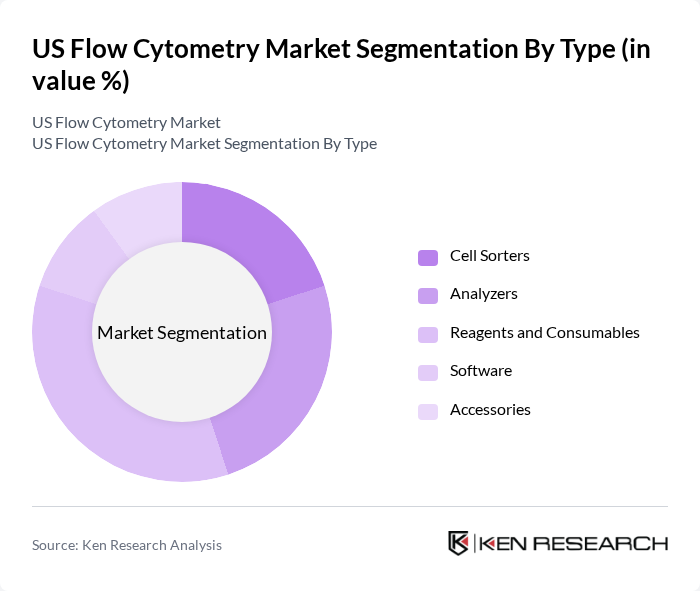

By Type:The flow cytometry market can be segmented into cell sorters, analyzers, reagents and consumables, software, and accessories. Among these, reagents and consumables hold the largest market share, reflecting their essential role in sample preparation and analysis. The growing volume of research activities and clinical applications continues to drive demand for these products, making them a critical component of the flow cytometry ecosystem. The increasing adoption of high-parameter flow cytometry and advanced reagent kits further supports segment growth.

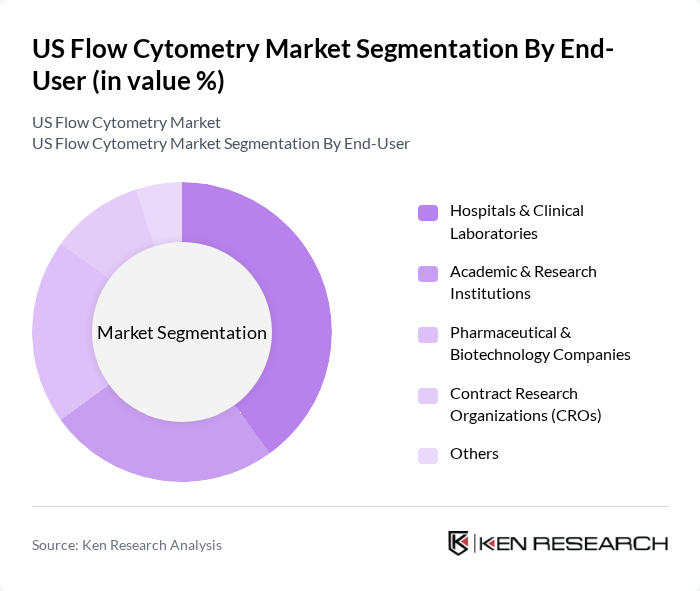

By End-User:The end-user segmentation includes hospitals and clinical laboratories, academic and research institutions, pharmaceutical and biotechnology companies, contract research organizations (CROs), and others. Hospitals and clinical laboratories are the leading end-users, driven by the increasing demand for diagnostic testing and the need for advanced technologies to improve patient outcomes. The rising focus on personalized medicine and the growing incidence of chronic and infectious diseases further enhance the adoption of flow cytometry in these settings. Academic and research institutions also represent a significant share, reflecting robust investment in biomedical research and innovation.

The US Flow Cytometry Market is characterized by a dynamic mix of regional and international players. Leading participants such as BD Biosciences, Beckman Coulter (Danaher Corporation), Thermo Fisher Scientific, Merck KGaA (MilliporeSigma), Bio-Rad Laboratories, Luminex Corporation, Miltenyi Biotec, Agilent Technologies, PerkinElmer (Revvity), Sartorius AG, Sysmex Corporation, Abcam plc, Cell Signaling Technology, R&D Systems (Bio-Techne), 10x Genomics, Sony Biotechnology, Apogee Flow Systems, Cytek Biosciences contribute to innovation, geographic expansion, and service delivery in this space.

The US flow cytometry market is poised for significant growth, driven by technological advancements and increasing applications in personalized medicine. As automation and multi-parameter analysis become more prevalent, laboratories will enhance their operational efficiency. Furthermore, the integration of artificial intelligence in flow cytometry is expected to streamline data analysis, making it more accessible. These trends indicate a robust future for flow cytometry, with ongoing innovations likely to expand its applications in diagnostics and research.

| Segment | Sub-Segments |

|---|---|

| By Type | Cell Sorters Analyzers Reagents and Consumables Software Accessories |

| By End-User | Hospitals & Clinical Laboratories Academic & Research Institutions Pharmaceutical & Biotechnology Companies Contract Research Organizations (CROs) Others |

| By Application | Immunophenotyping Cancer Research & Oncology Hematology Stem Cell Research Infectious Disease Research Drug Discovery & Development Others |

| By Technology | Conventional (Cell-based) Flow Cytometry Mass Cytometry (CyTOF) Imaging Flow Cytometry Spectral Flow Cytometry Microfluidic Flow Cytometry Bead-based Flow Cytometry Others |

| By Region | Northeast Midwest South West |

| By Product Type | Instruments Reagents & Consumables Software Accessories Services Others |

| By Service Type | Maintenance & Support Services Consulting Services Training & Education Services Data Analysis Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 60 | Laboratory Managers, Clinical Pathologists |

| Research Institutions | 50 | Principal Investigators, Research Scientists |

| Biotechnology Firms | 40 | Product Development Managers, R&D Directors |

| Pharmaceutical Companies | 40 | Clinical Research Associates, Regulatory Affairs Specialists |

| Diagnostic Centers | 45 | Operations Managers, Quality Control Analysts |

The US Flow Cytometry Market is valued at approximately USD 5.1 billion, reflecting significant growth driven by technological advancements, increased applications in clinical diagnostics, and a rising prevalence of chronic diseases.