Region:Global

Author(s):Rebecca

Product Code:KRAB2156

Pages:91

Published On:January 2026

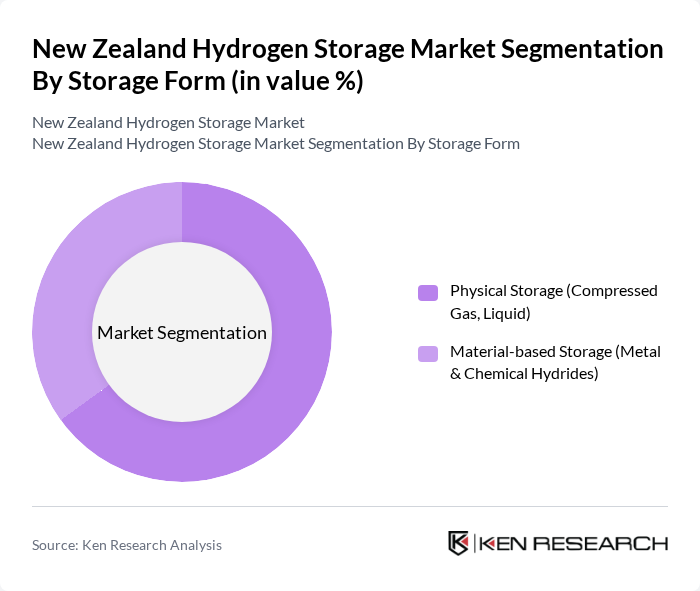

By Storage Form:The market is segmented into Physical Storage and Material-based Storage. Physical Storage includes methods like compressed gas and liquid hydrogen, which currently account for the majority of deployed and planned hydrogen infrastructure in New Zealand pilot projects and refuelling networks, while Material-based Storage involves metal and chemical hydrides that are primarily at R&D or early demonstration stages. The Physical Storage segment is currently leading due to its established technology, compatibility with mobility and industrial applications, and lower near-term implementation risk relative to more advanced material-based options.

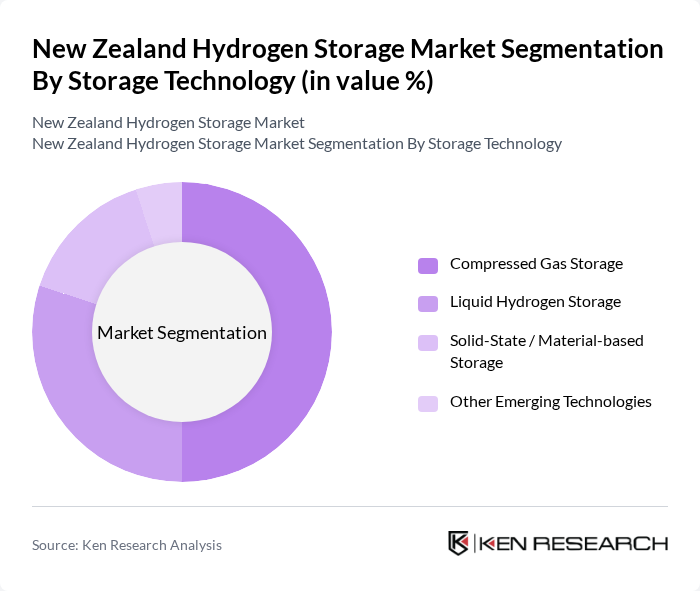

By Storage Technology:This segment includes Compressed Gas Storage, Liquid Hydrogen Storage, Solid-State / Material-based Storage, and Other Emerging Technologies. Compressed Gas Storage is the dominant technology, reflecting its use in New Zealand’s early commercial and pilot projects for refuelling networks and distributed production, as well as its global maturity and standardisation for stationary and mobility applications.

The New Zealand Hydrogen Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Contact Energy, Meridian Energy, Genesis Energy, Ballance Agri-Nutrients, Hydrogen New Zealand (H?NZ), Hiringa Energy, Z Energy, Powerco, Vector Limited, Ng?i Tahu Holdings, Firstgas Group, Mercury NZ, Trustpower, Auckland International Airport, Wellington Water contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand hydrogen storage market appears promising, driven by increasing investments in renewable energy and supportive government policies. As the country progresses towards its future renewable energy targets, the demand for efficient hydrogen storage solutions is expected to rise. Collaborations between public and private sectors will likely enhance technological advancements, while the establishment of a robust hydrogen infrastructure will facilitate market growth and integration into various sectors, including transportation and industrial applications.

| Segment | Sub-Segments |

|---|---|

| By Storage Form | Physical Storage (Compressed Gas, Liquid) Material-based Storage (Metal & Chemical Hydrides) |

| By Storage Technology | Compressed Gas Storage Liquid Hydrogen Storage Solid-State / Material-based Storage Other Emerging Technologies |

| By Storage Type / Deployment | Cylinder Storage Bulk / Merchant Storage On-site (Production-integrated) Storage On-board Vehicle Storage |

| By Application | Grid & Renewable Energy Storage Transportation (Road, Rail, Marine, Aviation Pilots) Industrial & Chemical Processes Power Generation & Backup Power Others |

| By End-User | Energy & Utilities Industrial & Manufacturing Mobility & Transport Operators Commercial & Public Infrastructure Others |

| By Project Scale | Pilot & Demonstration Projects Small-scale Distributed Systems Large-scale / Export-oriented Projects |

| By Ownership & Finance Model | Public Sector-led Private Sector-led Public–Private Partnerships (PPPs) International / Multilateral-funded |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hydrogen Storage Technology Providers | 60 | Product Managers, Technical Directors |

| Energy Policy Experts | 50 | Government Officials, Regulatory Analysts |

| Industrial Users of Hydrogen | 40 | Operations Managers, Energy Procurement Officers |

| Research Institutions Focused on Hydrogen | 40 | Research Scientists, Academic Professors |

| Environmental Consultants | 50 | Sustainability Analysts, Environmental Policy Advisors |

The New Zealand Hydrogen Storage Market is valued at approximately USD 1.1 billion, driven by investments in renewable energy, government decarbonisation targets, and the demand for energy storage solutions to support grid stability and heavy transport decarbonisation.