Region:North America

Author(s):Geetanshi

Product Code:KRAD8155

Pages:84

Published On:December 2025

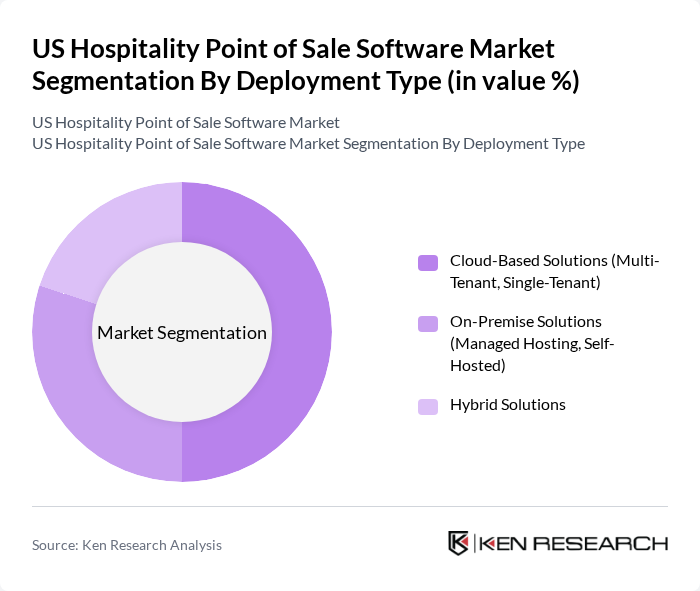

By Deployment Type:The deployment type segmentation includes Cloud-Based Solutions, On-Premise Solutions, and Hybrid Solutions. Cloud-based solutions are gaining traction due to their scalability and cost-effectiveness, enabling real-time data access and remote management capabilities, while on-premise solutions are preferred by businesses that require complete control over their systems. Hybrid solutions offer a blend of both, catering to diverse business needs.

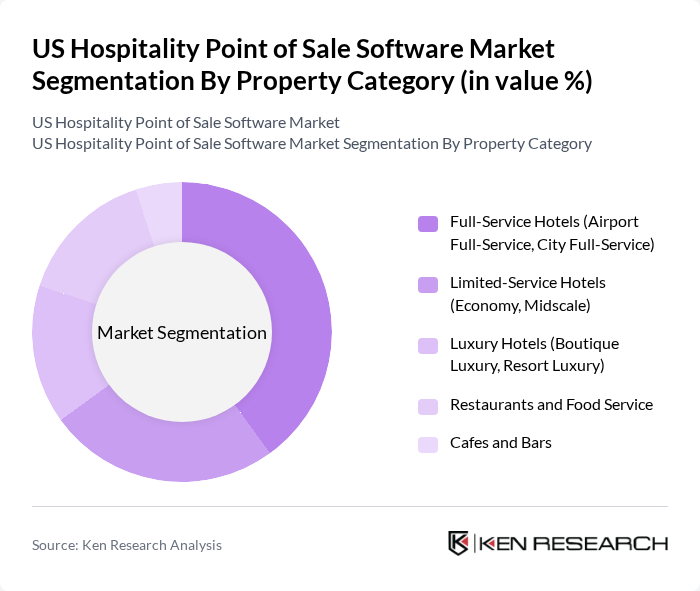

By Property Category:This segmentation includes Full-Service Hotels, Limited-Service Hotels, Luxury Hotels, Restaurants and Food Service, and Cafes and Bars. Full-service hotels dominate the market due to their extensive operational needs, while restaurants and food service establishments are rapidly adopting POS systems to enhance customer engagement, streamline operations, and integrate with third-party delivery aggregators and online ordering portals.

The US Hospitality Point of Sale Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Square, Inc., Toast, Inc., Lightspeed POS, Clover (Fiserv), TouchBistro, Revel Systems, NCR Corporation, Oracle Hospitality, Agilysys, Inc., ShopKeep (Lightspeed), Zomato, Micros Systems (Oracle), MarginEdge, Toast Marketplace Partners, Plate IQ contribute to innovation, geographic expansion, and service delivery in this space.

The US hospitality POS software market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt integrated payment solutions and AI-driven analytics, operational efficiencies will improve. Furthermore, the shift towards subscription-based pricing models will provide flexibility for smaller establishments. Sustainability initiatives will also gain traction, influencing software development and operational practices, ultimately shaping a more resilient and customer-centric industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Deployment Type | Cloud-Based Solutions (Multi-Tenant, Single-Tenant) On-Premise Solutions (Managed Hosting, Self-Hosted) Hybrid Solutions |

| By Property Category | Full-Service Hotels (Airport Full-Service, City Full-Service) Limited-Service Hotels (Economy, Midscale) Luxury Hotels (Boutique Luxury, Resort Luxury) Restaurants and Food Service Cafes and Bars |

| By Enterprise Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Service Model | Licensed (Perpetual License, Subscription License) Software as a Service (SaaS) |

| By System Type | Integrated Systems Standalone Systems |

| By Payment Method | Credit/Debit Cards Mobile Wallets Contactless Payments Cash |

| By Feature Set | Inventory Management Customer Relationship Management Employee Management Reporting and Analytics Mobile Ordering Integration Third-Party Delivery Integration |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hotel Management Systems | 120 | General Managers, IT Directors |

| Restaurant POS Solutions | 95 | Owners, Operations Managers |

| Bar and Nightclub Software | 75 | Bar Managers, Financial Controllers |

| Mobile POS Systems | 65 | Product Managers, Customer Experience Managers |

| Integrated Payment Solutions | 85 | Payment Processing Managers, CFOs |

The US Hospitality Point of Sale Software Market is valued at approximately USD 4.7 billion, reflecting significant growth driven by the adoption of digital payment solutions and technology integration in the hospitality sector.