Region:North America

Author(s):Dev

Product Code:KRAB0453

Pages:86

Published On:August 2025

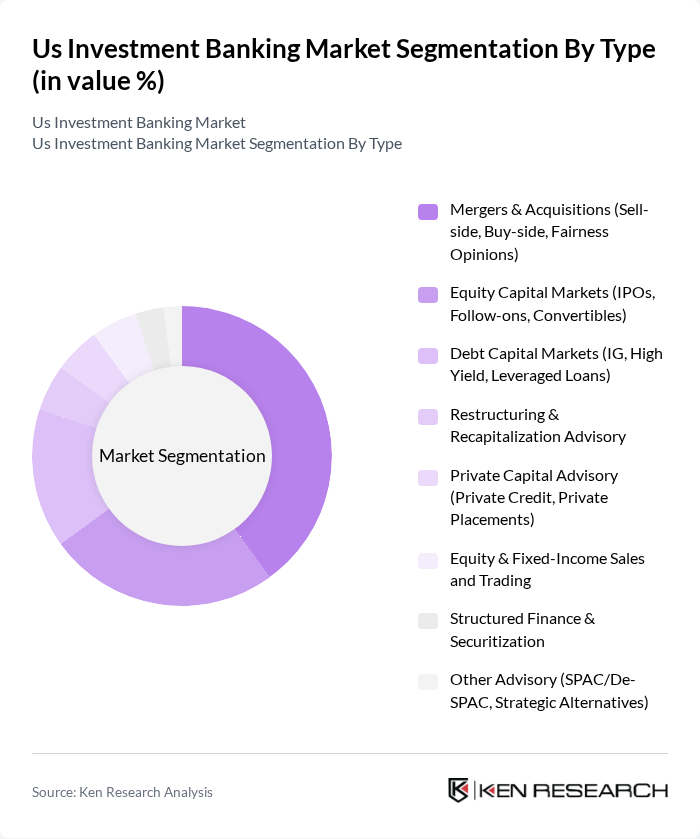

By Type:The US Investment Banking Market is segmented into various types, including Mergers & Acquisitions, Equity Capital Markets, Debt Capital Markets, Restructuring & Recapitalization Advisory, Private Capital Advisory, Equity & Fixed-Income Sales and Trading, Structured Finance & Securitization, and Other Advisory services. Among these, Mergers & Acquisitions (M&A) is the leading segment, supported by the continued dominance of M&A advisory in fee pools and recent data indicating M&A led with the largest share of mandates, while ECM has benefited from a recovering IPO window and convertibles issuance, and DCM/leveraged finance has improved alongside better credit markets . The demand for advisory services in M&A has been bolstered by favorable market liquidity, strong sponsor activity, and strategic consolidation across technology, healthcare, energy transition, and infrastructure-related sectors .

By End-User:The end-user segmentation of the US Investment Banking Market includes Public Corporations, Private/Founder-Owned Companies, Financial Sponsors, Institutional Investors, Government & Public Sector Entities, and Family Offices & Ultra-High-Net-Worth Clients. Public Corporations dominate this segment, as they frequently engage in capital raising and M&A activities to enhance their market position and drive growth, while financial sponsors (private equity and increasingly private credit managers) generate substantial deal flow through acquisitions, exits, and capital solutions that utilize ECM, DCM, and advisory services . The increasing trend of public companies seeking strategic acquisitions to expand market share, coupled with opportunistic carve-outs and portfolio rebalancing, has significantly contributed to the growth of this segment .

The US Investment Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Goldman Sachs Group, Inc., Morgan Stanley, JPMorgan Chase & Co., Bank of America, Citigroup Inc., Barclays PLC, Deutsche Bank AG, UBS Group AG, Wells Fargo & Company, Evercore Inc., Lazard Ltd, Moelis & Company, Houlihan Lokey, Inc., Jefferies Financial Group Inc., PJT Partners Inc. contribute to innovation, geographic expansion, and service delivery in this space, with bulge bracket banks dominating the fee wallet and elite boutiques maintaining strong M&A franchises .

The future of the US investment banking market appears promising, driven by ongoing technological advancements and a strong focus on sustainable finance. As firms increasingly adopt digital transformation strategies, the integration of data analytics and AI will enhance decision-making processes and client interactions. Furthermore, the growing emphasis on environmental, social, and governance (ESG) criteria will likely reshape investment strategies, positioning banks to capitalize on emerging trends and client demands in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mergers & Acquisitions (Sell-side, Buy-side, Fairness Opinions) Equity Capital Markets (IPOs, Follow-ons, Convertibles) Debt Capital Markets (IG, High Yield, Leveraged Loans) Restructuring & Recapitalization Advisory Private Capital Advisory (Private Credit, Private Placements) Equity & Fixed-Income Sales and Trading Structured Finance & Securitization Other Advisory (SPAC/De-SPAC, Strategic Alternatives) |

| By End-User | Public Corporations Private/Founder-Owned Companies Financial Sponsors (Private Equity, Venture Capital) Institutional Investors (Pension, Sovereign, Insurance) Government & Public Sector Entities Family Offices & Ultra-High-Net-Worth Clients |

| By Service Type | Underwriting & Bookrunning Syndication & Distribution Research & Analytics (Equity/ Credit Research) Risk Management & Hedging (Derivatives, FX, Rates) Market Making & Execution Prime Brokerage & Financing |

| By Transaction Size | Sub-$100 Million $100 Million–$1 Billion $1 Billion–$5 Billion Above $5 Billion (Mega Deals) |

| By Geographic Focus | Domestic (U.S.-Only) Transactions Cross-Border – Inbound Cross-Border – Outbound Multiregional/Global Mandates |

| By Client Type | Large-Cap (>$10B market cap) Mid-Cap ($2B–$10B) Small-Cap & Emerging Growth (<$2B) Sponsor-Backed vs. Non-Sponsor |

| By Capital Source | Public Markets (NYSE/Nasdaq, SEC-Registered) Private Markets (Private Credit, PE, Venture) Bank Balance Sheet & Loan Syndications Government/Agency Programs (e.g., muni, GSEs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| M&A Advisory Services | 120 | Investment Bankers, Corporate Development Executives |

| Equity Underwriting | 90 | Equity Analysts, Syndicate Managers |

| Debt Capital Markets | 80 | Debt Analysts, Treasury Managers |

| Asset Management | 70 | Portfolio Managers, Wealth Advisors |

| Private Equity Investments | 60 | Private Equity Analysts, Fund Managers |

The US Investment Banking Market is valued at approximately USD 135 billion, reflecting a robust fee/revenue pool primarily driven by mergers and acquisitions (M&A) and underwriting activities, as well as increased private equity investments.