Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7312

Pages:86

Published On:October 2025

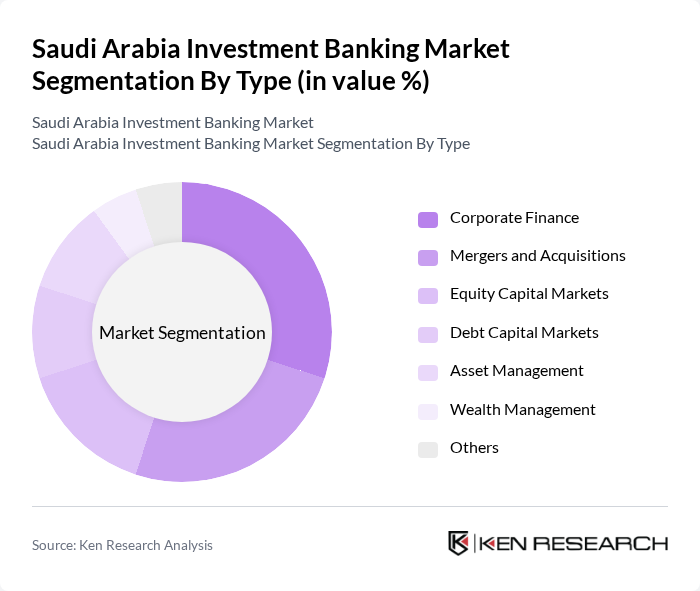

By Type:The market is segmented into various types, including Corporate Finance, Mergers and Acquisitions, Equity Capital Markets, Debt Capital Markets, Asset Management, Wealth Management, and Others. Each of these segments plays a crucial role in the overall investment banking landscape, catering to different client needs and market demands.

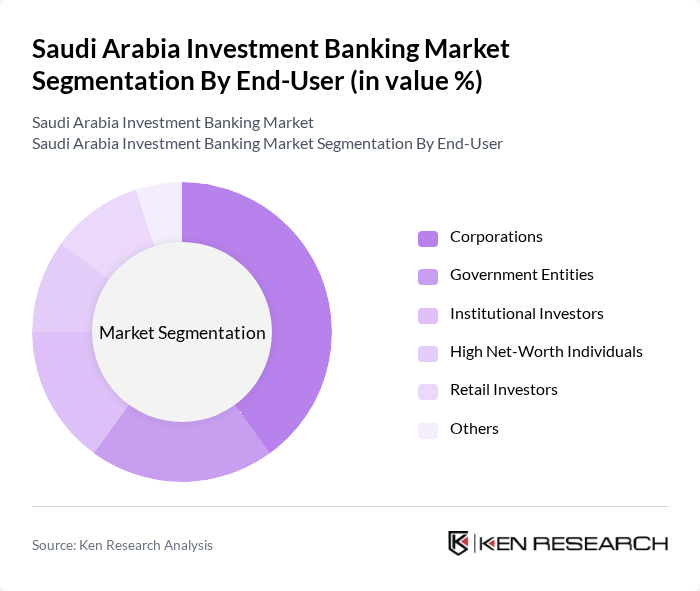

By End-User:The end-user segmentation includes Corporations, Government Entities, Institutional Investors, High Net-Worth Individuals, Retail Investors, and Others. Each segment represents a distinct group of clients that utilize investment banking services for various financial needs.

The Saudi Arabia Investment Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi National Bank, Al Rajhi Capital, Samba Financial Group, Riyad Bank, Arab National Bank, Banque Saudi Fransi, NCB Capital, Alinma Investment, Gulf International Bank, Emirates NBD, HSBC Saudi Arabia, Morgan Stanley Saudi Arabia, Citigroup Saudi Arabia, Deutsche Bank Saudi Arabia, Credit Suisse Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabian investment banking market is poised for significant transformation, driven by ongoing economic diversification and technological advancements. As the government continues to implement Vision 2030, investment banks will increasingly focus on sustainable finance and digital transformation. The integration of artificial intelligence and data analytics will enhance customer experiences and operational efficiencies, while the rise of fintech partnerships will create new avenues for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Corporate Finance Mergers and Acquisitions Equity Capital Markets Debt Capital Markets Asset Management Wealth Management Others |

| By End-User | Corporations Government Entities Institutional Investors High Net-Worth Individuals Retail Investors Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Service Model | Full-Service Investment Banks Boutique Investment Banks Online Investment Platforms Others |

| By Client Type | Institutional Clients Corporate Clients Individual Clients Others |

| By Geographical Presence | Central Region Eastern Region Western Region Southern Region Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| M&A Advisory Services | 100 | Investment Bankers, Corporate Finance Managers |

| Capital Raising Activities | 80 | Equity Analysts, Debt Issuance Specialists |

| Asset Management Trends | 70 | Portfolio Managers, Wealth Advisors |

| Regulatory Compliance Insights | 60 | Compliance Officers, Risk Management Executives |

| Client Relationship Management | 90 | Client Relationship Managers, Business Development Executives |

The Saudi Arabia Investment Banking Market is valued at approximately USD 5 billion, reflecting growth driven by economic diversification efforts under the Vision 2030 initiative, which aims to reduce reliance on oil revenues and enhance private sector investment.