Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1039

Pages:100

Published On:October 2025

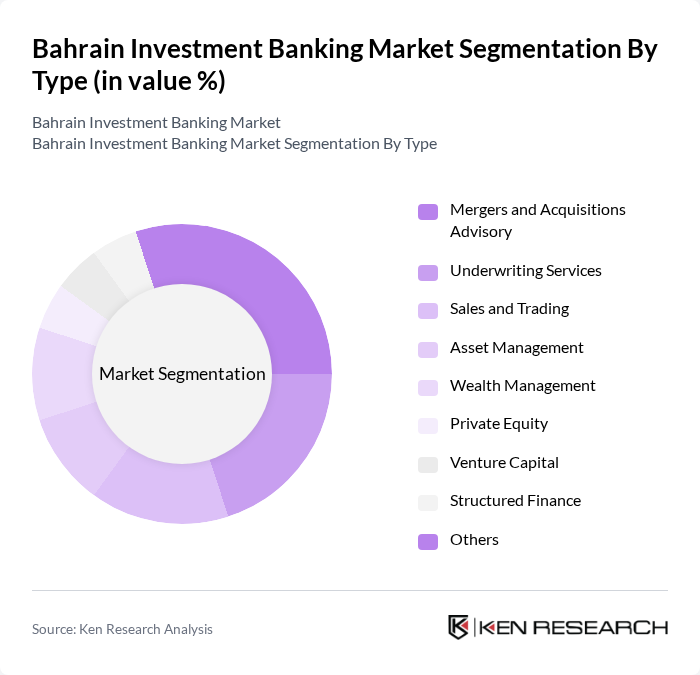

By Type:The investment banking market is segmented into Mergers and Acquisitions Advisory, Underwriting Services, Sales and Trading, Asset Management, Wealth Management, Private Equity, Venture Capital, Structured Finance, and Others. Each segment addresses distinct client needs and investment strategies, reflecting the diversity of Bahrain’s financial sector .

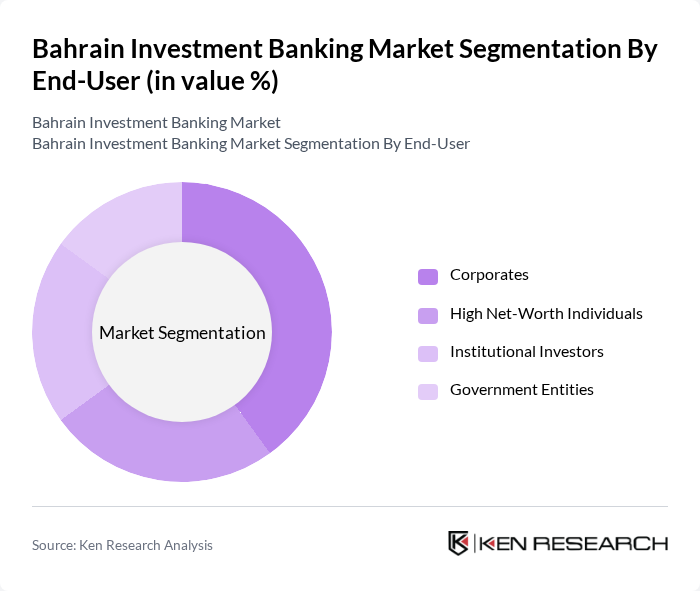

By End-User:The end-user segmentation includes Corporates, High Net-Worth Individuals, Institutional Investors, and Government Entities. Each group has distinct financial needs and investment strategies, influencing the types of services they seek from investment banks .

The Bahrain Investment Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf International Bank, Bahrain Islamic Bank, Ahli United Bank, National Bank of Bahrain, Bank of Bahrain and Kuwait, Investcorp, SICO BSC, Bahrain Commercial Facilities Company, Al Baraka Banking Group, Kuwait Finance House (KFH) Bahrain, Arab Banking Corporation (Bank ABC), HSBC Bank Middle East Bahrain, Citibank Bahrain, Emirates NBD Bahrain, Mashreq Bank Bahrain, and Standard Chartered Bank Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The future of Bahrain's investment banking market appears promising, driven by ongoing economic diversification and technological advancements. As the government continues to implement reforms aimed at enhancing the business environment, investment banks are likely to benefit from increased deal flow and new service opportunities. Additionally, the rise of fintech solutions will transform traditional banking practices, enabling firms to offer more efficient and customer-centric services, thus positioning Bahrain as a competitive player in the regional investment banking landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Mergers and Acquisitions Advisory Underwriting Services Sales and Trading Asset Management Wealth Management Private Equity Venture Capital Structured Finance Others |

| By End-User | Corporates High Net-Worth Individuals Institutional Investors Government Entities |

| By Service Offering | Mergers and Acquisitions Advisory Capital Raising (Equity & Debt) Financial Restructuring Risk Management Services IPO Advisory |

| By Investment Type | Equity Investments Debt Investments Real Estate Investments Alternative Investments |

| By Client Type | Retail Clients Corporate Clients Institutional Clients |

| By Distribution Channel | Direct Sales Online Platforms Financial Advisors |

| By Regulatory Framework | Conventional Banking Islamic Banking Hybrid Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Finance Advisory | 60 | Investment Bankers, Corporate Finance Managers |

| Equity Capital Markets | 50 | Equity Analysts, Fund Managers |

| Mergers & Acquisitions | 40 | M&A Advisors, Legal Counsel |

| Asset Management Services | 50 | Portfolio Managers, Wealth Advisors |

| Private Equity Investments | 40 | Private Equity Executives, Investment Directors |

The Bahrain Investment Banking Market is valued at approximately USD 520 million, reflecting a five-year historical analysis. This growth is driven by increasing foreign direct investment and the expansion of financial services catering to both local and international clients.