Region:North America

Author(s):Geetanshi

Product Code:KRAD7962

Pages:87

Published On:December 2025

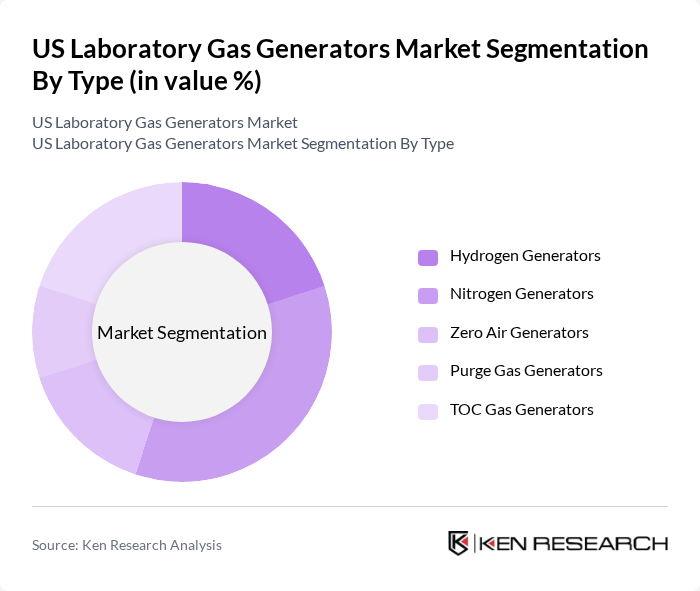

By Type:The market is segmented into various types of gas generators, each catering to specific applications and industries. The primary types include Hydrogen Generators, Nitrogen Generators, Zero Air Generators, Purge Gas Generators, and TOC Gas Generators. Hydrogen Generators represent the fastest-growing segment, driven by rising interest in hydrogen as a clean energy source and its applications in fuel cell research. Nitrogen Generators remain a significant segment due to their extensive use in laboratories for various applications, including sample preservation and analytical testing. The demand for high-purity nitrogen in the life sciences and chemical industries continues to drive this segment's growth.

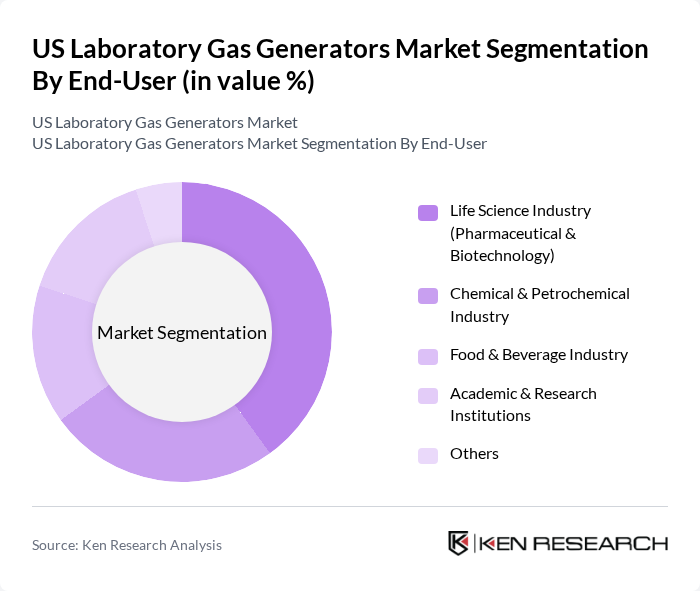

By End-User:The end-user segmentation includes various industries such as the Life Science Industry (Pharmaceutical & Biotechnology), Chemical & Petrochemical Industry, Food & Beverage Industry, Academic & Research Institutions, and Others. The Life Science Industry is the dominant segment, driven by the increasing need for laboratory gas generators in drug development and testing processes. The pharmaceutical sector's focus on innovation and compliance with stringent regulations further fuels the demand for reliable gas supply solutions. Academic and research institutions are witnessing steady growth, supported by government funding for research initiatives through programs such as National Science Foundation grants.

The US Laboratory Gas Generators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Parker Hannifin Corporation, Peak Scientific Instruments Ltd., Linde plc (which acquired Praxair Technology Inc.), Air Products and Chemicals, Inc., Matheson Tri-Gas, Inc., Entegris, Inc., Celerity Technologies, Inc., GCE Group, MESSER Group, TAIYO NIPPON SANSO Corporation, CMC Gas Technologies, and AGA Gas AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US laboratory gas generators market appears promising, driven by technological advancements and increasing environmental awareness. As laboratories continue to prioritize sustainability, the shift towards on-site gas generation is expected to gain momentum. Additionally, the integration of IoT technologies will enhance operational efficiency and monitoring capabilities, allowing for real-time adjustments and improved safety. These trends indicate a robust growth trajectory for the market, with significant potential for innovation and expansion in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrogen Generators Nitrogen Generators Zero Air Generators Purge Gas Generators TOC Gas Generators |

| By End-User | Life Science Industry (Pharmaceutical & Biotechnology) Chemical & Petrochemical Industry Food & Beverage Industry Academic & Research Institutions Others |

| By Application | Gas Chromatography Liquid Chromatography-Mass Spectrometry Gas Analysers Flame Ionization Detectors Others |

| By Technology | Membrane Separation Technology Pressure Swing Adsorption (PSA) Electrolysis Cryogenic Technology Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Northeast Midwest South West |

| By Customer Type | Government Agencies Private Sector Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Research Labs | 100 | Lab Managers, Research Scientists |

| Academic Institutions | 80 | Department Heads, Lab Technicians |

| Industrial Research Facilities | 70 | Procurement Managers, Facility Engineers |

| Government Research Organizations | 60 | Research Directors, Policy Makers |

| Private Sector R&D Departments | 90 | Product Development Managers, Quality Assurance Officers |

The US Laboratory Gas Generators Market is valued at approximately USD 484 million, reflecting a significant demand for high-purity gases across various applications, including pharmaceuticals and biotechnology.