Region:North America

Author(s):Geetanshi

Product Code:KRAD3847

Pages:80

Published On:November 2025

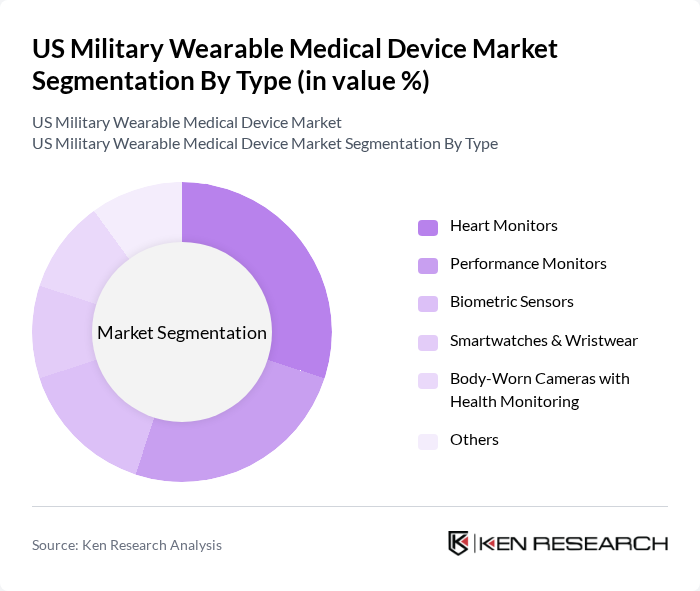

By Type:The market is segmented into various types of wearable medical devices, including heart monitors, performance monitors, biometric sensors, smartwatches & wristwear, body-worn cameras with health monitoring, and others. Among these, heart monitors and performance monitors are particularly significant due to their critical role in tracking vital signs and enhancing soldier performance. The increasing focus on health and fitness within military operations has led to a surge in demand for these devices, making them the leading subsegments in the market.

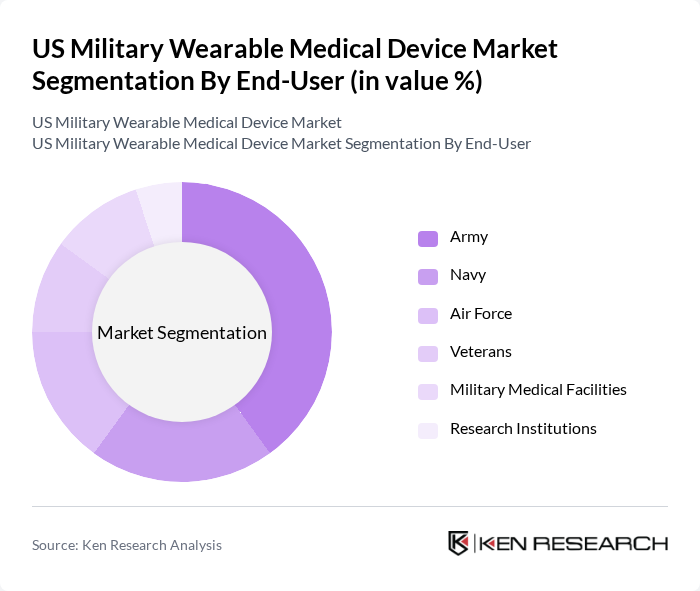

By End-User:The end-user segmentation includes the Army, Navy, Air Force, Veterans, Military Medical Facilities, Research Institutions, and others. The Army is the dominant end-user, driven by the need for continuous health monitoring and performance enhancement of soldiers in the field. The increasing emphasis on soldier readiness and health has led to a higher adoption rate of wearable medical devices within the Army, making it the leading segment in this category.

The US Military Wearable Medical Device Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Medtronic, Garmin, Bittium, Polar Electro, Oura Health, NeuroMetrix, Honeywell, BioBeat Technologies, Empatica, Fitbit (now part of Google), Abbott Laboratories, Dexcom, Stryker Corporation, OMRON Healthcare, Boston Scientific, AliveCor, Biofourmis, Blackrock Neurotech, Zephyr Technology (a Medtronic company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US military wearable medical device market appears promising, driven by technological advancements and a growing emphasis on soldier health. As the military increasingly adopts IoT technologies, devices will become more interconnected, enhancing data collection and analysis. Additionally, the integration of AI-driven analytics will enable predictive health monitoring, allowing for proactive interventions. These trends indicate a shift towards more personalized and efficient health management solutions, ultimately improving soldier performance and operational readiness in diverse environments.

| Segment | Sub-Segments |

|---|---|

| By Type | Heart Monitors Performance Monitors Biometric Sensors Smartwatches & Wristwear Body-Worn Cameras with Health Monitoring Others |

| By End-User | Army Navy Air Force Veterans Military Medical Facilities Research Institutions Others |

| By Application | Physiological Monitoring Injury Detection & Prevention Mental Health Assessment Rehabilitation Performance Enhancement Health Monitoring Others |

| By Technology | Wearable Sensors Mobile Health Applications Cloud Computing Solutions Data Analytics Platforms AI-Powered Diagnostic Tools Others |

| By Distribution Channel | Direct Sales Government Contracts Distributors Online Retail Others |

| By Region | Northeast Midwest South West |

| By Policy Support | Government Grants Tax Incentives Research Funding Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Healthcare Providers | 80 | Doctors, Nurses, Medical Technicians |

| Defense Procurement Officers | 50 | Procurement Managers, Contract Officers |

| Soldiers and Veterans | 120 | Active Duty Personnel, Retired Service Members |

| Military Technology Experts | 40 | Defense Analysts, R&D Engineers |

| Health Policy Makers | 40 | Government Officials, Health Program Directors |

The US Military Wearable Medical Device Market is valued at approximately USD 2.4 billion, reflecting significant growth driven by advancements in technology and the increasing demand for real-time health monitoring among military personnel.