Region:North America

Author(s):Rebecca

Product Code:KRAC8524

Pages:100

Published On:November 2025

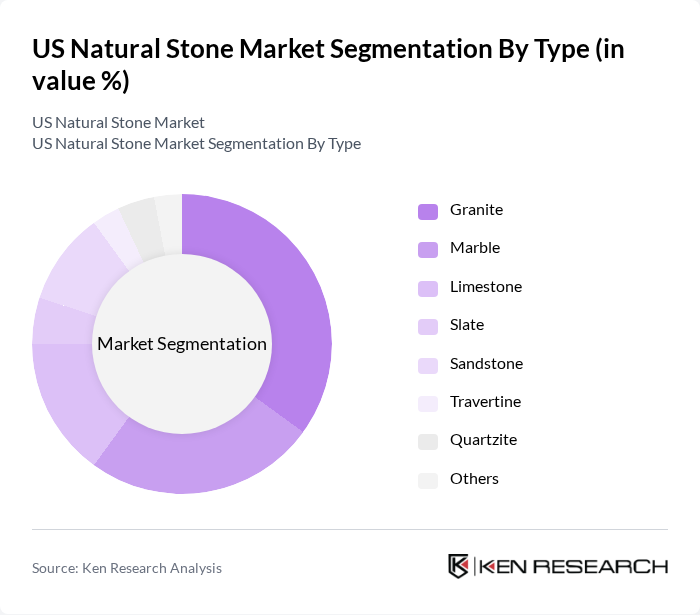

By Type:The natural stone market is segmented into various types, including granite, marble, limestone, slate, sandstone, travertine, quartzite, and others. Among these, granite and marble are the most popular due to their durability, longevity, and aesthetic appeal. Granite is particularly favored for countertops, flooring, and exterior cladding, while marble is often used in high-end residential and commercial applications for its luxurious appearance. The demand for limestone and sandstone is also significant, especially in construction, landscaping, and restoration projects. Technological advancements allow for customized finishes and innovative applications across all stone types .

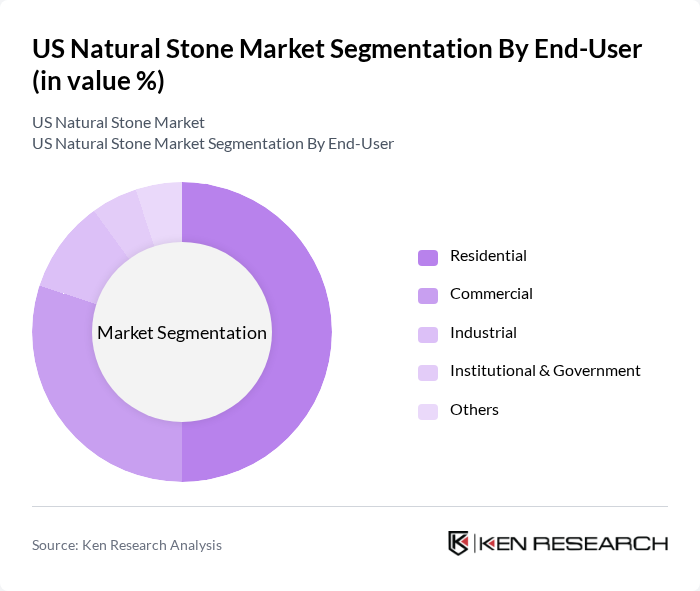

By End-User:The end-user segmentation of the natural stone market includes residential, commercial, industrial, institutional & government, and others. The residential sector is the largest consumer, driven by home renovations, new constructions, and the trend toward premium, sustainable materials in kitchens, bathrooms, and outdoor spaces. Commercial applications, particularly in retail, hospitality, and office developments, also contribute significantly to market demand, with natural stone used for flooring, façades, and decorative features. The industrial sector utilizes natural stone for specialized applications, while institutional and government projects require durable and aesthetically pleasing materials for public buildings and infrastructure .

The US Natural Stone Market is characterized by a dynamic mix of regional and international players. Leading participants such as Polycor Inc., MSI Surfaces (M S International, Inc.), Cambria Company LLC, Arizona Tile, Coldspring, Levantina USA, Daltile (Dal-Tile Corporation), Stone Source, Southland Stone USA, Inc., Rugo Stone, LLC, Vermont Quarries Corp., Rock of Ages Corporation, Indiana Limestone Company, New Mexico Travertine, A&G Marble Inc., Superior Granite and Marble, USA Marble LLC, Natural Stones USA, Virginia Black Granite contribute to innovation, geographic expansion, and service delivery in this space .

The US natural stone market is poised for continued growth, driven by increasing consumer awareness of sustainability and aesthetic preferences. As the construction sector expands, the demand for high-quality, eco-friendly materials will likely rise. Innovations in stone processing technology will enhance product offerings, while digitalization will streamline operations. Additionally, the trend towards customization in design will create new avenues for market players, ensuring a dynamic and competitive landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Granite Marble Limestone Slate Sandstone Travertine Quartzite Others |

| By End-User | Residential Commercial Industrial Institutional & Government Others |

| By Application | Flooring Countertops Wall Cladding Landscaping Memorial Arts & Monuments Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors/Wholesalers Others |

| By Region | Northeast Midwest South West |

| By Price Range | Low-End Mid-Range High-End Others |

| By Finish Type | Polished Honed Flamed Brushed Tumbled Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Natural Stone Usage | 60 | Homeowners, Interior Designers |

| Commercial Construction Projects | 50 | Project Managers, Architects |

| Quarry Operations Insights | 40 | Quarry Managers, Operations Directors |

| Natural Stone Retail Market | 45 | Retail Managers, Sales Executives |

| Architectural Trends in Natural Stone | 42 | Architects, Design Consultants |

The US Natural Stone Market is valued at approximately USD 2.1 billion, reflecting a significant growth trend driven by increased demand for natural stone in construction and renovation projects, as well as consumer preferences for sustainable materials.