Region:North America

Author(s):Rebecca

Product Code:KRAD4327

Pages:88

Published On:December 2025

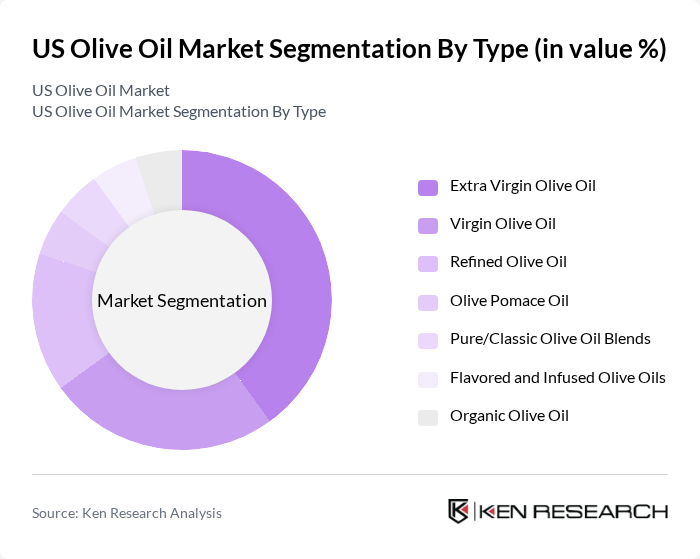

By Type:The olive oil market is segmented into various types, including Extra Virgin Olive Oil, Virgin Olive Oil, Refined Olive Oil, Olive Pomace Oil, Pure/Classic Olive Oil Blends, Flavored and Infused Olive Oils, and Organic Olive Oil. Among these, Extra Virgin Olive Oil is the most popular due to its superior quality and health benefits, driving consumer preference towards premium products. The demand for Organic Olive Oil is also rising as consumers become more health-conscious and environmentally aware.

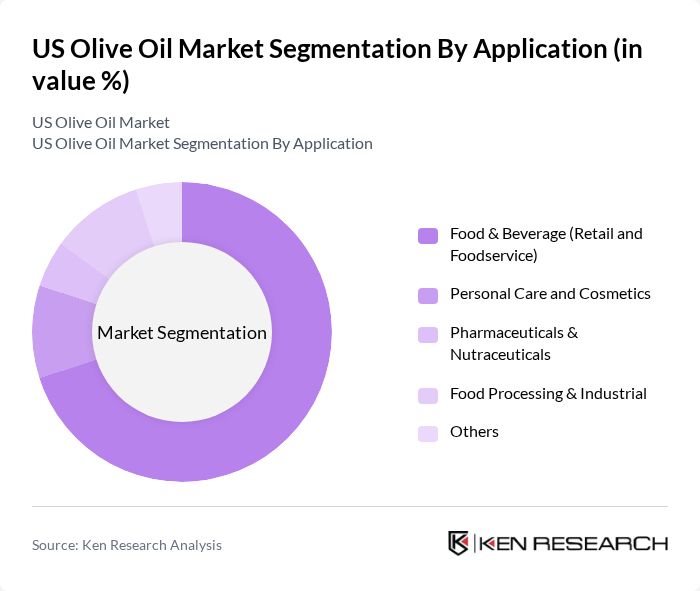

By Application:The applications of olive oil are diverse, including Food & Beverage (Retail and Foodservice), Personal Care and Cosmetics, Pharmaceuticals & Nutraceuticals, Food Processing & Industrial, and Others. The Food & Beverage sector dominates the market, driven by the increasing use of olive oil in cooking and food preparation, as well as its incorporation into health-focused diets. The Personal Care segment is also growing, as olive oil is recognized for its moisturizing properties.

The US Olive Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as California Olive Ranch Inc., Pompeian, Inc., Colavita USA, LLC, Bertolli (Deoleo S.A.), Filippo Berio (Salov Group), Corto Olive Company, Goya Foods, Inc., Star Fine Foods, La Tourangelle, Inc., Lucini Italia, O-Live & Co., Partanna, Spectrum Naturals (Hain Celestial), 365 by Whole Foods Market, and Private Label Brands (e.g., Kirkland Signature, Trader Joe’s) contribute to innovation, geographic expansion, and service delivery in this space.

The US olive oil market is poised for continued growth, driven by evolving consumer preferences and increasing health consciousness. As the demand for high-quality, gourmet, and organic products rises, producers will need to adapt to these trends. Additionally, the expansion of e-commerce channels will facilitate greater accessibility for consumers. Collaborations with culinary influencers will further enhance brand visibility, driving consumer engagement and loyalty in a competitive landscape, ultimately shaping the future of the olive oil market in the US.

| Segment | Sub-Segments |

|---|---|

| By Type | Extra Virgin Olive Oil Virgin Olive Oil Refined Olive Oil Olive Pomace Oil Pure/Classic Olive Oil Blends Flavored and Infused Olive Oils Organic Olive Oil |

| By Application | Food & Beverage (Retail and Foodservice) Personal Care and Cosmetics Pharmaceuticals & Nutraceuticals Food Processing & Industrial Others |

| By Packaging Type | Glass Bottles Plastic Bottles Metal Cans/Tins Bag-in-Box and Pouches Bulk/HoReCa Packaging |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Specialty & Gourmet Stores Online Retail & Direct-to-Consumer Foodservice Distributors Others |

| By Region | Northeast Midwest South West Others |

| By Price Range | Premium and Super-Premium Mid-Range Value/Economy Private Label |

| By Certification and Claim | USDA Organic Non-GMO Verified PDO/PGI and Origin-Designated Cold-Pressed/First Cold Press Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Olive Oil Sales | 120 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 150 | Health-Conscious Consumers, Food Enthusiasts |

| Production Insights from Farmers | 100 | Olive Oil Producers, Farm Managers |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Forecasting | 90 | Market Analysts, Industry Experts |

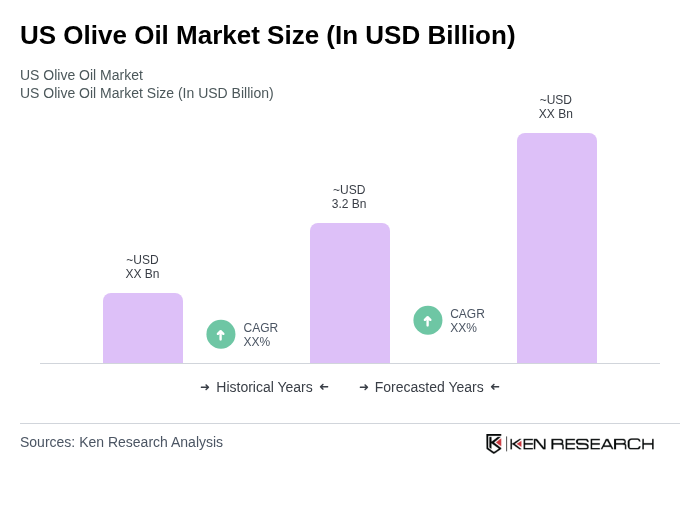

The US Olive Oil Market is valued at approximately USD 3.2 billion, reflecting a significant growth trend driven by increasing consumer awareness of health benefits and the popularity of the Mediterranean diet.