Region:North America

Author(s):Geetanshi

Product Code:KRAD4786

Pages:81

Published On:December 2025

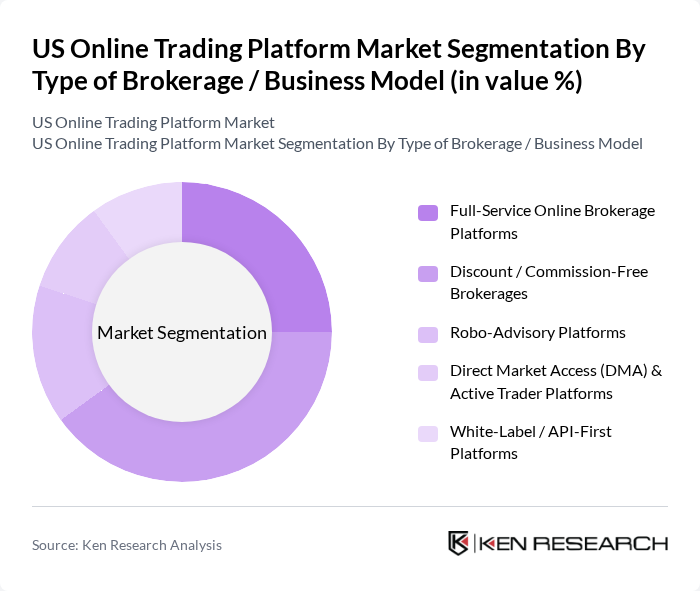

By Type of Brokerage / Business Model:This segmentation includes various business models that cater to different investor needs and preferences. The subsegments are Full-Service Online Brokerage Platforms, Discount / Commission-Free Brokerages, Robo-Advisory Platforms, Direct Market Access (DMA) & Active Trader Platforms, and White-Label / API-First Platforms. Each of these models serves distinct market segments, with varying levels of service and cost structures. Full-service platforms typically bundle research, advice, and planning tools; discount and commission-free brokerages focus on low-cost execution and mobile-first experiences; robo-advisory platforms automate portfolio management using algorithms; DMA and active trader platforms emphasize advanced tools, speed, and sophisticated order types; and white-label / API-first platforms enable financial institutions and fintechs to embed trading capabilities into their own branded offerings.

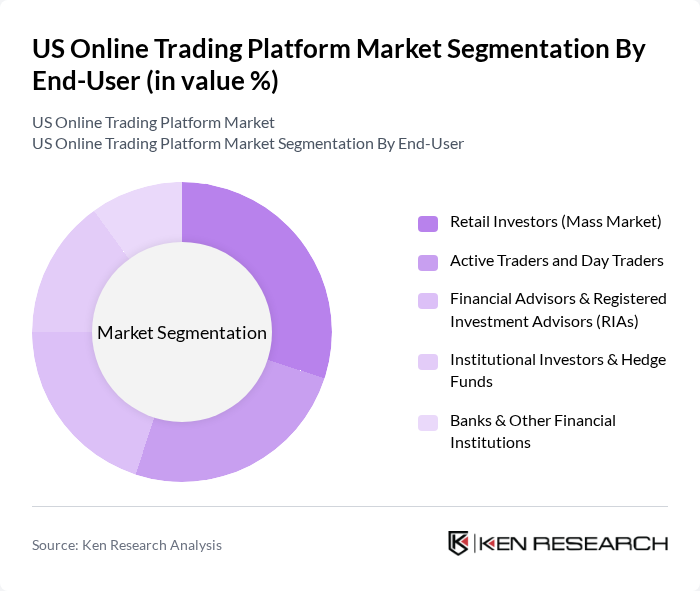

By End-User:This segmentation focuses on the different types of users engaging with online trading platforms. The subsegments include Retail Investors (Mass Market), Active Traders and Day Traders, Financial Advisors & Registered Investment Advisors (RIAs), Institutional Investors & Hedge Funds, and Banks & Other Financial Institutions. Each user group has unique trading behaviors and requirements, influencing the design and functionality of trading platforms. Retail investors generally seek intuitive interfaces, educational content, fractional investing, and low account minimums; active traders and day traders demand advanced charting, real-time data, and low-latency execution; financial advisors and RIAs require integrated portfolio management, compliance and reporting tools; institutional investors and hedge funds focus on robust order management systems, multi-asset connectivity, and risk controls; while banks and other financial institutions often integrate trading within broader digital banking, wealth management, and custody offerings.

The US Online Trading Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as Charles Schwab, TD Ameritrade (a Charles Schwab Company), E*TRADE from Morgan Stanley, Robinhood Markets, Inc., Fidelity Investments, Interactive Brokers Group, Inc., Webull Financial LLC, Ally Invest (Ally Financial Inc.), Merrill Edge (Bank of America Corporation), SoFi Invest (SoFi Technologies, Inc.), TradeStation Group, Inc., Zacks Trade, tastytrade, Inc. (formerly tastyworks), Acorns Grow Inc., Public Holdings, Inc. (Public.com) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. online trading platform market appears promising, driven by technological innovations and evolving investor preferences. As platforms increasingly adopt AI and machine learning, they will enhance user experiences and trading efficiencies. Additionally, the shift towards commission-free trading is likely to attract more retail investors, further expanding the market. However, platforms must navigate regulatory challenges and market volatility to sustain growth and maintain investor trust in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type of Brokerage / Business Model | Full-Service Online Brokerage Platforms Discount / Commission-Free Brokerages Robo-Advisory Platforms Direct Market Access (DMA) & Active Trader Platforms White-Label / API-First Platforms |

| By End-User | Retail Investors (Mass Market) Active Traders and Day Traders Financial Advisors & Registered Investment Advisors (RIAs) Institutional Investors & Hedge Funds Banks & Other Financial Institutions |

| By Account Type | Taxable Brokerage Accounts Individual Retirement Accounts (IRAs) Employer-Sponsored Retirement & Stock Plan Accounts Margin & Options-Enabled Accounts Custodial & Trust / Estate Accounts |

| By Asset Class Traded | Equities ETFs & Mutual Funds Options & Other Derivatives Fixed Income & Money Market Instruments Forex, Crypto & Other Alternative Assets |

| By Trading Style & Order Type | Buy-and-Hold / Long-Term Investing Active / Swing Trading High-Frequency & Algorithmic Trading Social & Copy Trading Fractional & Micro-Investing |

| By Deployment & Interface | Cloud-Based Platforms On-Premises / Proprietary In-House Platforms Mobile App–First Platforms Desktop & Web-Based Platforms Hybrid / Multi-Device Platforms |

| By Key Feature Set | Advanced Charting & Analytics Tools Integrated Research & Market Data Educational Content & Investor Tools API Access & Algo-Trading Support Customer Support & Advisory Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 140 | Individual Traders, Investment Enthusiasts |

| Institutional Trading Practices | 120 | Portfolio Managers, Institutional Investors |

| Platform Usability Feedback | 90 | UX Designers, Product Managers |

| Regulatory Impact Assessment | 60 | Compliance Officers, Legal Advisors |

| Market Trends and Predictions | 70 | Financial Analysts, Market Strategists |

The US Online Trading Platform Market is valued at approximately USD 3.4 billion, reflecting significant growth driven by the increasing adoption of digital trading solutions, mobile-first platforms, and advancements in technology such as AI-driven analytics and robo-advisory services.