Region:Asia

Author(s):Shubham

Product Code:KRAD2684

Pages:93

Published On:January 2026

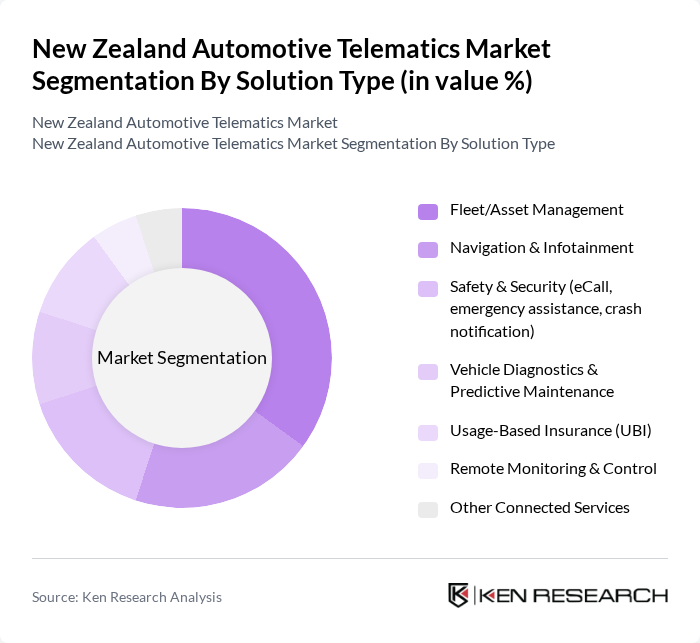

By Solution Type:The solution type segmentation includes various subsegments that cater to different needs within the automotive telematics landscape. The key subsegments are Fleet/Asset Management, Navigation & Infotainment, Safety & Security (eCall, emergency assistance, crash notification), Vehicle Diagnostics & Predictive Maintenance, Usage-Based Insurance (UBI), Remote Monitoring & Control, and Other Connected Services. Fleet/Asset Management is currently the leading subsegment due to the increasing need for efficient fleet operations, cost management, regulatory compliance, and the widespread use of GPS tracking and telematics control units in commercial and government fleets.

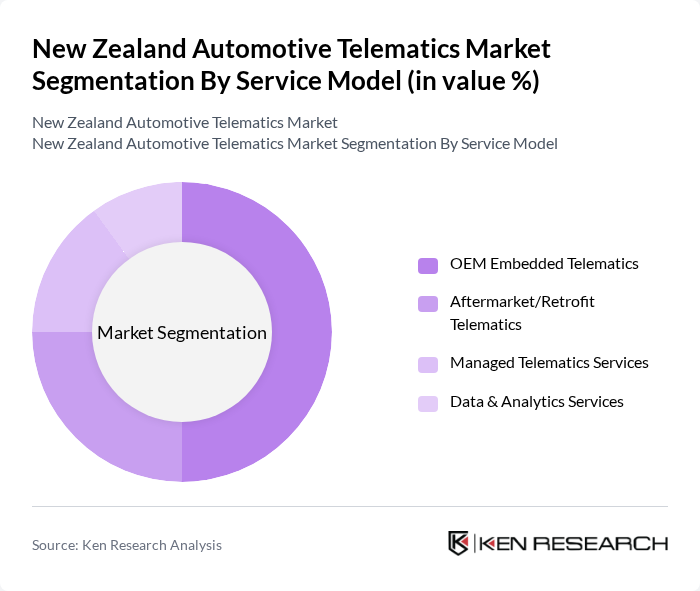

By Service Model:The service model segmentation encompasses OEM Embedded Telematics, Aftermarket/Retrofit Telematics, Managed Telematics Services, and Data & Analytics Services, which is consistent with global telematics value-chain structures. OEM Embedded Telematics is the dominant service model, as manufacturers increasingly integrate factory-fitted connectivity, safety, diagnostics, and infotainment platforms into vehicles, supported by 4G/5G connectivity and over-the-air update capabilities. This trend is driven by consumer demand for advanced connected features, regulatory focus on safety and incident response, and the need for real-time data analytics and subscription-based services that generate ongoing revenue for OEMs and service providers.

The New Zealand Automotive Telematics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teletrac Navman, EROAD, Coretex (Intelematics / MiX Telematics where relevant), Fleet Complete, Geotab, MiX Telematics, Verizon Connect, Webfleet Solutions (formerly TomTom Telematics), Ctrack, Gurtam, Samsara, Zubie, Inseego, Omnicomm, and other notable local and regional players contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand automotive telematics market appears promising, driven by technological advancements and increasing consumer awareness. The expansion of 5G networks is expected to enhance connectivity, enabling more sophisticated telematics applications. Additionally, the integration of artificial intelligence and machine learning will facilitate predictive analytics, improving vehicle maintenance and operational efficiency. As the market evolves, regulatory frameworks will likely adapt to support innovation while ensuring data security and privacy.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Fleet/Asset Management Navigation & Infotainment Safety & Security (eCall, emergency assistance, crash notification) Vehicle Diagnostics & Predictive Maintenance Usage-Based Insurance (UBI) Remote Monitoring & Control Other Connected Services |

| By Service Model | OEM Embedded Telematics Aftermarket/Retrofit Telematics Managed Telematics Services Data & Analytics Services |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCVs) Medium & Heavy Commercial Vehicles (MHCVs) Buses & Coaches Off-Highway & Specialist Fleets |

| By Connectivity & Technology | Embedded Telematics Control Units (TCUs) Tethered / Smartphone-Integrated Telematics GPS / GNSS Tracking Devices G / 4G / 5G Cellular Connectivity Satellite & LPWAN Connectivity Video Telematics & Dashcams |

| By End-User / Vertical | Transportation & Logistics Fleets Public Sector & Government Fleets Utilities & Field Services Construction, Mining & Resources Retail, Distribution & Last-Mile Delivery Insurance Providers Individual & Small Business Vehicle Owners |

| By Deployment Mode | Cloud-Based On-Premise Hybrid |

| By Revenue Model | One-Time Hardware Sales Subscription / SaaS Contracts Pay-Per-Use & Usage-Based Models Data Monetization & Value-Added Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Telematics Adoption | 150 | Vehicle Owners, Fleet Managers |

| Commercial Fleet Telematics Solutions | 110 | Logistics Managers, Fleet Operations Directors |

| Telematics Service Providers | 70 | Product Managers, Business Development Executives |

| Consumer Attitudes Towards Telematics | 130 | General Consumers, Automotive Enthusiasts |

| Regulatory Impact on Telematics Adoption | 50 | Policy Makers, Industry Analysts |

The New Zealand Automotive Telematics Market is valued at approximately USD 1.1 billion. This valuation is based on a five-year historical analysis and reflects the market's growth driven by connected vehicles and advancements in telematics technology.