Region:North America

Author(s):Dev

Product Code:KRAC2983

Pages:96

Published On:January 2026

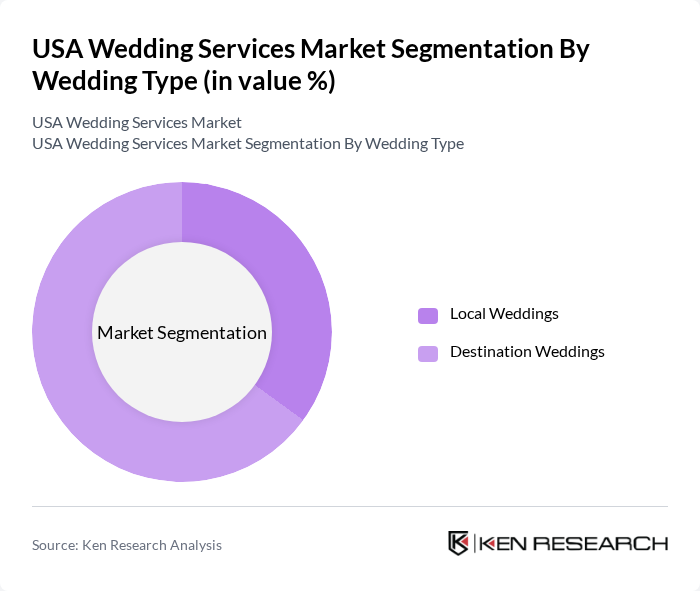

By Wedding Type:The wedding services market can be segmented into two primary types: Local Weddings and Destination Weddings. Local Weddings are typically more prevalent in terms of event count, as they offer easier logistics, better accessibility for guests, and generally more predictable budgets for couples marrying close to home. Destination Weddings, while accounting for a smaller share of total wedding volume, represent a substantial share of market value due to higher per-wedding spending on travel, accommodation, premium venues, and bundled experiences; recent industry research shows destination weddings capturing well over half of total U.S. wedding services revenue by value. The trend towards personalized, experiential, and themed weddings, including multi-day celebrations, is increasing demand for both distinctive local venues and domestic or international destination locations.

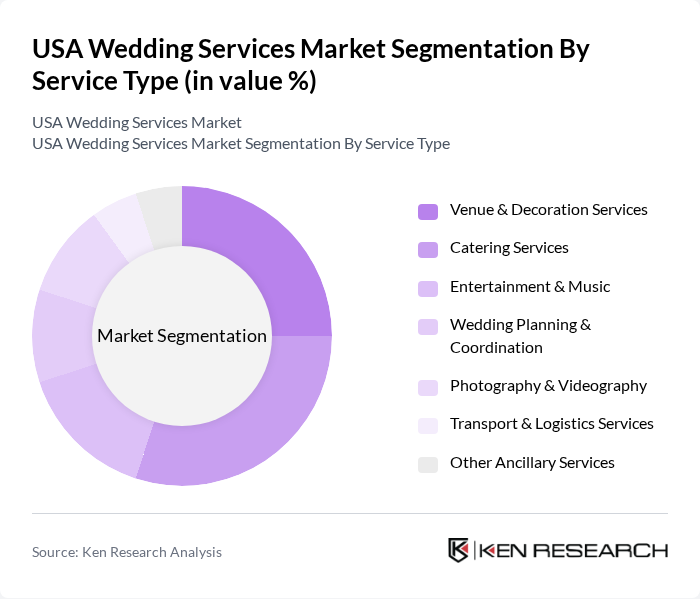

By Service Type:The market is further segmented by the types of services offered, including Venue & Decoration Services, Catering Services, Entertainment & Music, Wedding Planning & Coordination, Photography & Videography, Transport & Logistics Services, and Other Ancillary Services. Catering Services account for the single largest share of spending among defined service categories, reflecting the importance of food and beverage to guest satisfaction and overall event budgets. Venue- and décor-related spending, including rental of unique spaces and bespoke design, also represents a significant portion of total expenditure as couples prioritize ambiance and aesthetic. The rise of social media and content-sharing platforms has further increased the demand for high-quality Photography & Videography services, while professional Wedding Planning & Coordination is gaining share as couples seek expert support to manage complex, multi-vendor events and destination logistics.

The USA Wedding Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Knot Worldwide, WeddingWire (a The Knot Worldwide brand), Zola, David's Bridal, Minted, Joy, XO Group / The Bump, A Practical Wedding, Brides.com (Dotdash Meredith), The Wedding Report, Style Me Pretty, Green Wedding Shoes, Wedding Chicks, Hitched (U.S. operations), Wedding Spot contribute to innovation, geographic expansion, and service delivery in this space. These companies span digital planning platforms, marketplaces, media and inspiration sites, registry and stationery providers, and bridal apparel, collectively shaping consumer expectations around discovery, comparison, and booking of wedding services.

The USA wedding services market is poised for continued evolution, driven by changing consumer preferences and technological advancements. As couples increasingly seek personalized and unique experiences, service providers will need to adapt by offering tailored solutions. Additionally, the integration of technology in planning and execution will streamline processes and enhance customer satisfaction. The focus on sustainability will also shape future offerings, as eco-conscious couples prioritize environmentally friendly options in their wedding planning.

| Segment | Sub-Segments |

|---|---|

| By Wedding Type | Local Weddings Destination Weddings |

| By Service Type | Venue & Decoration Services Catering Services Entertainment & Music Wedding Planning & Coordination Photography & Videography Transport & Logistics Services Other Ancillary Services |

| By Booking Mode | Online Platforms Offline / Traditional Channels |

| By Budget Tier | Budget Weddings Mid-range Weddings Luxury / Premium Weddings |

| By Event Scope | Single-Day Weddings Multi-Day Weddings Micro / Intimate Weddings Large-Scale Weddings |

| By Cultural / Thematic Orientation | Traditional / Religious Weddings Cross-cultural / Fusion Weddings Themed & Experiential Weddings |

| By Customer Demographics | Age Group of Couple Household Income Level Urban vs Suburban vs Rural Residents |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wedding Planning Services | 120 | Wedding Planners, Event Coordinators |

| Catering Services | 100 | Catering Managers, Chefs |

| Photography and Videography | 80 | Photographers, Videographers |

| Floral Design Services | 70 | Florists, Event Designers |

| Venue Management | 90 | Venue Managers, Event Space Coordinators |

The USA Wedding Services Market is valued at approximately USD 65 billion, driven by increased spending on various services such as venues, catering, and photography, as couples seek personalized and immersive wedding experiences.