Region:North America

Author(s):Dev

Product Code:KRAD7809

Pages:100

Published On:December 2025

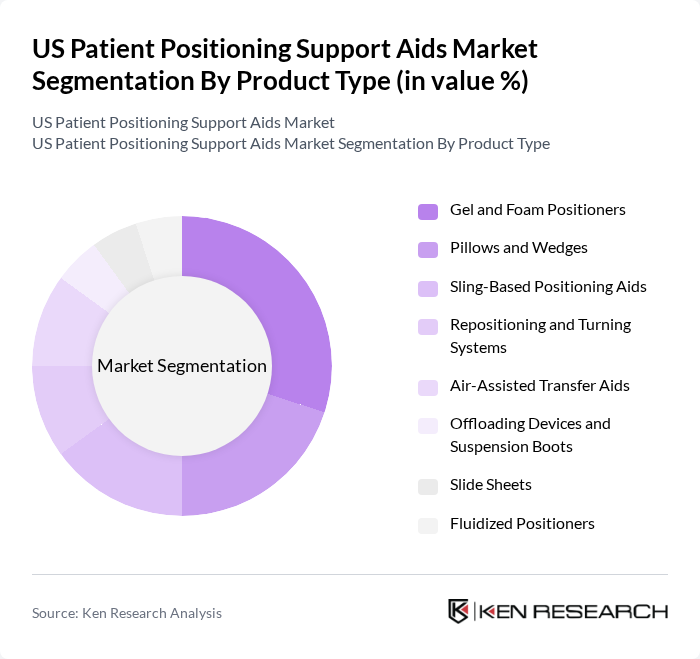

By Product Type:The product type segmentation includes various aids designed to enhance patient comfort, pressure redistribution, and procedural access during medical interventions. The subsegments are Gel and Foam Positioners, Pillows and Wedges, Sling-Based Positioning Aids, Repositioning and Turning Systems, Air-Assisted Transfer Aids, Offloading Devices and Suspension Boots, Slide Sheets, and Fluidized Positioners. Among these, Gel and Foam Positioners are leading the market due to their widespread use in operating rooms, ICUs, and imaging departments, where they provide effective pressure relief, help prevent pressure injuries and nerve damage during long procedures, and are available in a wide range of anatomical shapes and sizes.

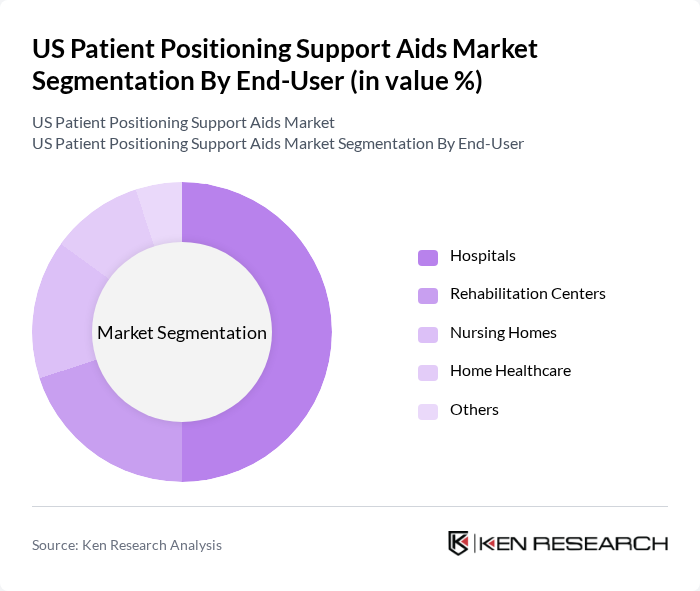

By End-User:The end-user segmentation encompasses various healthcare settings where patient positioning aids are utilized. This includes Hospitals, Rehabilitation Centers, Nursing Homes, Home Healthcare, and Others. Hospitals are the dominant end-user segment, driven by the high volume of surgical, interventional, and diagnostic imaging procedures that require effective patient positioning to ensure safety, avoid pressure injuries, and optimize access for clinicians. Rehabilitation centers and nursing homes increasingly adopt repositioning systems, slide sheets, and offloading devices to manage immobile and high-risk patients, while home healthcare is seeing growing use of simpler supports and transfer aids as more care shifts to home-based settings.

The US Patient Positioning Support Aids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hill-Rom Holdings, Inc. (Baxter Hillrom), Stryker Corporation, Arjo AB, Medline Industries, LP, Invacare Corporation, Drive DeVilbiss Healthcare (Drive Medical), GF Health Products, Inc. (Graham-Field), AliMed, Inc., Steris plc, Getinge AB, Joerns Healthcare LLC, Span-America Medical Systems, LLC, Blue Chip Medical Products, Inc., ROHO, Inc. (Permobil Group), Etac AB (including HoverTech International) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US Patient Positioning Support Aids Market appears promising, driven by ongoing technological innovations and demographic shifts. As the healthcare sector increasingly embraces smart technologies, patient positioning aids will evolve to offer enhanced functionality and improved patient outcomes. Additionally, the growing emphasis on personalized care will likely lead to tailored solutions that cater to individual patient needs. These trends, combined with the expansion of healthcare facilities, will create a conducive environment for market growth and innovation in future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Gel and Foam Positioners Pillows and Wedges Sling-Based Positioning Aids Repositioning and Turning Systems Air-Assisted Transfer Aids Offloading Devices and Suspension Boots Slide Sheets Fluidized Positioners |

| By End-User | Hospitals Rehabilitation Centers Nursing Homes Home Healthcare Others |

| By Clinical Application | Surgical Procedures Diagnostic & Imaging Procedures Patient Transfer & Transport Pressure Injury Prevention & Long-Term Care Rehabilitation & Physical Therapy |

| By Care Setting | Acute Care (Operating Rooms, ICUs, Emergency Departments) Post-Acute & Long-Term Care Facilities Home and Community-Based Care |

| By Distribution Channel | Direct Sales to Healthcare Providers Group Purchasing Organizations (GPOs) Medical Supply Distributors Online & E-commerce Platforms Retail Home Healthcare Stores |

| By Region | Northeast Midwest South West |

| By Buyer Type | Large Health Systems and IDNs Standalone Hospitals and Clinics Post-Acute and Long-Term Care Chains Home Health Agencies and DME Providers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 90 | Procurement Managers, Supply Chain Directors |

| Surgical Centers | 70 | Operating Room Managers, Surgical Coordinators |

| Healthcare Professionals | 110 | Surgeons, Anesthesiologists, Nurse Practitioners |

| Manufacturers of Positioning Aids | 50 | Product Managers, Sales Directors |

| Regulatory Bodies | 40 | Compliance Officers, Regulatory Affairs Specialists |

The US Patient Positioning Support Aids Market is valued at approximately USD 520 million, reflecting a significant growth trend driven by factors such as the increasing prevalence of chronic diseases and advancements in healthcare technology.