Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4010

Pages:84

Published On:December 2025

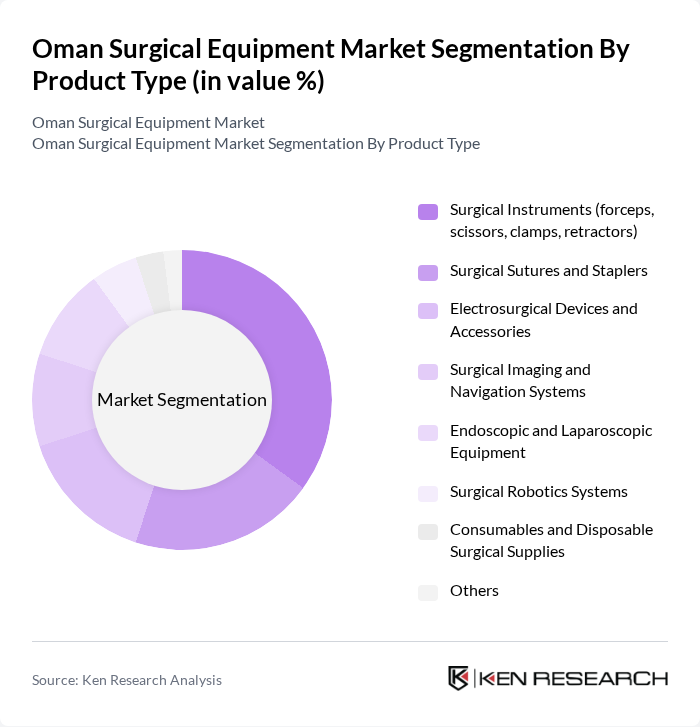

By Product Type:The product type segmentation includes various categories such as surgical instruments, sutures, electrosurgical devices, imaging systems, endoscopic equipment, surgical robotics, consumables, and others. Among these, surgical instruments are the most widely used due to their essential role in various surgical procedures. The demand for advanced surgical instruments is driven by the increasing complexity of surgeries and the need for precision in surgical interventions.

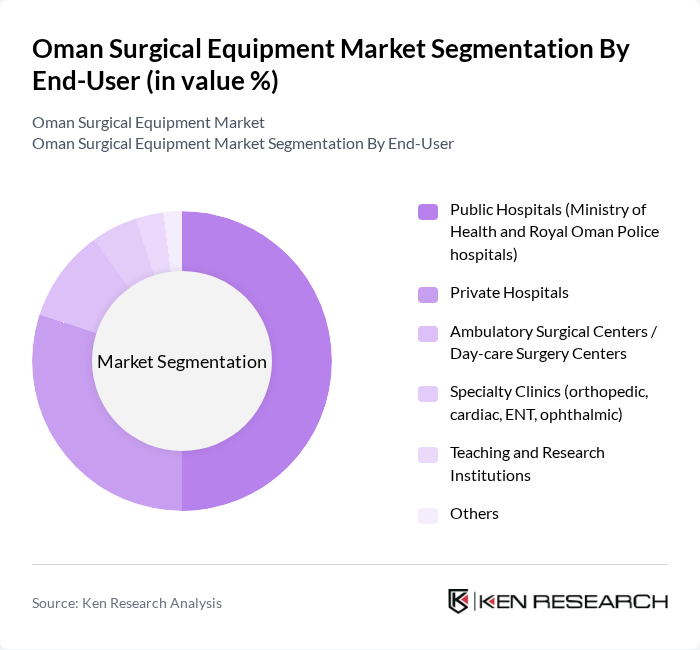

By End-User:The end-user segmentation encompasses public hospitals, private hospitals, ambulatory surgical centers, specialty clinics, and teaching institutions. Public hospitals, particularly those under the Ministry of Health, dominate the market due to their extensive patient base and government funding. The increasing number of private hospitals and specialized clinics also contributes to the growing demand for surgical equipment, as they adopt advanced technologies to enhance patient care.

The Oman Surgical Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson (Ethicon), Medtronic plc, Stryker Corporation, B. Braun Melsungen AG, Smith & Nephew plc, Zimmer Biomet Holdings, Inc., Olympus Corporation, Karl Storz SE & Co. KG, Boston Scientific Corporation, Terumo Corporation, Conmed Corporation, GE HealthCare Technologies Inc., Siemens Healthineers AG, Drägerwerk AG & Co. KGaA, Local and Regional Distributors (e.g., Gulf Medical Company Oman, Al Farsi Medical Supplies LLC) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman surgical equipment market is poised for significant transformation, driven by technological innovations and an increasing focus on patient-centered care. As healthcare expenditure rises, investments in advanced surgical technologies will likely enhance surgical outcomes. Additionally, the integration of telemedicine and AI in surgical planning is expected to streamline processes and improve efficiency. The emphasis on minimally invasive procedures will further shape the market, catering to the growing demand for safer and more effective surgical options in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Surgical Instruments (forceps, scissors, clamps, retractors) Surgical Sutures and Staplers Electrosurgical Devices and Accessories Surgical Imaging and Navigation Systems Endoscopic and Laparoscopic Equipment Surgical Robotics Systems Consumables and Disposable Surgical Supplies Others |

| By End-User | Public Hospitals (Ministry of Health and Royal Oman Police hospitals) Private Hospitals Ambulatory Surgical Centers / Day-care Surgery Centers Specialty Clinics (orthopedic, cardiac, ENT, ophthalmic) Teaching and Research Institutions Others |

| By Surgical Application | General and Gastrointestinal Surgery Orthopedic and Trauma Surgery Cardiothoracic and Vascular Surgery Neurosurgery and Spine Surgery Obstetrics & Gynecology Surgery ENT and Ophthalmic Surgery Urology and Other Specialties |

| By Distribution Channel | Direct Sales to Healthcare Providers Local Distributors and Agents Group Purchasing through Government Tenders Online and E-procurement Portals Others |

| By Region | Muscat Dhofar (including Salalah) Al Batinah (including Sohar) Ad Dakhiliyah (including Nizwa) Other Governorates (Al Sharqiyah, Al Dhahirah, Al Wusta, Musandam) |

| By Technology | Conventional Open Surgery Equipment Minimally Invasive and Laparoscopic Surgery Equipment Robotic and Computer-assisted Surgery Systems Image-guided and Navigation-enabled Surgery Others |

| By Policy and Funding Support | Central Government Capital Expenditure Programs Public–Private Partnership (PPP) Projects Health Insurance-driven Procurement Grants and Initiatives for Technology Upgradation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Procurement | 45 | Procurement Managers, Financial Officers |

| Private Clinic Equipment Usage | 35 | Clinic Owners, Surgeons |

| Distribution Channel Insights | 30 | Distributors, Sales Representatives |

| Technological Adoption in Surgery | 28 | Healthcare IT Managers, Surgical Technologists |

| Market Trends and Innovations | 32 | Industry Analysts, Medical Equipment Innovators |

The Oman Surgical Equipment Market is valued at approximately USD 150 million, reflecting a significant growth driven by increasing healthcare expenditure, advanced surgical procedures, and the rising prevalence of chronic diseases necessitating surgical interventions.