Region:North America

Author(s):Geetanshi

Product Code:KRAD5994

Pages:99

Published On:December 2025

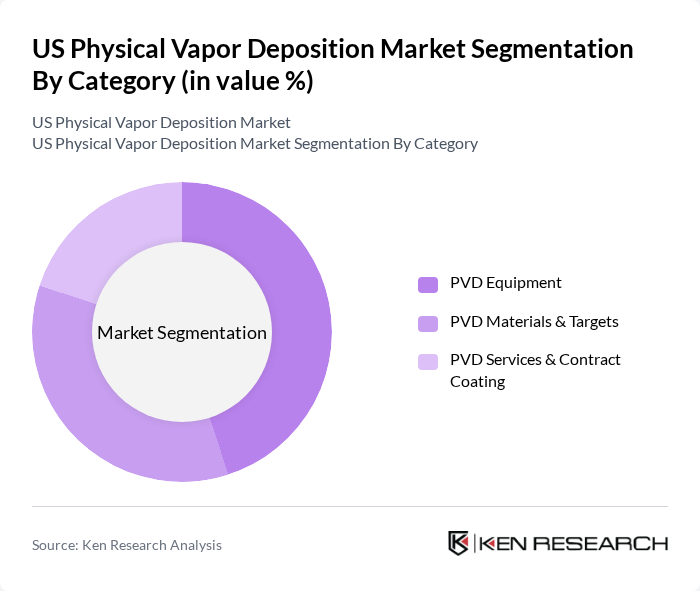

By Category:This segmentation includes PVD Equipment, PVD Materials & Targets, and PVD Services & Contract Coating. Each sub-segment plays a crucial role in the overall market dynamics, with equipment being essential for the deposition process, materials providing the necessary substrates, and services ensuring optimal performance and maintenance.

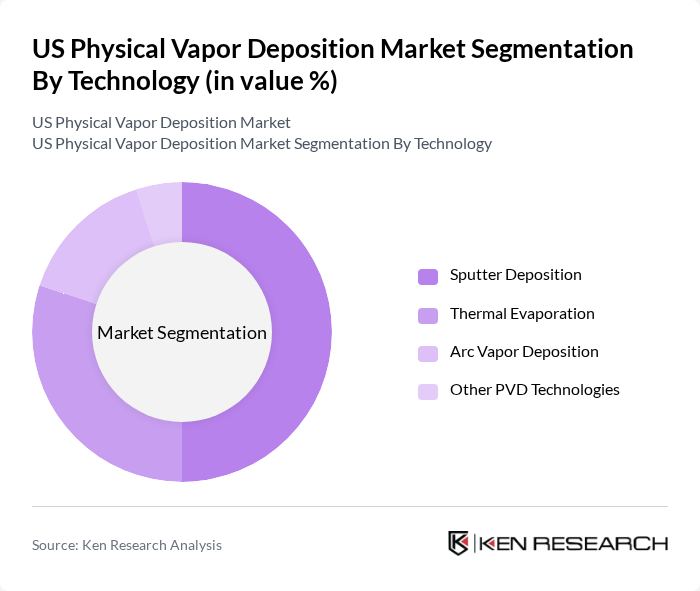

By Technology:This segmentation encompasses Sputter Deposition, Thermal Evaporation, Arc Vapor Deposition, and Other PVD Technologies. Each technology offers unique advantages, with sputter deposition being widely used in semiconductor applications due to its precision and control over film thickness.

The US Physical Vapor Deposition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Applied Materials, Inc., Lam Research Corporation, Veeco Instruments Inc., ULVAC, Inc., Oerlikon Balzers (OC Oerlikon Corporation AG), Denton Vacuum LLC, AJA International, Inc., Kurt J. Lesker Company, Angstrom Engineering Inc., CHA Industries, Inc., PVD Products, Inc., Advanced Energy Industries, Inc., MKS Instruments, Inc., KLA Corporation, CVD Equipment Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The US Physical Vapor Deposition market is poised for significant growth, driven by technological advancements and increasing demand across various sectors. As industries prioritize sustainability, the integration of eco-friendly practices in PVD processes will become essential. Additionally, the rise of automation and IoT integration in manufacturing will enhance efficiency and reduce costs. Companies that adapt to these trends will likely capture a larger market share, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Category | PVD Equipment PVD Materials & Targets PVD Services & Contract Coating |

| By Technology | Sputter Deposition Thermal Evaporation Arc Vapor Deposition Other PVD Technologies |

| By Application | Microelectronics & Semiconductors Data Storage & Displays Cutting Tools & Industrial Components Medical Devices & Implants Solar & Energy Decorative & Optical Coatings Other Applications |

| By End-Use Industry | Electronics & Semiconductor Manufacturing Automotive Aerospace & Defense Healthcare & Medical Devices Industrial & Heavy Machinery Others |

| By Material Type | Metals & Alloys Ceramics & Nitrides Carbides & Oxides Polymers & Others |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Manufacturing | 45 | Process Engineers, Production Managers |

| Optical Coatings | 35 | Product Development Managers, Quality Assurance Specialists |

| Automotive Component Coatings | 30 | Supply Chain Managers, Technical Sales Representatives |

| Aerospace Applications | 25 | R&D Directors, Compliance Officers |

| Consumer Electronics | 40 | Marketing Managers, Operations Directors |

The US Physical Vapor Deposition market is valued at approximately USD 700 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for advanced materials in various industries, including electronics, aerospace, and automotive.