Region:North America

Author(s):Rebecca

Product Code:KRAD6116

Pages:82

Published On:December 2025

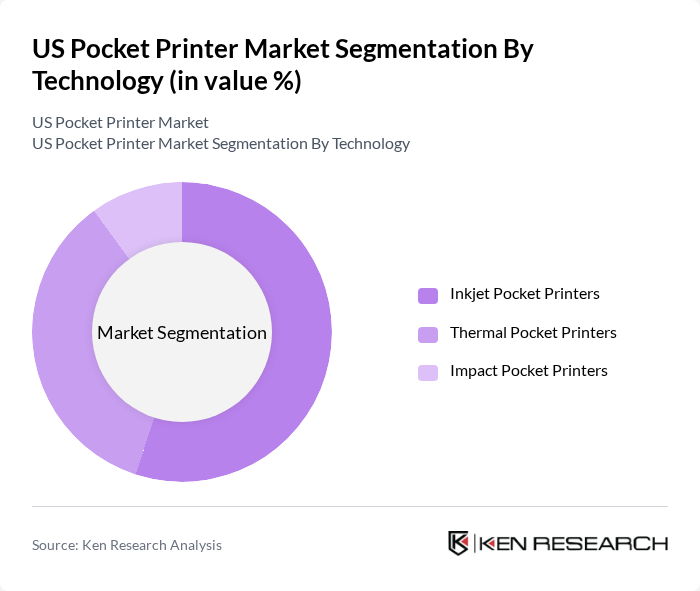

By Technology:The pocket printer market is segmented into three main technologies: Inkjet Pocket Printers, Thermal Pocket Printers, and Impact Pocket Printers. Inkjet Pocket Printers are widely used in photo-centric and consumer applications because they can produce high-quality, color-rich prints and are available in compact, smartphone-connected formats from brands such as Canon, HP, and Polaroid. Thermal Pocket Printers are gaining strong traction in retail, logistics, transportation, and field service operations, where they are used for receipts, shipping labels, barcodes, and proof-of-delivery documents due to their fast print speeds, low maintenance needs, and lower operating costs. Impact Pocket Printers remain a smaller, niche segment, primarily serving environments that require durable, multi-part forms or where impact printing offers advantages in harsh or industrial conditions.

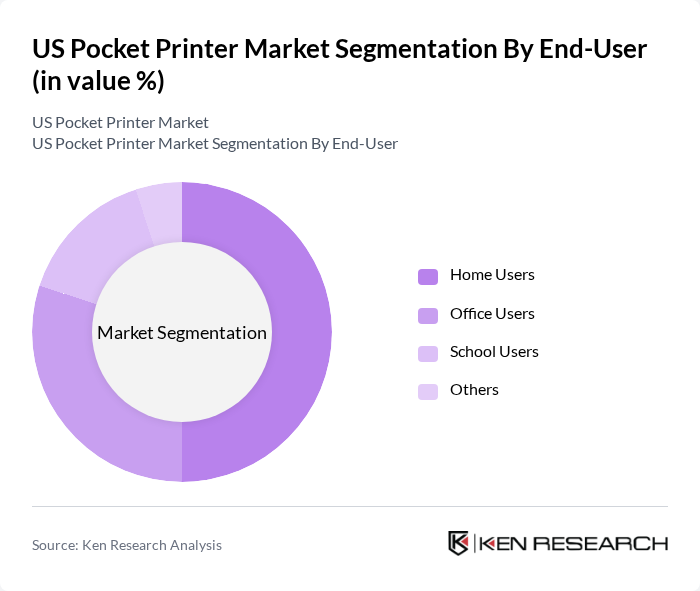

By End-User:The end-user segmentation includes Home Users, Office Users, School Users, and Others. Home Users represent a major usage segment, supported by trends such as instant photo printing, scrapbooking, and personal photo journaling with mobile photo printers, as well as remote work and home-based microbusinesses. Office Users constitute another substantial segment, as enterprises in sales, field service, logistics, and transportation increasingly deploy portable printers to improve documentation, mobility, and workflow efficiency. School Users contribute through adoption for classroom projects, event photography, and student activities, while the "Others" category includes sectors such as healthcare, hospitality, and retail, where pocket printers are utilized for bedside labeling, visitor badges, tickets, receipts, and other specialized applications.

The US Pocket Printer Market is characterized by a dynamic mix of regional and international players. Leading participants such as HP Development Company, L.P., Canon Inc., Epson America, Inc., Brother International Corporation, Fujifilm Instax, Kodak Alaris Inc., Polaroid Corporation, Zink Imaging, Inc., Zebra Technologies Corp., PeriPage, DNP Imagingcomm America Corporation, Prynt Inc., Lifeprint, Inc., Xiamen Hanin Co., Ltd., PoooliPrint contribute to innovation, geographic expansion, and service delivery in this space.

The US pocket printer market is poised for significant growth, driven by technological advancements and changing consumer behaviors. As mobile work continues to rise, the demand for portable printing solutions will likely increase. Additionally, the integration of smart technologies and eco-friendly practices will shape the future landscape, encouraging manufacturers to innovate. Companies that adapt to these trends and address consumer needs will find ample opportunities for expansion and market penetration in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Technology | Inkjet Pocket Printers Thermal Pocket Printers Impact Pocket Printers |

| By End-User | Home Users Office Users School Users Others |

| By Application | Retail Healthcare Transport & Logistics Telecom Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Usage of Pocket Printers | 120 | Students, Freelancers, Small Business Owners |

| Retail Insights on Pocket Printer Sales | 100 | Retail Managers, Sales Associates |

| Technological Adoption in Printing | 80 | IT Managers, Product Development Teams |

| Market Trends in Portable Printing | 70 | Market Analysts, Industry Experts |

| Consumer Preferences and Feedback | 90 | End-users, Tech Enthusiasts |

The US Pocket Printer Market is valued at approximately USD 420 million, reflecting a significant share of the global portable printer market. This valuation is based on a five-year historical analysis and recent revenue estimates of around USD 412.7 million.