Region:North America

Author(s):Shubham

Product Code:KRAD4718

Pages:95

Published On:December 2025

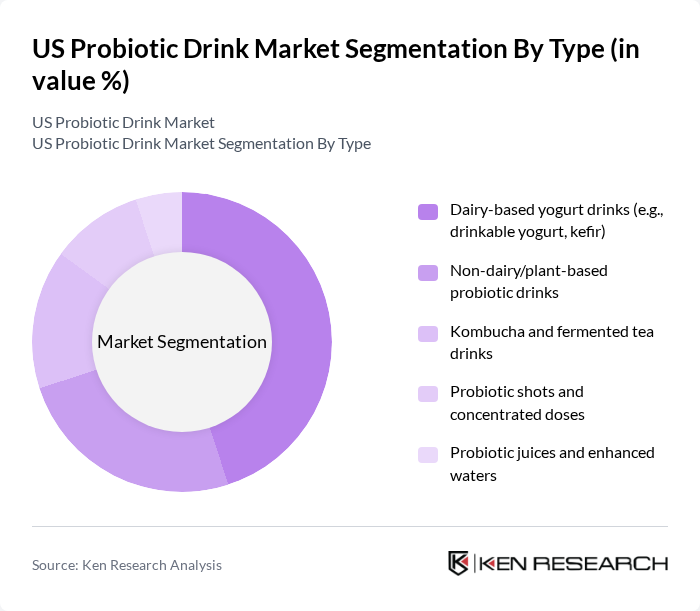

By Type:The market is segmented into various types of probiotic drinks, including dairy-based yogurt drinks, non-dairy/plant-based probiotic drinks, kombucha and fermented tea drinks, probiotic shots and concentrated doses, and probiotic juices and enhanced waters. Among these, dairy-based yogurt drinks are particularly popular due to their established presence in the market and consumer familiarity. Non-dairy options are gaining traction as more consumers seek plant-based alternatives. Kombucha has also seen a rise in popularity, especially among younger demographics who are drawn to its unique flavors and perceived health benefits.

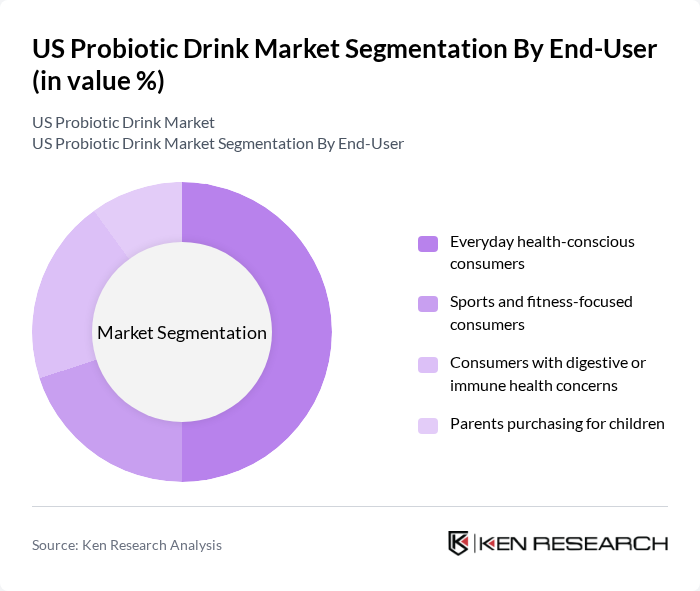

By End-User:The end-user segmentation includes everyday health-conscious consumers, sports and fitness-focused consumers, consumers with digestive or immune health concerns, and parents purchasing for children. Everyday health-conscious consumers represent the largest segment, driven by a growing trend towards preventive health measures. Sports and fitness-focused consumers are also significant, as they seek products that enhance performance and recovery. Parents purchasing for children are increasingly looking for healthy beverage options that support their children's growth and immunity.

The US Probiotic Drink Market is characterized by a dynamic mix of regional and international players. Leading participants such as Danone North America (Activia, DanActive, Horizon Organic), Yakult U.S.A. Inc., PepsiCo Inc. (KeVita, Propel Immune Support), Nestlé USA, Inc. (Culturelle, Nesquik probiotic extensions), Lifeway Foods, Inc., GT's Living Foods (GT's Synergy, Alive), Health-Ade LLC (Health-Ade Kombucha), Brew Dr. Kombucha LLC, Suja Life, LLC, NextFoods, Inc. (GoodBelly), Hain Celestial Group, Inc. (The Greek Gods brand and related probiotic beverages), Reed's Inc. (Reed's and Virgil's probiotic-ready lines), Better Booch, LLC, Chobani LLC (probiotic yogurt drinks), Califia Farms, LLC (plant-based probiotic beverages) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US probiotic drink market appears promising, driven by ongoing trends in health and wellness. As consumers increasingly seek products that align with their health goals, the demand for innovative probiotic formulations is expected to rise. Additionally, the integration of technology in personalized nutrition will likely enhance consumer engagement, allowing brands to tailor offerings to individual health needs. This evolving landscape presents opportunities for growth and differentiation in a competitive market.

| Segment | Sub-Segments |

|---|---|

| By Type | Dairy-based yogurt drinks (e.g., drinkable yogurt, kefir) Non-dairy/plant-based probiotic drinks Kombucha and fermented tea drinks Probiotic shots and concentrated doses Probiotic juices and enhanced waters |

| By End-User | Everyday health-conscious consumers Sports and fitness-focused consumers Consumers with digestive or immune health concerns Parents purchasing for children |

| By Distribution Channel | Supermarkets/Hypermarkets Natural and health food stores Online retail and direct-to-consumer Convenience stores Pharmacies and specialty wellness retailers |

| By Packaging Type | Plastic bottles Glass bottles Cartons (Tetra Pak and similar) Cans and other formats |

| By Flavor | Dairy-forward and plain flavors Fruit-based flavors (single fruit) Mixed and exotic fruit combinations Botanical, herbal, and spice-infused flavors |

| By Age Group | Children and adolescents Young adults (18–34) Middle-aged adults (35–54) Older adults (55+) |

| By Price Range | Mass-market Better-for-you/accessible premium Premium and craft/specialty Subscription and functional bundles |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Probiotic Drink Sales | 120 | Store Managers, Category Buyers |

| Health and Wellness Influencers | 85 | Nutritionists, Fitness Coaches |

| Consumer Preferences in Probiotics | 150 | Health-Conscious Consumers, Millennials |

| Distribution Channel Insights | 75 | Logistics Managers, Supply Chain Analysts |

| Market Trends and Innovations | 65 | Product Developers, Marketing Executives |

The US probiotic drink market is valued at approximately USD 7 billion, reflecting significant growth driven by increased consumer awareness of health benefits associated with probiotics, particularly for digestive health and immune support.