Region:North America

Author(s):Geetanshi

Product Code:KRAD4056

Pages:98

Published On:December 2025

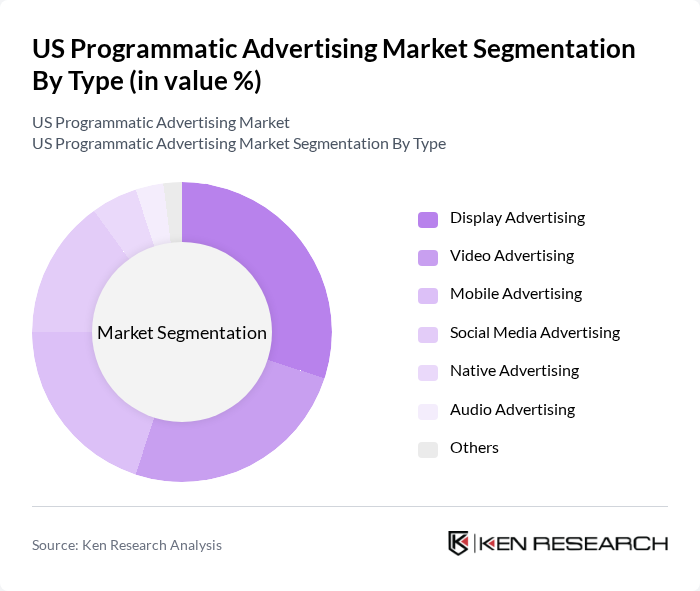

By Type:The programmatic advertising market can be segmented into various types, including Display Advertising, Video Advertising, Mobile Advertising, Social Media Advertising, Native Advertising, Audio Advertising, and Others. Each of these sub-segments plays a crucial role in the overall market dynamics, catering to different advertising needs and consumer preferences.

The Display Advertising sub-segment is currently dominating the market due to its widespread use across various platforms and its effectiveness in reaching a broad audience. Advertisers favor display ads for their visual appeal and ability to generate brand awareness. Video Advertising is also gaining traction, particularly with the rise of streaming services and social media platforms, which offer engaging content that captures consumer attention. The increasing use of mobile devices further propels the growth of Mobile Advertising, as consumers spend more time on their smartphones and tablets.

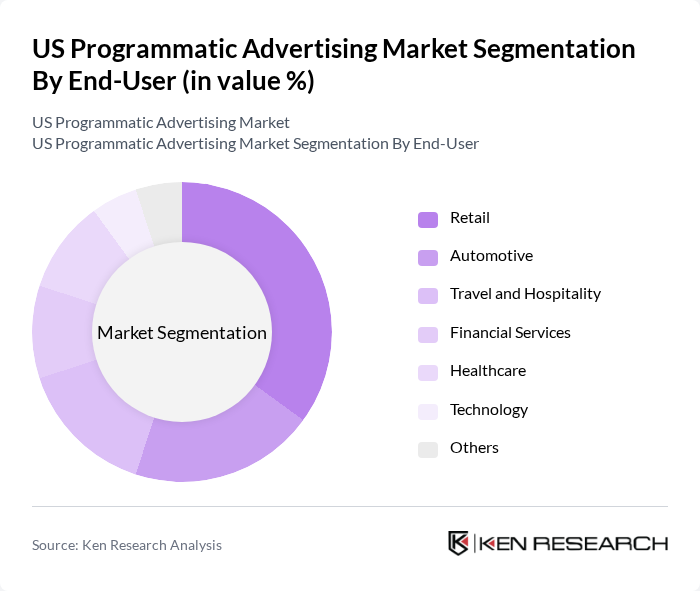

By End-User:The programmatic advertising market can also be segmented by end-user industries, including Retail, Automotive, Travel and Hospitality, Financial Services, Healthcare, Technology, and Others. Each of these sectors utilizes programmatic advertising to enhance their marketing strategies and reach targeted audiences effectively.

The Retail sector is the leading end-user of programmatic advertising, driven by the need for targeted marketing and the ability to track consumer behavior effectively. Retailers leverage programmatic platforms to optimize their ad spend and enhance customer engagement through personalized advertising. The Automotive and Travel sectors also significantly contribute to the market, utilizing programmatic advertising to reach potential customers during their decision-making processes. Financial Services and Healthcare are increasingly adopting programmatic strategies to improve their outreach and customer acquisition efforts.

The US Programmatic Advertising Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Trade Desk, Adobe Advertising Cloud, Google Marketing Platform, MediaMath, AppNexus (Xandr), Amazon Advertising, Rubicon Project, PubMatic, OpenX, Sizmek, Criteo, SpotX, AdRoll, InMobi, Taboola contribute to innovation, geographic expansion, and service delivery in this space.

The US programmatic advertising market is poised for transformative growth, driven by technological advancements and evolving consumer behaviors. As advertisers increasingly adopt programmatic direct buying, the focus will shift towards enhancing customer experience through personalized content. Additionally, the integration of blockchain technology is expected to improve transparency and trust in ad transactions. These trends will shape the landscape, enabling advertisers to optimize their strategies and achieve better engagement with their target audiences.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Video Advertising Mobile Advertising Social Media Advertising Native Advertising Audio Advertising Others |

| By End-User | Retail Automotive Travel and Hospitality Financial Services Healthcare Technology Others |

| By Industry Vertical | E-commerce Entertainment Telecommunications Education Real Estate Others |

| By Advertising Format | Programmatic Display Programmatic Video Programmatic Audio Programmatic Native Others |

| By Device Type | Desktop Mobile Tablet Connected TV Others |

| By Buying Method | Real-Time Bidding (RTB) Programmatic Direct Private Marketplaces Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Programmatic Spend | 120 | Media Buyers, Digital Marketing Managers |

| Automotive Advertising Strategies | 90 | Brand Managers, Advertising Executives |

| Financial Services Digital Campaigns | 70 | Marketing Directors, Compliance Officers |

| Consumer Goods Programmatic Insights | 110 | Product Marketing Managers, Data Analysts |

| Technology Sector Ad Spend Analysis | 80 | Chief Marketing Officers, Digital Strategy Leads |

The US Programmatic Advertising Market is valued at approximately USD 155 billion, reflecting significant growth driven by the increasing adoption of digital advertising and advancements in technology, alongside a growing demand for data-driven marketing strategies.