Region:North America

Author(s):Geetanshi

Product Code:KRAC2417

Pages:98

Published On:October 2025

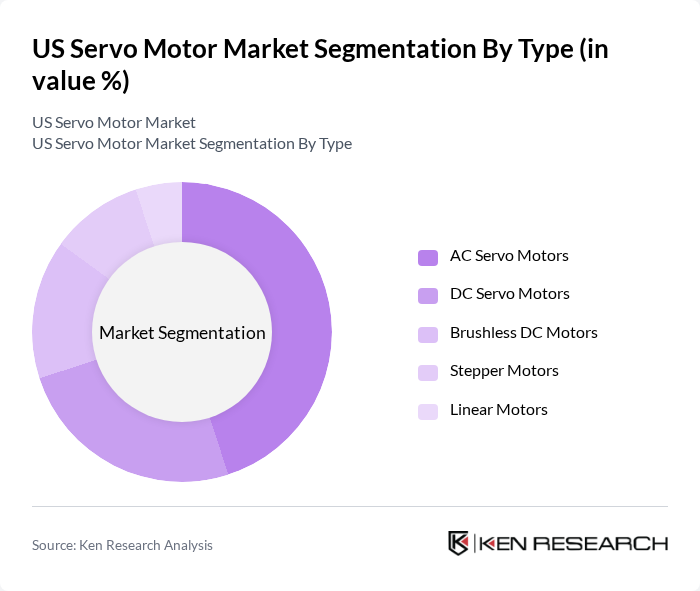

By Type:The servo motor market can be segmented into various types, including AC Servo Motors, DC Servo Motors, Brushless DC Motors, Stepper Motors, and Linear Motors. Among these, AC Servo Motors are currently leading the market due to their high efficiency and reliability in various applications. The increasing adoption of automation in industries such as manufacturing and robotics has significantly boosted the demand for AC Servo Motors. Additionally, the trend towards energy-efficient solutions and the development of more precise servo motor technology have further solidified their position in the market. AC servo motors are particularly favored in robotic assembly lines, precision manufacturing, and automated logistics where high-performance motion control is critical.

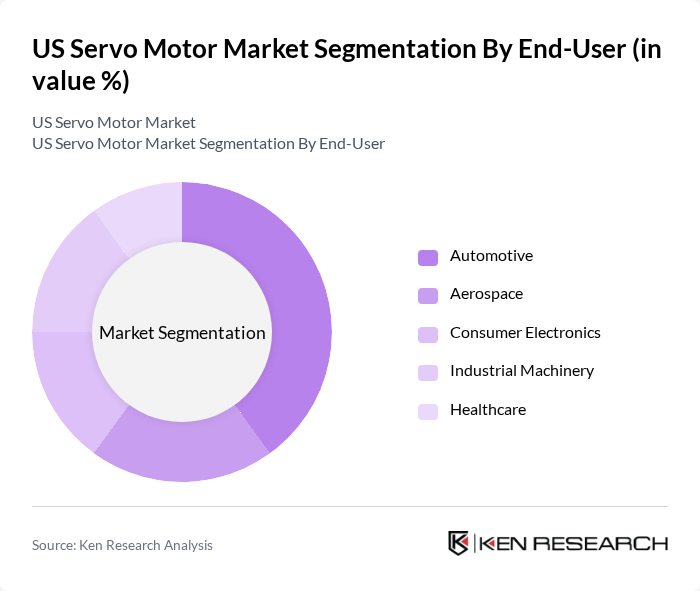

By End-User:The servo motor market is also segmented by end-user industries, including Automotive, Aerospace, Consumer Electronics, Industrial Machinery, and Healthcare. The Automotive sector is the dominant end-user, driven by the increasing demand for automation in manufacturing processes and the growing trend of electric vehicles. The need for precision and efficiency in automotive applications has led to a significant rise in the adoption of servo motors, making this sector a key contributor to market growth. The shift toward EV production and autonomous vehicles is driving demand for high-precision servo motors in assembly and testing operations. Other key sectors include aerospace and defense, where servo-controlled actuators are increasingly used in flight control systems and defense robotics, as well as healthcare applications requiring precise motion control in medical devices.

The US Servo Motor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Mitsubishi Electric Corporation, Rockwell Automation, Inc., Yaskawa Electric Corporation, Fanuc Corporation, ABB Ltd., Schneider Electric SE, Omron Corporation, Bosch Rexroth AG, Parker Hannifin Corporation, National Instruments Corporation, Delta Electronics, Inc., Kollmorgen Corporation, B&R Industrial Automation GmbH, Beckhoff Automation GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The US servo motor market is poised for significant advancements, driven by technological innovations and increasing integration with smart manufacturing practices. As industries embrace Industry 4.0, the demand for intelligent servo systems that can communicate and adapt in real-time will rise. Furthermore, the focus on sustainability will push manufacturers to develop energy-efficient servo motors, aligning with regulatory standards and consumer preferences. This evolving landscape presents a dynamic environment for growth and innovation in the servo motor sector.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Servo Motors DC Servo Motors Brushless DC Motors Stepper Motors Linear Motors |

| By End-User | Automotive Aerospace Consumer Electronics Industrial Machinery Healthcare |

| By Application | Robotics CNC Machinery Packaging Material Handling Electric Vehicle Manufacturing |

| By Component | Motors Drives Controllers Feedback Devices Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Others |

| By Distribution Mode | B2B B2C E-commerce Others |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Automation | 120 | Automation Engineers, Production Managers |

| Robotics Applications | 100 | Robotics Engineers, R&D Managers |

| CNC Machinery | 80 | Machine Operators, Technical Directors |

| Automotive Manufacturing | 70 | Procurement Managers, Quality Assurance Leads |

| Aerospace Sector | 60 | Design Engineers, Compliance Officers |

The US Servo Motor Market is valued at approximately USD 3.8 billion, driven by increasing automation demands across various industries, including manufacturing and robotics, as well as advancements in technology that enhance servo motor efficiency and performance.